Forward Industries delivered a stunning performance on Wall Street this week, with shares soaring 36% on September 11 following the company’s announcement of a $1.65 billion Solana Treasury plan. The move, which marks a significant pivot into the crypto sector, has boosted investor confidence, propelling FORD’s stock up 135% in just one week.

FORD’s $1.65 Billion Solana Bet

Earlier this week, Forward Industries finalized a $1.65 billion private placement to fund its large-scale purchase of Solana’s native token, SOL. The announcement immediately sparked a wave of optimism in both equity and crypto markets. Daily trading volumes for Solana surged by 27%, topping $11.1 billion, highlighting the market’s strong appetite for this news.

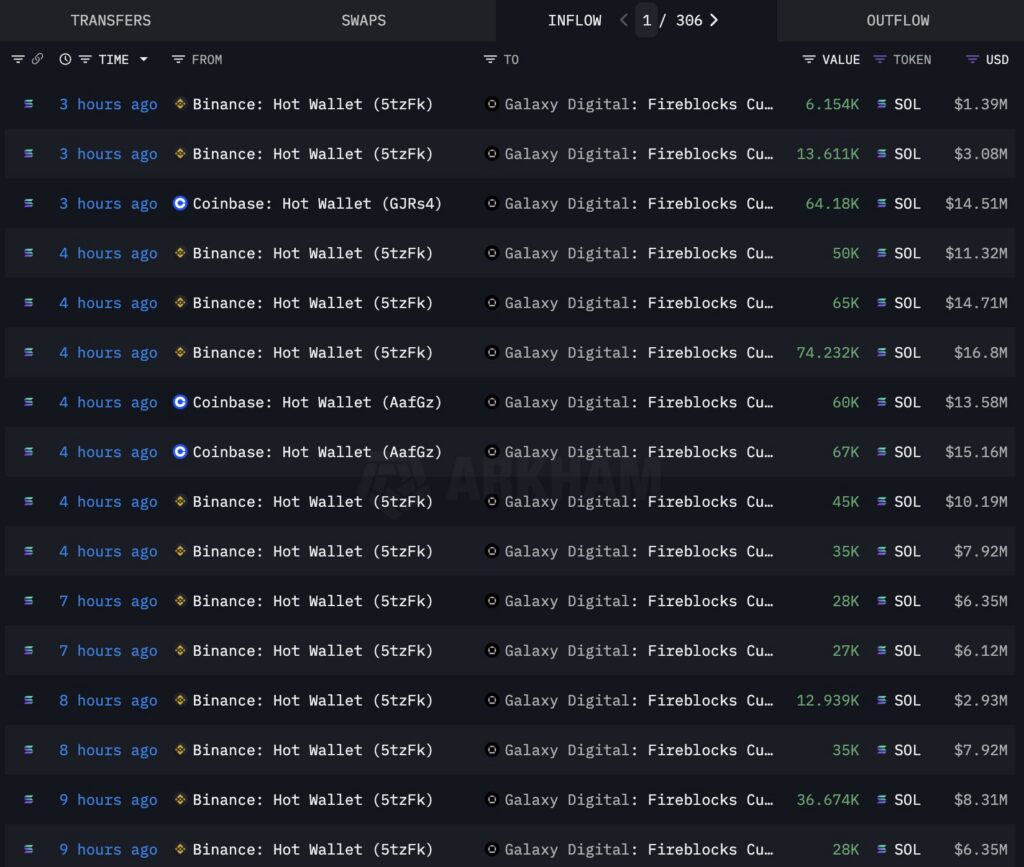

Galaxy Digital, the digital asset management firm led by Mike Novogratz, is working closely with Forward Industries on this ambitious acquisition. Data from Arkham Intelligence revealed that in just 24 hours, the firms acquired more than 2.1 million SOL tokens worth roughly $486 million.

Novogratz, speaking in a CNBC interview, emphasized Solana’s unmatched blockchain capabilities, noting its ability to handle up to 14 billion transactions per second, a scale exceeding traditional equities, fixed income, commodities, and FX markets combined.

This positioning, he argued, makes Solana a “special treasury asset,” capable of playing a role beyond conventional crypto holdings.

Ripple Effect in the Market

The announcement didn’t just propel FORD stock higher; it also intensified the broader race for Solana-based treasuries. Another firm, SOL Strategies, made its Nasdaq debut this week under the ticker STKE, further underscoring the growing demand for exposure to Solana. On Thursday alone, FORD’s daily trading volume crossed $1 million, reflecting heightened retail and institutional participation.

Meanwhile, Solana itself continues to dominate the crypto rally. After softer U.S. Producer Price Index (PPI) data improved market sentiment, SOL gained 6% to reach $234, extending weekly gains to 15%. Futures market activity has also accelerated, with open interest rising 7.28% to $16.41 billion, according to Coinglass.

Prominent crypto analyst Javon Marks suggested that if SOL maintains support above $233, it could pave the way for a breakout rally, potentially doubling to $457.

DeFi and ETF Tailwinds

Solana’s momentum extends beyond trading speculation. The blockchain’s decentralized finance (DeFi) ecosystem is thriving, with total value locked (TVL) surpassing $13 billion for the first time. These fundamentals, paired with growing institutional interest, have positioned Solana as a leading force in the crypto economy.

Adding to the excitement, investors are closely watching the potential approval of a spot Solana ETF, expected as early as October. If approved by the U.S. SEC, it could attract a new wave of capital inflows, further solidifying Solana’s position.

With FORD’s bold treasury strategy and Solana’s accelerating adoption, the partnership between traditional equities and blockchain ecosystems appears to be gaining strength. The coming weeks may prove pivotal, as both FORD and Solana test the limits of investor enthusiasm in a rapidly evolving market.