Quantum technology is advancing at breakneck speed, sparking both excitement and concern within the cryptocurrency community. With computing power that can solve complex problems in seconds rather than decades, quantum computers pose a unique challenge to Bitcoin’s long-standing cryptographic defenses. While the technology is not yet advanced enough to pose an immediate threat, its potential to unlock millions of lost Bitcoin has stirred debate across the industry.

From Quantum Mechanics to Real-World Power

Quantum computing stems from quantum mechanics, a branch of physics that explores how matter and energy behave at subatomic levels. Its principles already power everyday technologies such as lasers, transistors, and MRI machines. But quantum computers—like Google’s experimental chip Willow—are said to be up to 300,000 times faster than traditional systems, making them capable of breaking encryption schemes once thought impenetrable.

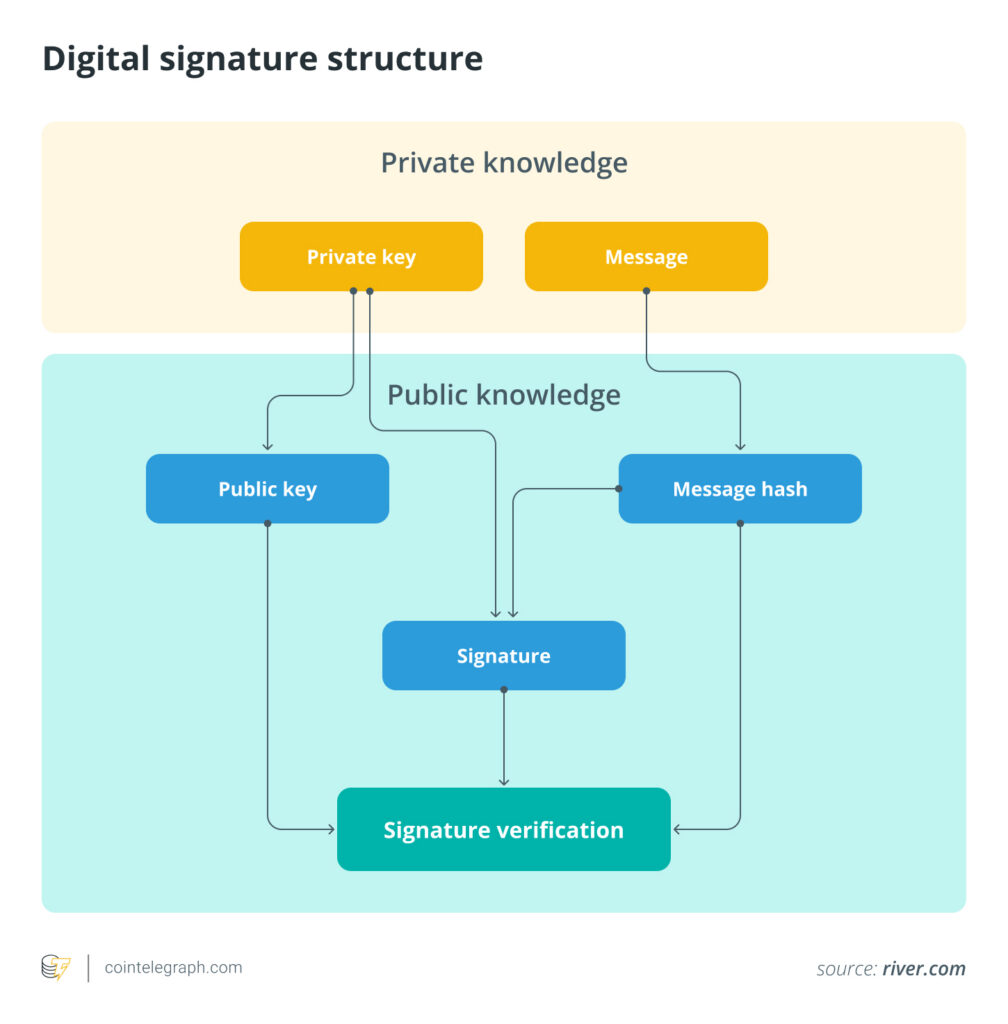

Bitcoin’s cryptographic system, built on the Elliptic Curve Digital Signature Algorithm (ECDSA), could eventually become vulnerable to quantum attacks. ECDSA relies on the elliptic curve discrete logarithm problem (ECDLP), which classical computers cannot solve efficiently. However, with tools like Peter Shor’s quantum algorithm, a sufficiently advanced quantum computer could derive private keys from public ones—effectively exposing Bitcoin wallets.

The Dormant Bitcoin Dilemma

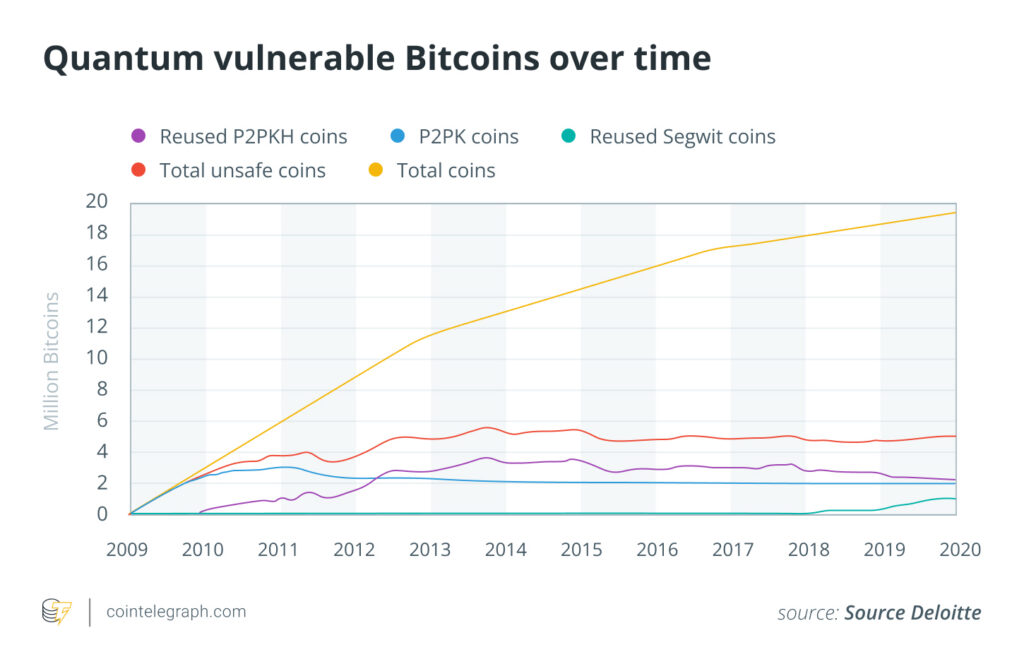

Analysts estimate that between 2.3 million and 3.7 million Bitcoin—roughly 11% to 18% of the total supply—are permanently lost due to forgotten passwords, destroyed hard drives, or inaccessible private keys. These dormant wallets, many dating back to Bitcoin’s earliest days, often use outdated cryptographic formats that are more susceptible to quantum attacks.

If quantum computers were able to crack these wallets, coins long thought to be gone forever could re-enter circulation. The most famous case would be the roughly one million BTC tied to Satoshi Nakamoto, Bitcoin’s anonymous creator. Should these coins suddenly flood the market, Bitcoin’s scarcity narrative could be shaken, potentially driving dramatic swings in price and investor confidence.

Risks, Ethics, and Economics

The possibility of recovering lost Bitcoin raises ethical and economic questions. On one hand, redistributing dormant coins could restore billions of dollars in lost wealth. On the other, it risks undermining Bitcoin’s fixed supply narrative, a cornerstone of its value proposition.

Some experts, like Bitcoin veteran Jameson Lopp, argue that if such coins are ever recovered, they should be destroyed—or “burned”—to preserve the integrity of Bitcoin’s scarcity. Others propose redistributing them to address inequality within the ecosystem.

Protecting Bitcoin in a Quantum World

While experts such as Adam Back and Michael Saylor insist quantum threats are decades away, Bitcoin developers are not standing still. Research into quantum-resistant protocols and wallets is ongoing. Proposed solutions, like the Quantum-Resistant Asset Mapping Protocol (QRAMP), aim to safeguard Bitcoin while maintaining cross-chain compatibility.

For everyday users, simple practices can still reduce risk. Avoiding address reuse, using wallets that support Taproot and SegWit, and staying vigilant against phishing attacks like address poisoning can strengthen wallet security today.

Did you know? Around 25% of Bitcoin is stored in wallets that reveal their public keys, making them particularly vulnerable to future quantum attacks.

A Race Against Time

Currently, the most powerful quantum computers process between 100 and 1,000 qubits. Experts estimate that breaking Bitcoin’s encryption would require between 13 million and 300 million qubits—far beyond today’s capabilities. Still, research is accelerating, and firms like BlackRock have already flagged quantum computing as a long-term risk in Bitcoin investment filings.

Bitcoin’s resilience lies in its adaptability. With ongoing research into quantum-resistant cryptography, it may not just survive the quantum era but evolve stronger. Until then, the prospect of dormant wallets reawakening remains both a tantalizing possibility and a looming challenge for the world’s largest cryptocurrency.