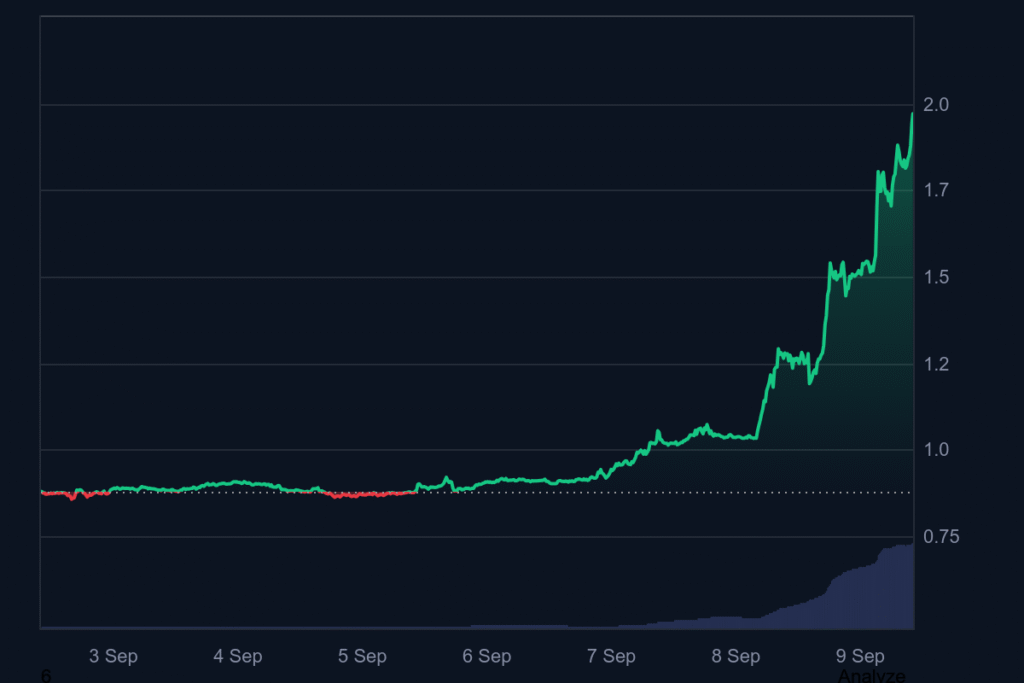

World (WLD) surged nearly 20% on Monday after Nasdaq-listed Eightco Holdings revealed plans to adopt the token as the centerpiece of its $270 million treasury strategy. The announcement marks the first time a public company has committed to holding Worldcoin as its primary reserve asset.

This has sparked a noticable rally for both WLD’s price and an unprecedented spike in Eightco’s stock. At the time of press, WLD is swapping hands with $1.97 after surging 57.07% in the past 24 hours.

The move comes after Eightco confirmed a $250 million private placement, selling over 171 million shares at $1.46 each, alongside a $20 million investment from BitMine Immersion Technologies. Altogether, the financing will fund the creation of what Eightco describes as the world’s first Worldcoin treasury.

Pending Nasdaq approval, the deal is expected to close by September 11, after which Eightco will rebrand its ticker from OCTO to ORBS.

Dual Rally in Stocks and Crypto

The market reaction was immediate and dramatic. Eightco’s Nasdaq-listed shares skyrocketed by more than 2,000%, soaring from $1.45 to $17.34 intraday, according to TradingView data. At the same time, WLD climbed from $1.03 to briefly testing $1.30 before settling around $1.25. The surge represented Worldcoin’s sharpest single-day gain in weeks.

The treasury plan will prioritize Worldcoin while holding smaller reserves in Ethereum and cash. Analysts suggest this model could pave the way for other firms to diversify into blockchain-based assets.

Strategic Leadership and Market Endorsements

Eightco also named Dan Ives, a respected Wall Street analyst and technology expert, as chairman of its board. Ives praised Worldcoin’s potential as a foundational technology for authentication in an AI-driven economy. “World is the internet of people,” he said, framing the project as a trust layer in what he called the Fourth Industrial Revolution.

Despite this optimism, Worldcoin continues to face regulatory scrutiny. Beijing recently cracked down on iris-scanning practices tied to the project, reflecting global concerns about privacy and biometric data security.

Backing From Industry Heavyweights

Worldcoin’s co-founder Sam Altman welcomed Eightco’s move, describing it as a signal of growing institutional belief in the project. Altman highlighted the creation of over 16 million Proof of Human accounts across 45 countries, calling the mission to build the largest verified human network “a step toward a trusted digital identity layer for the internet.”

Chairman Tom Lee also emphasized Worldcoin’s alignment with Ethereum’s ecosystem, since WLD operates as an ERC-20 token. He suggested its Proof of Human model could become essential for trust and safety as platforms prepare for billions of new digital identities.

The placement attracted backing from notable firms, including MOZAYYX, Kraken, Pantera, Discovery Capital, GSR, and Brevan Howard. Advisory roles were handled by RF Lafferty, Cantor Fitzgerald, and Moelis & Company, further validating institutional interest in the initiative.

A Pivotal Moment for Worldcoin

Eightco’s bold adoption of Worldcoin places the project squarely in the spotlight, with both supporters and critics watching closely. If successful, the treasury initiative could set a precedent for how corporations integrate blockchain assets into their balance sheets, while cementing WLD’s role in the race to establish trust in a digital-first economy.