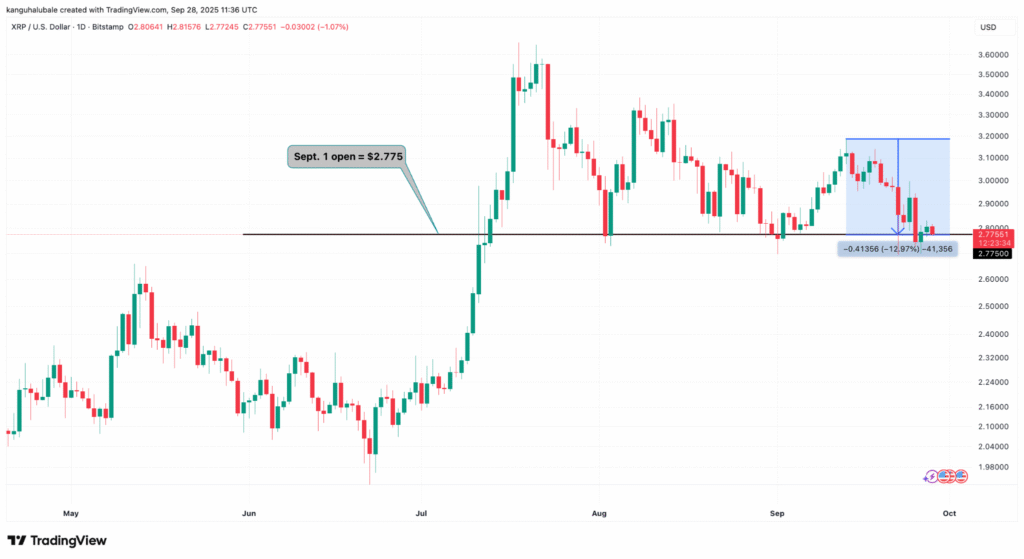

XRP is holding steady above a crucial support level, keeping bullish hopes alive for a potential October recovery. After sliding nearly 14% in September, the token opened the month around $2.77 and now trades near $2.88. For analysts, the $2.75 zone remains the line in the sand that could determine whether XRP rebounds toward higher targets, or falls into deeper losses.

The $2.75 level aligns with the lower boundary of a symmetrical triangle pattern, making it a key technical zone to watch.

On-chain data from Glassnode further highlights its importance, showing that nearly 1.58 billion XRP were accumulated around this price point. If buyers defend this level, XRP could attempt to break above the immediate resistance at $2.81, which coincides with the 100-day simple moving average (SMA).

A successful breakout could trigger a rally toward the bullish target of the triangle at $3.62, roughly 30% above current levels.

Still, XRP bulls face hurdles. A significant supply wall sits around $2.81, threatening to cap any near-term upside. Conversely, losing the $2.75 support could send prices tumbling toward $2.00, the bearish target for the pattern. “$XRP is still in a solid bullish consolidation,” analyst Hardy noted on X, adding that as long as the price holds above the $2.72–$2.75 range, upside momentum remains possible.

Analyst XForceGlobal echoed the sentiment, suggesting that prolonged consolidation around support could strengthen the eventual breakout, with long-term targets still in the $20–$30 range.

History, however, complicates the bullish narrative. October has often been a difficult month for XRP, with the token posting negative returns in seven of the last 12 years and averaging a −4.58% decline. But November and December have historically been far stronger, delivering average quarterly gains of 51%.

The last quarter of 2024 saw XRP climb 240%, while 2017’s Q4 delivered an eye-popping 1,064% surge. This seasonal trend leaves open the possibility of another dramatic rally beginning mid-October.

The ETF narrative could also act as a catalyst. Multiple applications, including those from Franklin Templeton, Grayscale, and REX/Osprey, face key SEC deadlines in October and November. Analysts estimate XRP ETFs could draw $4–$8 billion in inflows within their first year if approved.

Post-lawsuit clarity around Ripple has further boosted optimism, with approval odds projected at near certainty by year-end. That said, some traders warn the market may have already priced in much of this optimism, raising the risk of a “sell the news” reaction once approvals arrive.

For now, XRP’s path forward hinges on the $2.75 level. Holding above it could set the stage for an ETF-fueled rally into year-end, while losing it risks breaking the bullish momentum. With ETF deadlines and historical Q4 trends aligning, October could prove to be the pivotal month for XRP’s next big move.