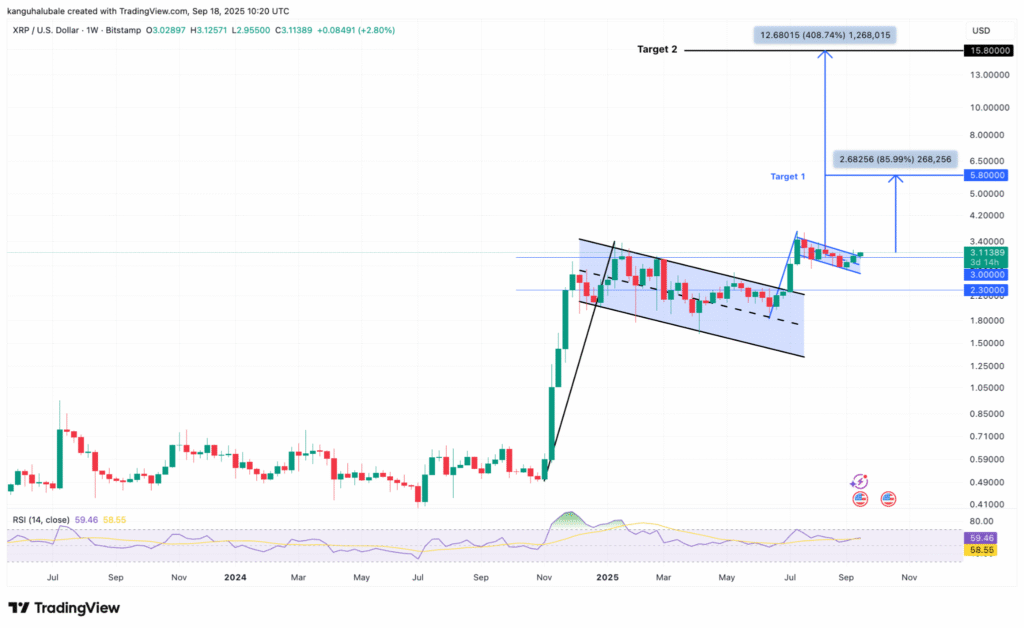

XRP’s price momentum is building once again, with technical patterns and fresh institutional catalysts aligning to set the stage for a potential breakout toward the long-awaited $15 mark.

The altcoin was trading at $3.12 on Thursday, up 3% in the past 24 hours and nearly 17% higher than its September 1 low of $2.69. Market analysts say the rebound strengthens XRP’s bullish setup, with both technical and fundamental drivers suggesting further gains ahead.

Bull Flag Patterns Signal Higher Targets

On the charts, XRP has painted a bull flag pattern on the weekly time frame, a classic continuation formation that often precedes the next leg higher. A smaller bull flag that began forming in mid-June recently broke out above $3, setting a measured target of $5.80, a 46% gain from current levels.

Crypto analyst Crypto Pulse commented,

“On the daily chart, XRP is forming another bull flag. This continuation pattern suggests $XRP could be gearing up for its next big breakout toward $5+.”

But the larger story lies in a bigger bull flag pattern dating back to November 2024, which remains active. XRP confirmed its breakout in July with a rally that pushed prices above nine-year highs of $3.66. If this structure fully plays out, XRP could rally to as high as $15.80, more than 400% above current levels.

Supporting the bullish case, analyst Egrag Crypto pointed to a fractal megaphone pattern on the five-day chart, predicting XRP could trade between $6 and $7 by mid-November.

ETF Launch Brings XRP Into Mainstream Finance

Adding to the technical momentum is a landmark regulatory development. The REX-Osprey XRP ETF ($XRPR) began trading on U.S. exchanges Thursday, becoming the first spot XRP ETF under full regulatory oversight. The fund cleared its 75-day SEC review period without objections, thanks to its structure under the Investment Company Act of 1940—offering a smoother approval path than the Bitcoin ETF route.

Nate Geraci, president of ETF Store, noted that the launch “will be another good litmus test for spot XRP ETF demand,” highlighting that futures-based XRP ETFs already hold nearly $1 billion in assets. Analysts say the ETF could channel institutional capital into XRP markets at an unprecedented scale.

Beyond ETFs, Ripple continues to strengthen XRP’s real-world utility. Its recent partnership with DBS Bank and Franklin Templeton to launch a tokenized money market fund on the XRP Ledger underscores growing institutional interest in leveraging the network for tokenization and settlement.

Outlook: $15 Still in Play

With XRP trading firmly above $3, technical indicators and institutional developments both point to a new growth phase. If the current bull flag patterns hold, XRP’s next targets include $5.80 in the short term and as high as $15.80 over the coming cycle.

For a cryptocurrency that has weathered years of regulatory uncertainty, the combination of bullish technicals, ETF approval, and real-world adoption suggests that XRP could be entering one of its strongest phases yet.