The crypto market is once again bracing for turbulence, with Mantra (OM) and IOTA (MIOTA) facing contrasting but equally challenging scenarios. While Mantra prepares for a fresh wave of token unlocks that could flood the market with new supply, IOTA continues to hover near multi-year lows with limited catalysts to spur growth. Together, these developments raise questions for traders seeking the best crypto to buy today.

Mantra Faces Daily Unlocks and Bearish Momentum

Once hyped as a modular blockchain play, Mantra is now battling intense downward pressure. Trading at $0.165, OM has plunged more than 86% over the past year, according to CoinGecko data. With a market cap of $179 million and $20.7 million in 24-hour trading volume, liquidity is present but not strong enough to absorb the incoming supply shock.

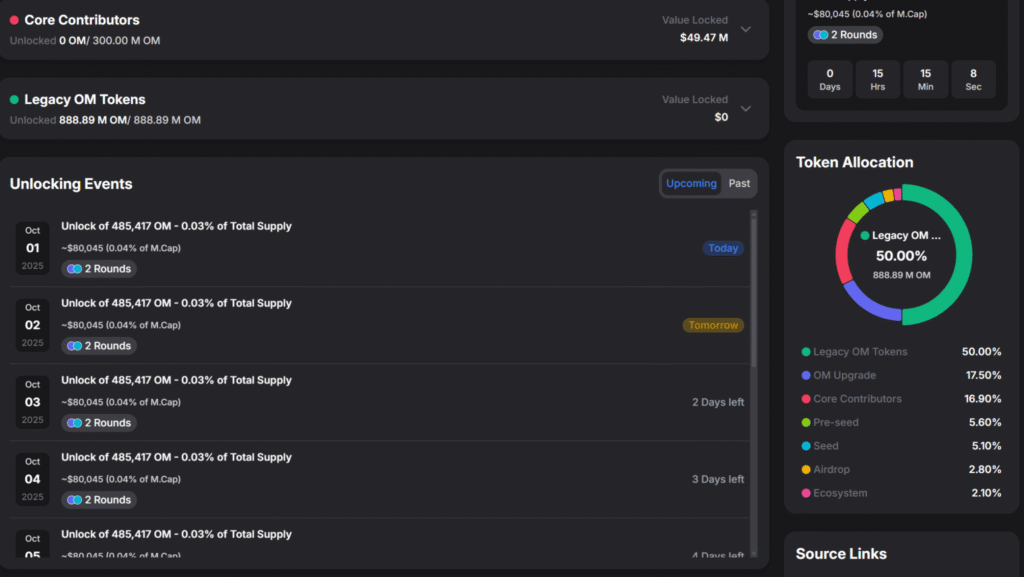

From October 1–8, Mantra will undergo daily token unlocks of 485,417 OM, worth about $80,000 per day, or 0.03% of its circulating supply. Half of OM’s supply already stems from legacy tokens, while another 16.9% sits with core contributors whose vesting schedules loom. Analysts warn that with OM already in a steep downtrend, “each unlock increases the risk of cascading sell-offs,” according to Messari’s DeFi research desk.

Unless Mantra can attract new users or strike meaningful partnerships, reclaiming its summer highs of $0.34 looks increasingly difficult. Without external demand, the constant drip of supply could keep the token pinned under heavy selling pressure.

IOTA Holds Ground but Lacks Catalysts

In contrast, IOTA is not dealing with unlocks but has its own hurdles. Currently trading at $0.167, the token has a market cap of $681 million and daily volume of just $4.47 million, largely in USDT pairs. While IOTA is down 12.5% this month, it still trades 23% higher year-on-year, suggesting long-term holders and whales are keeping the floor intact.

However, the network that pioneered the “Tangle” architecture has largely lost ground to newer Layer-1 competitors like SUI and SEI. According to DefiLlama, IOTA’s wallet growth has stagnated, and its lack of developer momentum continues to weigh heavily on sentiment. With no fresh DeFi activity or institutional drivers, IOTA risks slipping further into irrelevance despite holding its base.

Macro Backdrop: Rate Cuts vs. Unlock Headwinds

The broader crypto market remains mixed. Bitcoin is steady near $114K following the Fed’s rate cut, but altcoins are diverging. Mantra’s unlock schedule practically guarantees short-term sell pressure, while IOTA, though stable, lacks the growth narrative to attract new buyers.

For investors, the dilemma is clear: Mantra may see further downside unless demand offsets dilution, while IOTA’s future hinges on whether it can reinvent itself in a crowded market. With token unlocks looming and stagnant growth persisting, both OM and MIOTA face a pivotal Q4 that could decide whether they rebound, or sink deeper.