- Arthur Hayes’ Ferrari-funded HYPE exit highlights the risks of following bold predictions over on-chain actions.

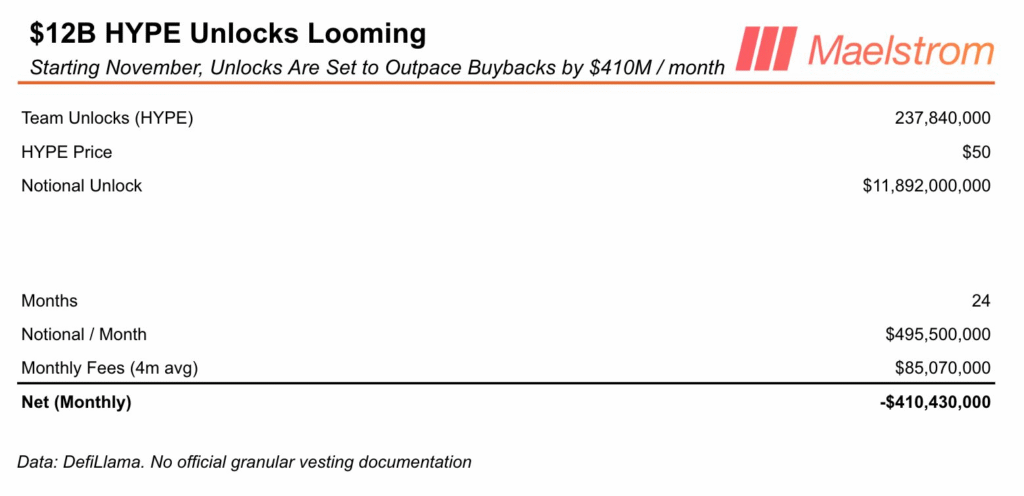

- Maelstrom warns the token faces intense selling pressure from $11.9 billion in upcoming unlocks that could weigh heavily on its price.

BitMEX co-founder Arthur Hayes has once again stirred the crypto community, this time by selling off his entire stash of Hyperliquid’s HYPE tokens, and apparently using the profits to secure a Ferrari. The move comes just a month after Hayes predicted the token could surge 126-fold within three years.

On Sept. 21, Hayes confirmed on X, that he had cashed out 96,628 HYPE tokens, worth over $823,000 in profit, writing: “Need to pay my deposit on the new Rari 849 Testarossa.” The new Ferrari model is expected to retail for up to $590,000, leaving Hayes with both a luxury car and a tidy gain of 19.2%, according to blockchain tracker HypurrScan.

HYPE Faces Major Headwinds

HYPE, the native token of the Hyperliquid decentralized derivatives exchange, is currently trading around $49.14, down 8% in the last 24 hours but still up more than 660% since launch. The project has seen rapid growth, with trading volume climbing from $560 million in early August to a record $3.4 billion on Aug. 24, per DeFiLlama data.

Despite that growth, Hayes’ family office, Maelstrom Fund, has sounded alarms about the token’s looming supply overhang. Beginning Nov. 29, Hyperliquid’s 24-month vesting schedule will start releasing a massive $11.9 billion worth of tokens to team members.

This translates to roughly $500 million in new supply each month, a scale of dilution that Maelstrom’s researcher Lukas Ruppert described as a “Sword of Damocles” hanging over HYPE’s price.

With current buybacks absorbing only 17% of that supply, the remaining $410 million monthly overhang could create serious downward pressure. Ruppert put it bluntly: “Put yourself in the shoes of a Hyperliquid dev. You’ve worked insanely hard for years. A life-changing sum in tokens is starting to vest; and it’s only one click away.”

Hayes’ Predictions and Market Outlook

Hayes’ decision to sell contrasts sharply with his own bullish forecast just weeks earlier at WebX 2025 in Tokyo, where he argued that continued fiat debasement and stablecoin growth could propel Hyperliquid’s annualized revenue to $255 billion, up from $1.2 billion, fueling a 126x rally in HYPE by 2028.

Still, Hayes has a history of making bold predictions and shrugging off inaccuracies. In June, he told Cointelegraph Magazine he is “unfazed” when his calls miss, noting that markets are unpredictable. Beyond HYPE, Hayes has also projected Bitcoin could hit $250,000 by the end of 2025 if global liquidity conditions shift.

Rising Competition

Adding to Hyperliquid’s challenges, competition from Binance-linked Aster, a new decentralized derivatives exchange, has quickly intensified. Aster’s APX token launch pushed its total value locked above $2 billion, with Maelstrom hinting that Binance founder Changpeng Zhao’s timing , just two months before HYPE’s unlocks, was likely strategic.