???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

1️⃣ Ethereum Gets Official Commodity Status! U.S. Court Tosses Investor Suit Against Uniswap!

2️⃣ YouTuber Loses $60K Worth of Crypto Live on Stream by Revealing Seed Phrases!

3️⃣ Ethereum Smartphones Sells Out First Batch in Just 24 Hours!

4️⃣ Grayscale Bitcoin ETF Verdict : Why It Matters More Than You Think!

ETH Officially Classified as a Commodity by U.S. Court

A lawsuit was filed earlier this year, accusing Uniswap of operating as an unregistered exchange and offering securities without the proper paperwork. The plaintiffs also wanted to hold Uniswap accountable for investors losing money to those pesky “scam tokens” like EthereumMax, Bezoge, and Alphawolf Finance. ????????

The judge had quite the plot twist in store. ???????? Judge Katherine Polk Failla categorized Ethereum as a commodity, explicitly contradicting the SEC’s stance. She refused to extend federal securities laws to cover Uniswap’s alleged misconduct.

According to the court ruling, the real villains in this story are the “scam token” issuers, not Uniswap. Turns out, the decentralized nature of the Uniswap Protocol made it impossible to pinpoint these sneaky culprits. ????️♀️????️♂️ And without identifiable defendants, the case got thrown right out the door. Case dismissed! ????????

Some might argue that the judge hit the nail on the head by calling out the scammers and steering clear of punishing the platform facilitating the trades. It’s like blaming a rideshare app for the driver’s shenanigans rather than holding the actual driver responsible. Makes sense, right? ????????️♀️

This court ruling can pave the way for future litigation involving decentralized protocols. It could even influence how allegations of U.S. securities law violations against such platforms are handled. ????????????

Judge Polk Failla isn’t done yet. In addition to this case, she’s also overseeing the SEC lawsuit against Coinbase.????????

YouTuber’s Costly Mistake: $60K Worth of Crypto Vanishes After Exposing Seed Phrases on Live Stream!

We’ve got some shocking news from the world of YouTube. Ivan Bianco, the unlucky YouTuber from Brazil had his crypto and NFTs swiped right from under his nose. ????????????

During a livestream, Ivan made a grave mistake. He accidentally revealed his seed phrases to the entire world. ????♂️ Little did he know, this slip-up was all the invitation some sneaky individuals needed to snatch his funds.????????

In a subsequent livestream, Ivan was seen shedding tears of regret as he shared what had happened with his viewers. He tried to create a new wallet to secure his assets, but alas, it was too late. The crypto from two wallets had already vanished, leaving him stunned and devastated. ????????

The Polygon wallet that made off with around 86,600 MATIC (worth about $50,800 at the time) became the prime suspect. And let’s not forget about the 3.35 ETH (approximately $5,750) stuck in someone else’s wallet on Arbitrum. . ????????????

However, there’s a twist in this tale! After the incident, a mysterious figure slid into Ivan’s Discord DMs. They had a heart-to-heart conversation, where the unknown person admitted their wrongdoing and expressed remorse for their actions. Ivan was left both surprised and perplexed by this unexpected change of heart. ????❤️

And here’s where the story takes an interesting turn: The wallet that initially gobbled up the majority of Ivan’s funds had a change of heart too. They decided to return the 86,600 MATIC back to its rightful owner. Ivan confirmed that around $50,000 worth of cryptocurrency found their way back to him. ????????

Now, some skeptics out there questioned the authenticity of this bizarre twist of events. But let’s give Ivan the benefit of the doubt, shall we? ????????????

First-Ever Smartphones on Ethereum Sold Out in Just 24 Hours!

Ethereum Phone,” a game-changer in the world of Web3 smartphones.????????????

This futuristic device is based on the trusty Google Pixel 7a, but what sets it apart is its unique open-source operating system called ethOS. Get it? It’s not just an operating system, but also a nod to the Greek word meaning “character.” How fitting for a phone that’s all about blockchain innovation! ????️

What makes this Ethereum Phone stand out from the crowd is its built-in Ethereum light client. This snazzy feature allows the ethOS operating system to independently validate blocks, making the phone a “light node” on the Ethereum network.

This cutting-edge smartphone comes loaded with tools for seamless payments, messaging, and more. Say goodbye to clunky third-party apps when handling your crypto transactions. Plus, it integrates beautifully with Ethereum Name Services (ENS), making payments a breeze.

This phone is not just about Ethereum. It also supports Ethereum Virtual Machines (EVM) and Layer 2 scaling networks, opening the door to a wide range of decentralized applications.

But here’s the catch: Only a lucky few had the chance to get their hands on one of these groundbreaking devices during the pre-order phase. And how did they qualify, you might ask? By purchasing an ethOS non-fungible token (NFT), of course! ????????

Now, let’s talk prices. These Ethereum smartphones are in a league of their own. While the regular Google Pixel 7a comes with a price tag of $499 in the US, these Ethereum Phone marvels are being sold for a whopping 10 times that amount—around three Ethereum (ETH)! . ????????????

Breaking Down the Importance of the Grayscale Bitcoin ETF Decision – What You Need to Know!

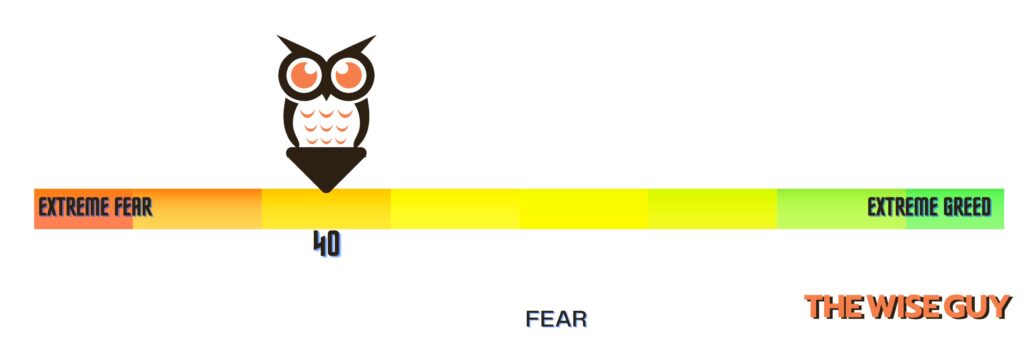

The U.S. Court of Appeals just delivered a smackdown to the Securities and Exchange Commission (SEC) over their denial of a bitcoin exchange-traded fund (ETF). And let me tell you, crypto folks are loving it! ????

The court sided with Grayscale Investments (yep, CoinDesk’s sister company) in their quest to turn their massive Grayscale Bitcoin Trust (GBTC) into an ETF. That’s right, the judges granted Grayscale’s petition for review, forcing the SEC to take another look at their rejected ETF application. About time, right? ????

The court’s ruling isn’t just a victory for the ETF hopefuls, but it’s also a blow to the SEC. The judges basically said that the SEC acted all “capriciously” and “arbitrarily” in denying the ETF. Ouch! The SEC didn’t do a good job of explaining why they approved some bitcoin-related ETFs and not others. And get this, they ignored the fact that the spot and futures bitcoin markets are highly correlated. ????

Now, what does all this mean for the existing ETF applications floating around? Well, it’s still uncertain. These applications were submitted in a hurry after BlackRock unexpectedly jumped on the ETF bandwagon. But hey, at least we can clearly see that the SEC’s crypto policies are divorced from reality. ⏰

But this ruling is a big deal for two key reasons. First, it means more people can invest in crypto through ETFs, which adds billions of potential dollars to the market. Imagine if bitcoin could be traded on regular stock exchanges! ???? And second, it shows that the SEC doesn’t have the final say in the crypto world. The U.S. court system and even Congress can offer their own interpretations and challenge the SEC’s authority.

CoinWestern Quixplaned????

????Crypto millionaire were found dead in 5-star Bali Resort

????Max Keiser’s warns about approaching economic apocalypse: Is Bitcoin to the Rescue?

????Who is the real founder of Shiba Inu?

Top Reddits This Week That Got Our Attention

How do you choose your cryptocurrency exchange?

Could GBTC be a harmful product for BTC? (Opinion)

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?