???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

Free NFT Inspired By The Simpsons Crosses $2M In Trading Volume

Free NFT Inspired By The Simpsons Crosses $2M In Trading Volume

Bored Ape Crypto Art Craze Investigates Reports of Eye Pain and Vision Problems at ApeFest

Bored Ape Crypto Art Craze Investigates Reports of Eye Pain and Vision Problems at ApeFest

Crypto Traders Share Their Winning Strategies in the Post-Crypto Winter Market

Crypto Traders Share Their Winning Strategies in the Post-Crypto Winter Market

Lawmaker Proposes Slashing SEC Chair’s Salary to $1 Per Year

Lawmaker Proposes Slashing SEC Chair’s Salary to $1 Per Year

Free NFT Inspired By The Simpsons Crosses $2M In Trading Volume

A special Halloween-themed episode titled “Treehouse of Horror,” the long-running animated series “The Simpsons” delved into the world of non-fungible tokens (NFTs) and cryptocurrencies. The episode introduced a fictional metaverse called Microcosm, where the characters embarked on misadventures involving decentralized finance and digital art.

The central plot revolves around Bart Simpson unexpectedly becoming an NFT, representing his unique digital character. This humorous take on NFTs allowed the show to provide social commentary and satirical insights into the rapidly growing world of crypto.

In a synchronistic move, the episode coincided with the launch of the Springfield Punks NFT collection by Italian artist Rino Russo. The collection, consisting of 3,405 NFTs, quickly sold out.

Collectors had the opportunity to mint one NFT for free, while additional NFTs were available for purchase at 0.01 ETH ($19) each. The initial surge in demand drove the floor price of the collection above 0.3 ETH ($600), eventually settling at 0.14 ETH.

“The Simpsons” has a longstanding legacy of cultural satire, and this latest episode continues that tradition by playfully exploring the world of NFTs and cryptocurrencies. It cleverly intertwines real-world market trends with the fictional universe of Springfield to create an entertaining narrative.

While the episode pokes fun at NFTs, it’s worth highlighting that the show’s producer, Disney, did not hesitate to capitalize on the bullish NFT market earlier this year. This further emphasizes the widespread interest and potential profitability associated with digital collectibles.

In a broader context, the NFT market has witnessed a recent resurgence in trading volumes. After experiencing a lull during the summer, NFT trading activity has quietly picked up alongside the increasing value of Bitcoin and other altcoins. Notable gainers in the NFT space include projects like Cryptoadz, Mocaverse by Animoca Brands, and OnChainMonkey. Furthermore, popular collections like CyberBrokers, Treeverse, Parallel Avatars, and Doodles have also posted substantial gains.

The positive sentiment in the NFT market has been further buoyed by the rising popularity of the BLUR token, which is experiencing a rally ahead of Season 2’s conclusion on November 20. Additionally, Yuga Labs co-founder Wylie Aronow made waves by purchasing a rare CryptoPunk for 600 ETH ($1.1M), demonstrating a continued interest in high-value NFT acquisitions.

As the NFT space continues to evolve, it raises intriguing questions about how the entertainment industry will further embrace and explore the realms of NFTs and the metaverse. Will other television shows, movies, or even music artists follow “The Simpsons'” lead and incorporate NFTs into their creative endeavors? Only time will tell.

Bored Ape Crypto Art Craze Investigates Reports of Eye Pain and Vision Problems at ApeFest

The company behind the popular Bored Ape Yacht Club is looking into concerning reports of attendees experiencing eye burn, extreme pain, and impaired vision after attending its annual ApeFest event. ApeFest brings together members of the Bored Ape Yacht Club, who have invested in a collection of 10,000 non-fungible tokens (NFTs) featuring computer-generated profile pictures of cartoon apes.

Following last weekend’s ApeFest in Hong Kong, more than a dozen attendees took to social media to express their discomfort, with complaints ranging from eye pain to vision problems. One attendee, known as CryptoJune on X (formerly Twitter), revealed that the pain was so severe that they had to seek medical attention at a hospital in the middle of the night.

The doctor attributed the issue to UV exposure from the stage lights. This was a surprising and uncommon experience for CryptoJune, who frequents festivals regularly.

Another attendee, Chloe Ge, described the stage lights as “quite strong” and reported feeling as though her eyes were being burned with spicy chili by 3 am after the party. While some discomfort still persists, the pain has eased since then. Adrian Zduńczyk woke up with severe eye burn and was diagnosed with photokeratitis (snow blindness) in both eyes, a condition caused by exposure to unprotected ultraviolet radiation.

Thankfully, Adrian’s vision remains close to perfect with no serious cornea damage, thanks to steroid eye drops and lubricants prescribed by the hospital.

In response to these eye-related issues, the Bored Ape Yacht Club acknowledged the incidents and has been actively contacting individuals to investigate potential causes. According to their estimates, less than 1% of attendees and event staff experienced these symptoms. Although most individuals have reported improvements in their symptoms, they encourage anyone who continues to have concerns to seek medical attention.

Approximately 2,250 people are believed to have attended ApeFest, as seen in a video where a crowd was dancing under the UV lights.

While Bored Ape NFTs gained popularity during the pandemic, attracting investments from celebrities, a recent report indicates that the majority of NFTs are now deemed worthless, with sales declining by 98% since their peak in May 2022.

???? Did the strong stage lights at ApeFest pose an unforeseen risk to attendees’ eye health, or was it a rare occurrence? How can events strike a balance between creating an immersive experience and ensuring the safety and well-being of attendees?

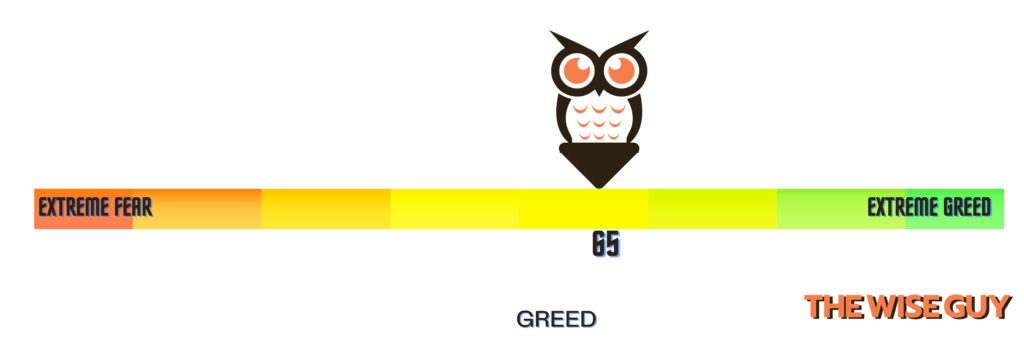

Crypto Traders Share Their Winning Strategies in the Post-Crypto Winter Market

As the crypto market enters a new phase, traders are adapting their strategies to take advantage of the changing landscape. Here are seven successful strategies being employed by crypto traders today:

1. More Breakouts, More Trades

Many traders, like Adrian Zduńczyk of The Birb Nest, are focusing on breakouts as a signal to enter trades. Zduńczyk emphasizes that while his win rate is only 30%, he manages risk by setting tight stop losses and allowing winners to run.

2. The “Moonbag” Strategy

Wendy O, former CoinDesker and host of The O Show, follows the “moonbag” strategy. When a project she invests in starts to surge in value, she takes profits and recoups her initial investment. What remains is her “moonbag,” which she owns free and clear. She may also stake her moonbag on a platform to earn passive income.

3. Correlated Arbitrage

Paweł Łaskarzewskitakes advantage of price correlations between assets. For example, he notes that the price of Tesla often moves in the same direction as the NASDAQ. By capitalizing on the spread between these correlated assets, he can profit regardless of whether prices go up or down.

4. Trading the “Wyckoff Method”

Christopher Inks uses the Wyckoff market cycle theory developed by Richard Wyckoff over a century ago. This theory suggests that the market moves in cycles, and understanding these cycles provides signals for buying and selling. Inks emphasizes the importance of trading in the direction of the trend.

5. Diversify into Other Markets

Rather than limiting themselves to the crypto market, some traders, like Łaskarzewski, also trade stocks and forex. By seeking out the best setups across multiple markets, they maximize their opportunities for profit.

6. Use Leverage with Caution Traders

Wendy O and Łaskarzewski stress the importance of using leverage cautiously, if at all. Over-leveraging can lead to significant losses, especially for inexperienced traders. It’s crucial to understand the risks involved and manage leverage responsibly.

7. Scalping

Scalping is a strategy employed by Nomad Fulcrum, where traders take advantage of short-term price fluctuations within a range. By repeatedly buying at the lower end of the range and selling at the higher end, scalpers aim to profit from these small movements.

These strategies are not a one-size-fits-all solution, and each trader may have their own unique approach. It’s important to conduct thorough research, understand the risks, and tailor strategies to one’s individual trading style.

Lawmaker Proposes Slashing SEC Chair’s Salary to $1 Per Year

The ongoing battle between lawmakers and the Securities and Exchange Commission (SEC), Representative Tim Burchett has put forward a surprising proposal. He suggests that SEC Chair Gary Gensler’s salary should be reduced to just $1 per year. This amendment is part of a broader effort to defund the regulatory agency, as outlined in the Financial Services and General Government (FSGG) bill introduced on July 13.

The FSGG bill encompasses a wide range of measures aimed at reducing government spending. By significantly cutting funding to various government agencies, including the SEC, lawmakers believe they can curb what they see as overreach and restore focus to the agencies’ core missions.

Representative Steve Womack, who presented the bill to the House Rules Committee, emphasized the need to address the regulatory “intrusiveness” of the SEC.

This move to reduce Gensler’s salary is not the first attempt to challenge his position and authority.

In June, Representatives Warren Davidson and Tom Emmer introduced the SEC Stabilization Act, which sought to remove Gensler as SEC Chair. The proposed legislation also aimed to redistribute power within the agency and prevent any one political party from having majority control.

Critics of Gensler and the SEC argue that the agency has been excessively targeting the crypto community without effectively addressing more significant issues. In particular, Emmer has accused Gensler of being a “bad faith regulator” who fails to discern between deserving scrutiny and baseless enforcement actions.

These legislative efforts demonstrate a growing dissatisfaction with the SEC and its perceived overreach. As discussions and debates continue, it remains to be seen how these proposals will affect the SEC’s operations and regulatory focus moving forward.

CoinWestern Quixplaned????

????Tesla’s $312M Bitcoin hoard remains untouched in Q3 2023

????Binance sees over $500M withdrawn amid ongoing regulatory troubles

????Dubai investor rues early exit from Shiba Inu investment; misses out on $70 million

Top Reddits This Week That Got Our Attention

JPMorgan says Ethereum’s activity post-Shanghai upgrade has been ‘disappointing’

I made new art for the Bitcoin Crab Market

Shrinkflation: a subtle way to hide inflation

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?