???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

1️⃣ Market Update: Crypto Prices React to Middle East Turmoil

2️⃣Israel’s Police Collaborates with Binance to Freeze Hamas-Linked Cryptocurrency Accounts

3️⃣ Zimbabwe Launches Gold-Backed Digital Token as Payment Method

4️⃣Editor’s Wrap: We Should Skip The Damn SBF Trial

The Intricacies Behind Jaynti Kanani’s Departure and the Future of Polygon 2.0

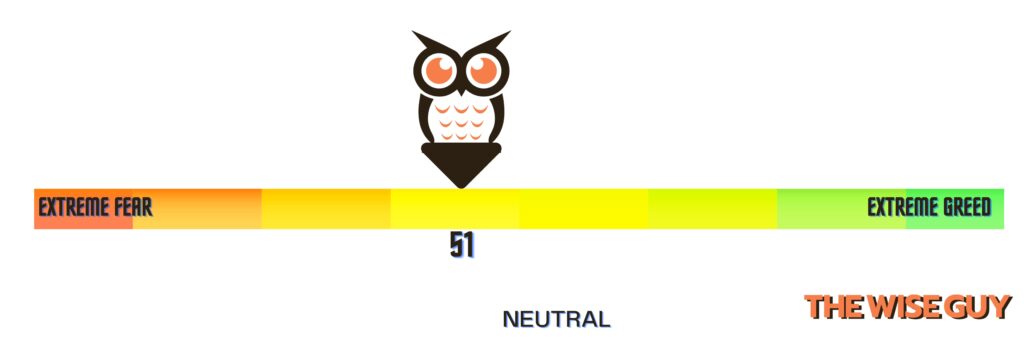

The cryptocurrency market experienced a downward trend on Monday, following a slight decline in global equity markets and rising oil prices amidst escalating tensions in the Middle East. Bitcoin (BTC) recorded a 1.7% drop over the past 24 hours, reaching $27,500. Despite this dip, Bitcoin outperformed most other digital assets, with crypto investment services firm Matrixport advocating its status as “better than digital gold.”

Throughout the weekend, Bitcoin appeared poised to surpass a two-month high above $28,400 but was unable to break the $28,200 resistance level before undergoing a bearish turn earlier today.

In line with the broader market sentiment, the CoinDesk Market Index (CMI) experienced a 2% decrease. Ether (ETH) faced a 2.5% decline, influenced by macroeconomic concerns and the Ethereum Foundation selling $2.7 million worth of tokens on UniSwap.

Furthermore, ETH extended its losing streak against BTC, hitting a 15-month low relative to Bitcoin.

Altcoins also experienced significant losses, as Ripple Labs’ associated token (XRP), solana (SOL), Polygon’s native token (MATIC), Avalanche’s (AVAX), and the popular meme token dogecoin (DOGE) all registered declines of 4%-5% over the past 24 hours.

Amidst these market fluctuations, the ongoing Israel-Hamas conflict added to the uncertainties impacting global markets. The conflict, which entered its third day on Monday, raised concerns about potential spillover effects on neighboring countries, particularly Iran.

Traders speculated that these tensions could disrupt oil supply, leading to a rise in prices. Josh Young, Chief Investment Officer of energy investment firm Bison Interests, noted that the enforcement of sanctions on Iranian exports by the U.S. could have a significant impact, potentially driving WTI crude oil prices up by around $5.

Indeed, WTI crude oil experienced a 3.5% increase since Sunday, reaching $86.54 per barrel, marking a three-month gain of 16%.

In response to these geopolitical events and resulting market uncertainties, Asian equity markets closed in the red. Although both European and U.S. stocks also experienced losses, the declines were relatively modest, with the Stoxx 600 down just 0.25% and the S&P 500 down 0.6%.

Israel’s Police Collaborates with Binance to Freeze Hamas-Linked Cryptocurrency Accounts

In response to the recent deadly attacks on Israel by Hamas, the Cyber Unit of Israel’s police announced on Tuesday its partnership with Binance to freeze multiple cryptocurrency accounts associated with the terrorist organization. This collaborative effort involved various national intelligence agencies, the Ministry of Defense, and the Israel Security Agency.

The initiative comes as part of the measures taken to counteract Hamas’ fundraising activities that have been carried out through social media platforms since Saturday. Binance, a leading cryptocurrency exchange, provided valuable assistance by helping the Israeli authorities identify and deactivate these accounts.

A spokesperson from Binance expressed their commitment to combatting terror financing, stating that the exchange actively collaborates with global law enforcement agencies and regulators. The team at Binance worked tirelessly to support ongoing efforts in real-time, emphasizing their dedication to ensuring safety and security within both the blockchain ecosystem and the global community.

Additionally, Israel’s Police Cyber Unit collaborated with British police to freeze a Barclays Bank account in the UK, which Hamas had specifically referred to for donation purposes. At the time of writing, representatives from the Israeli police and Barclays were unavailable for immediate comments.

This is not the first time Hamas has turned to cryptocurrency for fundraising. In February 2019, the militant group initiated a call for crypto donations to evade international sanctions. Last year, Israeli authorities had already immobilized nearly 190 crypto accounts on Binance, with a significant portion linked to Palestinian firms connected to Hamas.

Despite this, in April of this year, the military branch of Hamas, the Al-Qassam Brigades (AQB), announced the shutdown of their crypto donation program, citing successful government efforts to identify and prosecute donors. Additionally, the Israeli government seized $1.7 million worth of crypto from accounts linked to Hezbollah and the Iranian paramilitary Revolutionary Guard’s elite Quds Force in June, as part of ongoing efforts to combat terrorist financing.

Amidst the ongoing conflicts, the local crypto community launched Crypto Aid Israel, an initiative aimed at raising funds to support citizens displaced due to the violence. The initiative includes a multi-signature wallet capable of accepting donations in various cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and USD Coin (USDC).

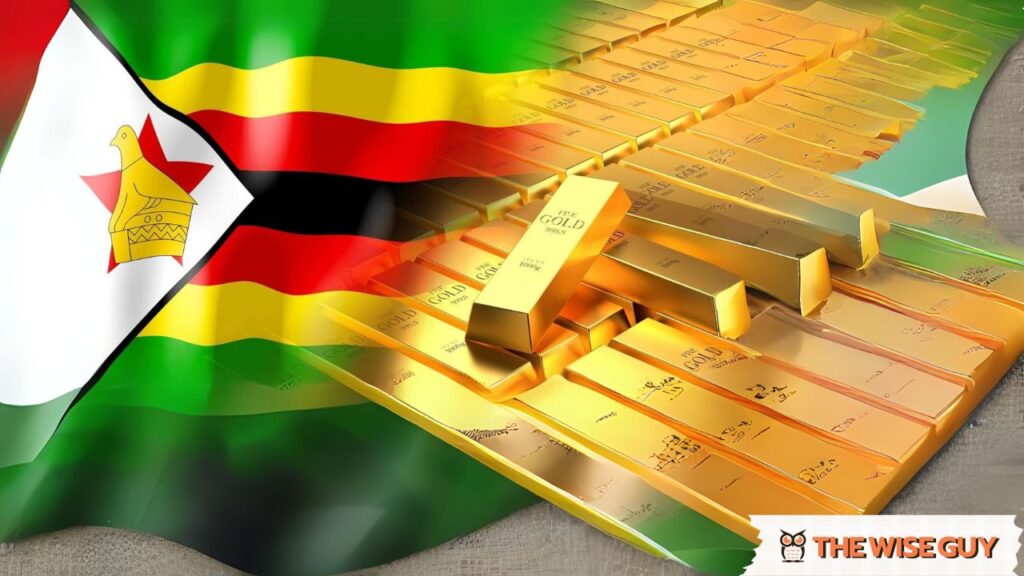

Zimbabwe Launches Gold-Backed Digital Token as Payment Method

In an effort to combat currency instability and rising inflation, the Reserve Bank of Zimbabwe (RBZ) officially introduced Zimbabwe Gold (ZiG), a gold-backed digital token, on October 5th. This marks a significant milestone for the central bank, which had previously begun issuing physical gold tokens last year.

The RBZ’s motive behind this new initiative is to encourage local investors to shift their focus from holding American dollars to investing in national assets.

The introduction of ZiG aims to expand the range of value-preserving instruments available in the economy, improve the tradability of investment instruments, and increase accessibility for the public.

ZiG, backed by physical gold reserves held by the RBZ, can be stored in e-gold wallets or on e-gold cards. These digital tokens are not only tradable for peer-to-peer transactions but can also be used for various business transactions.

To accommodate different investor preferences, the RBZ has set different price levels based on the weight of the gold reserve. For instance, one ounce of ZiG can be purchased for $1,910, while 0.1 ounce is available for $191.

According to recent reports from the RBZ, investors have bought the equivalent of approximately 17.65 kg in ZiG, using both Zimbabwean and American dollars as payment. It is estimated that a total of around 350 kg of gold in ZiG has been sold since the previous rounds of digital token sales.

Zimbabwe has faced economic challenges, including currency instability and high inflation, for over a decade. In 2009, the nation abandoned its local currency due to hyperinflation and adopted the U.S. dollar as the official currency.

However, in 2019, in an attempt to revive the domestic economy, Zimbabwe reintroduced its own currency, which led to

Editor’s Wrap: We Should Skip The Damn SBF Trial

In the world of cryptocurrencies, all eyes are on the courtroom as former crypto maverick turned alleged fraudster, Sam Bankman-Fried, faces conspiracy and fraud charges. While the media eagerly covers this unfolding drama, there is a concern that legitimate crypto businesses may get distracted by the spectacle rather than focusing on their customers and strategic plans.

Katherine Snow, the Head of Legal at Messari, a leading platform for crypto market intelligence, emphasizes the need for the industry to stay on course amidst the frenzy surrounding Bankman-Fried’s trial. It’s important that the actions of one individual do not overshadow the sector’s ongoing efforts to promote sensible regulations and maintain the trust of their stakeholders.

In recent times, the crypto industry has made significant strides in Washington, positioning itself as a key player rather than an outsider. Trade associations, think tanks, political action committees, and lobbyists have all played a part in attracting the attention of policymakers and regulators. Notably, June saw the successful passage of four regulatory bills through a Congressional committee for the first time, signaling progress and regulatory clarity.

Snow highlights the critical nature of the current juncture. The industry cannot afford to lose focus due to the Bankman-Fried trial. It’s time for all industry participants, from developers to startups and established firms, to unite and showcase their commitment to ethical conduct and responsible practices. The industry has already demonstrated its ability to react swiftly to regulatory challenges, engage in constructive discussions, and educate lawmakers.

Amidst the sensationalism surrounding the trial, the crypto community must prioritize its core business and goals. With the clock ticking towards progress in Washington, stakeholders must amplify their collective voice and demonstrate that blockchain technology is both tangible and worthy of support. By doing so, they aim to establish a regulatory framework that fosters innovation, safeguards consumers and developers, and ensures the United States remains at the forefront of the Web3 revolution.

Ultimately, the fate of America’s digital future rests in the hands of Washington policymakers. It’s crucial that they delve beyond the headlines and fully understand the potential impact of their decisions. The crypto industry’s advancement and America’s hegemonic power are at stake, making it imperative for responsible regulation to be established.

Let’s keep our focus on the bigger picture and strive for progress while the world watches the trial unfold.

CoinWestern Quixplaned????

????Elusive ‘Satoshi Nakamoto’ twitter handle springs back to life after years of dormancy

????Metaplex’s “Bubblegum” fuels the minting of Millions of compressed NFTs on Solana

????Dubai investor rues early exit from Shiba Inu investment; misses out on $70 million

Top Reddits This Week That Got Our Attention

JPMorgan says Ethereum’s activity post-Shanghai upgrade has been ‘disappointing’

I made new art for the Bitcoin Crab Market

Shrinkflation: a subtle way to hide inflation

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?