???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

1️⃣ Bitcoin’s Wikipedia Page Surges in Popularity!

2️⃣ Is Crypto Winter Finally Over?

3️⃣Andreessen Horowitz Raises $3.4 Billion for Future Venture Funds

4️⃣Editor’s Wrap: On Bitcoin White Paper’s 15th Anniversary, Wall Street Threatens to Swallow Its One-Time Challenger

Bitcoin’s Wikipedia Page Surges in Popularity!

Bitcoin’s Wikipedia page experienced a remarkable surge in interest last week, reaching the highest level since mid-2022. Can you guess the number of page views on October 24th? It hit a staggering 13,490.

What sparked this surge in interest? As per Rebecca Stevens from The Block Research, the rally in Bitcoin’s price and the potential for a spot ETF have captivated people. She stated, “The newfound interest can be shown in more casual ways, like more people visiting Bitcoin’s Wikipedia page.” It seems like the excitement surrounding Bitcoin has extended beyond just the financial realm!

Speaking of price rallies, Bitcoin soared above $35,000 on October 23rd, marking the first time since May 2022. Impressive, isn’t it? This world’s largest cryptocurrency has witnessed an impressive 13% surge over the past week alone. In fact, over the last month, Bitcoin has skyrocketed by nearly 29%. Seems like Bitcoin is on a bullish streak!

Speaking of price rallies, Bitcoin soared above $35,000 on October 23rd, marking the first time since May 2022. Impressive, isn’t it? This world’s largest cryptocurrency has witnessed an impressive 13% surge over the past week alone. In fact, over the last month, Bitcoin has skyrocketed by nearly 29%. Seems like Bitcoin is on a bullish streak!

When can we expect the approval of spot bitcoin ETFs? According to JPMorgan analysts led by Nikolaos Panigirtzoglou, the timing of spot bitcoin ETF approvals remains uncertain. However, they anticipate that it could happen within the next few months, and most likely before January 10, 2024, which is the final deadline for Ark Invest and 21Shares applications. Hold on tight, as the wait for ETF approval may soon be over!

When can we expect the approval of spot bitcoin ETFs? According to JPMorgan analysts led by Nikolaos Panigirtzoglou, the timing of spot bitcoin ETF approvals remains uncertain. However, they anticipate that it could happen within the next few months, and most likely before January 10, 2024, which is the final deadline for Ark Invest and 21Shares applications. Hold on tight, as the wait for ETF approval may soon be over!

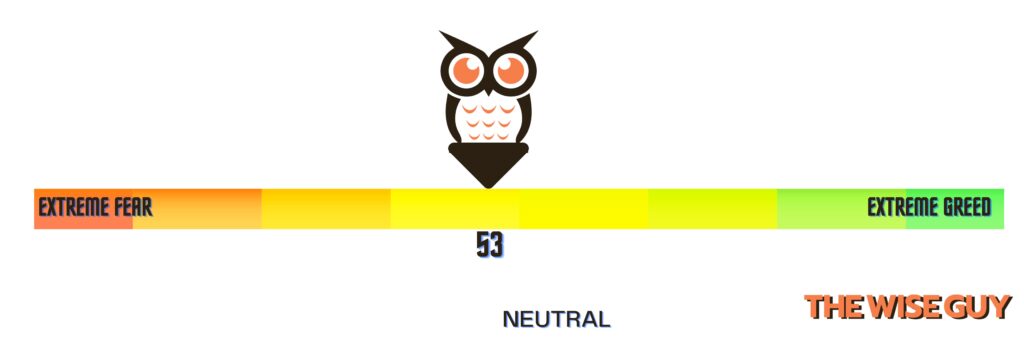

Is Crypto Winter Finally Over?

It appears that Crypto Winter may be coming to an end! Despite not having an official definition, anyone in the crypto space understands the term and its implications. During this period, crypto prices fall, critics abound, venture capital becomes scarce, and a new narrative is sought. However, recently, a fresh narrative has emerged, bringing hope and excitement to the industry.

It appears that Crypto Winter may be coming to an end! Despite not having an official definition, anyone in the crypto space understands the term and its implications. During this period, crypto prices fall, critics abound, venture capital becomes scarce, and a new narrative is sought. However, recently, a fresh narrative has emerged, bringing hope and excitement to the industry.

With Bitcoin’s 28% surge in the last month and the anticipation of BTC exchange-traded funds (ETFs) on the horizon, the mainstream adoption of cryptocurrencies by Wall Street has become a game-changer. Institutional investors are now poised to bring billions of dollars into the digital assets industry, aiming to make tokens safer and provide regulatory clarity. The focus has shifted from meme coins and overpriced NFTs to sustainable products like ETFs, tokenized securities, and stablecoins.

With Bitcoin’s 28% surge in the last month and the anticipation of BTC exchange-traded funds (ETFs) on the horizon, the mainstream adoption of cryptocurrencies by Wall Street has become a game-changer. Institutional investors are now poised to bring billions of dollars into the digital assets industry, aiming to make tokens safer and provide regulatory clarity. The focus has shifted from meme coins and overpriced NFTs to sustainable products like ETFs, tokenized securities, and stablecoins.

So, what’s driving this new narrative? Macro factors such as Middle East instability and the threat of inflation have contributed to the recent rally in cryptocurrencies. Larry Fink, CEO of BlackRock, highlighted a “flight to quality,” where investors seek safety amid uncertainty, turning to assets like Bitcoin. Previously skeptical, Fink’s change of tune signifies the shifting sentiment towards cryptocurrencies among Wall Street giants.

So, what’s driving this new narrative? Macro factors such as Middle East instability and the threat of inflation have contributed to the recent rally in cryptocurrencies. Larry Fink, CEO of BlackRock, highlighted a “flight to quality,” where investors seek safety amid uncertainty, turning to assets like Bitcoin. Previously skeptical, Fink’s change of tune signifies the shifting sentiment towards cryptocurrencies among Wall Street giants.

According to Noelle Acheson, a leading crypto expert, the end of Crypto Winter may have been apparent even earlier this year with significant regulatory progress, major banks building crypto teams, emergence of new funds, and deepening participation of financial and technology giants in blockchain services. While challenges remain, the growth and interest in cryptocurrencies have been evident for months.

According to Noelle Acheson, a leading crypto expert, the end of Crypto Winter may have been apparent even earlier this year with significant regulatory progress, major banks building crypto teams, emergence of new funds, and deepening participation of financial and technology giants in blockchain services. While challenges remain, the growth and interest in cryptocurrencies have been evident for months.

Andreessen Horowitz Raises $3.4 Billion for Future Venture Funds

Andreessen Horowitz, also known as a16z, is gearing up to raise a whopping $3.4 billion for its upcoming early and seed-stage venture funds. Let’s dive in and explore the details together:

Q1: How much is Andreessen Horowitz aiming to raise for its next venture funds? According to Axios, a16z has its sights set on a massive $3.4 billion for its early and seed-stage venture funds. This would continue to solidify their position as the largest venture capital firm in terms of assets under management.

Q2: When will a16z begin its fundraising efforts? Sources say that a16z plans to kickstart its fundraising process at some point before the end of this year. It’s an exciting time for investors and entrepreneurs alike!

Q3: Does a16z limit itself to just investing in tech companies? Not at all! While a16z is predominantly known for its focus on technology, AI, and social media platforms, the firm also takes an interest in the crypto space. Their diverse portfolio encompasses various crypto projects and businesses, including big names like Coinbase, Aptos, and OpenSea.

Q4: Will crypto investments remain a priority for a16z? Absolutely! Axios reports that a16z intends to keep crypto investing at the forefront of its strategy. In fact, they’re planning to introduce new investing vehicles specifically dedicated to crypto in 2025. Exciting times lie ahead for the crypto community!

Q5: Any noteworthy recent crypto investments by a16z? Indeed! In late October, a16z backed smlXL in its successful $13.4 million funding round. Additionally, a16z Crypto led a $16.8 million seed round in September for NFT-focused startup IYK, alongside other prominent investors like Lattice Capital and 1kx.

Q6: Is a16z eyeing the UK market as well? Absolutely! In May, a16z made its voice heard by writing to the UK government regarding crypto regulations. They advocated for a tailored approach and cautioned against a “one-size-fits-all” approach. It’s clear that a16z has its sights set on global opportunities!

Editor’s Wrap: On Bitcoin White Paper’s 15th Anniversary, Wall Street Threatens to Swallow Its One-Time Challenger

15 Years of Bitcoin: A Game-Changer Amidst Financial Turmoil In late October 2008, as traditional finance was facing an unprecedented crisis, Satoshi Nakamoto introduced Bitcoin. However, most of the financial world, including myself, remained oblivious to the brewing cryptocurrency revolution.

The Birth of a Crypto Revolution: Satoshi Nakamoto’s Bitcoin white paper captured the imagination of many. It hinted at a world where peer-to-peer systems could challenge and replace the trusted giants of Wall Street. As Bitcoin started gaining traction, the crypto landscape began to take shape.

The Rise of Bitcoin ETFs and Derivatives Trading: The recent excitement surrounding the potential listing of Bitcoin ETFs by major asset managers like BlackRock has sent ripples through the crypto community.

Beyond Bitcoin: Embracing Blockchain’s Potential While Bitcoin captures the spotlight, it’s important to remember that the crypto world extends far beyond a single cryptocurrency. Blockchains like Ethereum and its associated networks offer decentralized alternatives to traditional finance, with smart contracts and their own tokens. Should we view this as a continuation of Satoshi’s vision?

What Lies Ahead for Crypto and TradFi? As Wall Street increasingly enters the crypto space, the role of regulators becomes crucial. Their decisions will shape the future landscape.

CoinWestern Quixplaned????

????Tesla’s $312M Bitcoin hoard remains untouched in Q3 2023

????Binance sees over $500M withdrawn amid ongoing regulatory troubles

????Dubai investor rues early exit from Shiba Inu investment; misses out on $70 million

Top Reddits This Week That Got Our Attention

JPMorgan says Ethereum’s activity post-Shanghai upgrade has been ‘disappointing’

I made new art for the Bitcoin Crab Market

Shrinkflation: a subtle way to hide inflation

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?