XRP has remained firmly in the spotlight in recent weeks, managing to hold key price levels while navigating through mixed market phases. The token continues to attract widespread investor attention, with analysts pointing to familiar growth setups from past cycles.

Adding to the momentum is Ripple’s upcoming Swell 2025 event in New York, which will feature participation from global financial giant BlackRock, a move that many believe adds institutional weight to XRP’s long-term outlook.

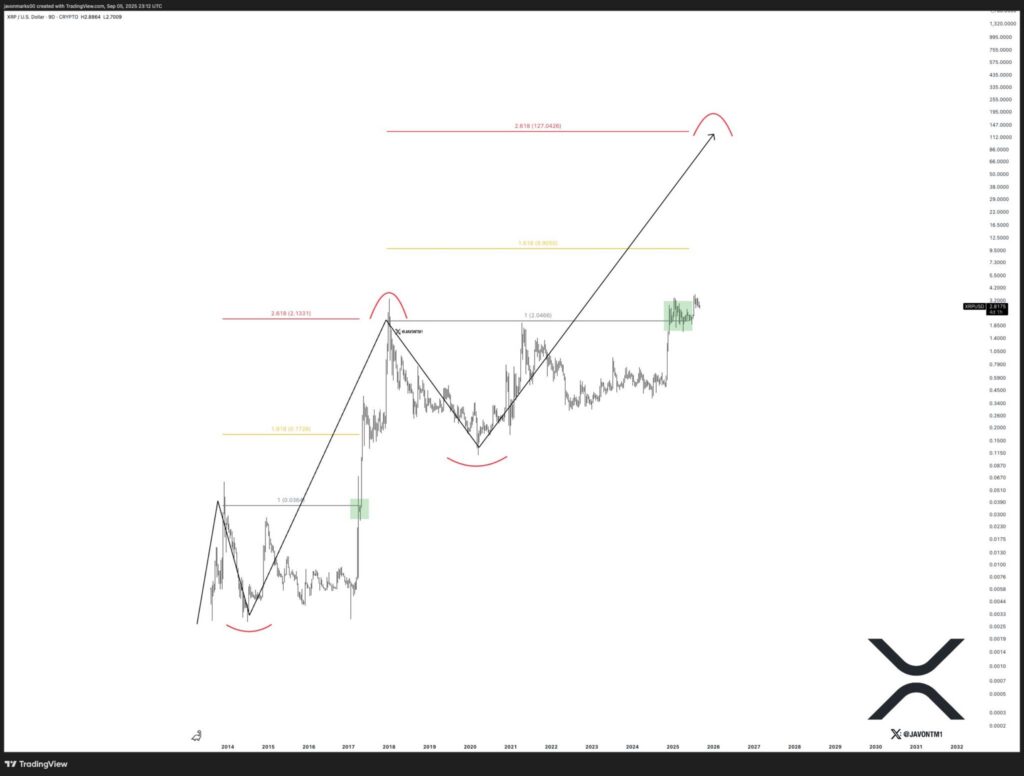

Historical Patterns Point Toward $127 XRP Target

Analyst Javon Marks has drawn comparisons between XRP’s current market structure and its explosive rally in 2017. His analysis highlights a repeating fractal pattern that could signal the potential for another exponential run. Using Fibonacci extension levels, Marks outlined a possible trajectory that could take XRP as high as $127, provided the cycle unfolds in a similar fashion.

Marks further noted that XRP’s ongoing consolidation could serve as the foundation for a major rally. With price action currently trading around $2.81, the setup appears to be forming a cup-and-handle pattern, a classic bullish continuation signal.

On the technical side, XRP is holding between $2.80 and $2.85, with the handle shaping into a descending channel. A breakout from this zone could trigger a move toward the $3.20 resistance area, followed by the $3.80 Fibonacci extension level. However, the $3.38 zone remains the critical barrier that must be cleared for confirmation of stronger upside momentum.

Overall, the technical and historical signals suggest that XRP may be laying the groundwork for a breakout attempt, potentially setting the stage for the larger price projections discussed by analysts.

BlackRock Adds Institutional Spotlight to Ripple Swell 2025

Excitement around XRP has been amplified further by news that BlackRock will participate in Ripple Swell 2025, scheduled for later this year. The event will feature more than 60 speakers, including BlackRock’s Maxwell Stein, whose presence has sparked discussions on the growing intersection between traditional finance and blockchain technology.

Although BlackRock has clarified that it has no immediate plans for an XRP ETF, its involvement in Ripple’s flagship event is significant. Swell conferences have historically been a platform for major announcements and industry-shaping dialogue, and BlackRock’s participation underscores the increasing seriousness of institutional interest in Ripple’s ecosystem.

For many in the XRP community, the presence of one of the world’s largest asset managers adds credibility and anticipation to the event, reinforcing the notion that XRP is gaining traction well beyond the retail investor base.

XRP remains one of the most closely watched digital assets in the market. While shorter-term technicals highlight a potential breakout from the cup-and-handle formation, the long-term outlook, backed by historical patterns, suggests the possibility of a far greater rally, with targets extending as high as $127. Combined with the spotlight of Ripple Swell 2025 and BlackRock’s participation, XRP continues to strengthen its case as both a speculative and institutional play in the evolving crypto landscape.