???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

1️⃣ Valkyrie is the first to provide ETH ETF futures And The Crypto Market Is Booming

2️⃣ Zuckerberg’s Metaverse Is Coming to Life

3️⃣ 5 lowlights of Gary Gensler’s testimony before Congress

4️⃣ Editor’s Wrap: Don’t lose life over price charts

Valkyrie is the first to provide ETH ETF futures And The Crypto Market Is Booming

The US Securities and Exchange Commission (SEC) has given approval for ether futures funds while the fate of bitcoin ETFs remains uncertain.

Crypto investment firm Valkyrie successfully changed its Bitcoin Strategy ETF to invest in ether futures. The Valkyrie Bitcoin Strategy ETF will now be renamed the Valkyrie Bitcoin and Ether Strategy ETF (BTF) and will start investing in ether futures contracts on October 3.

Other companies, including Grayscale Investments, Bitwise Asset Management, ProShares, VanEck, Direxion, and Roundhill Investments, have also filed proposals for ether futures ETFs. Valkyrie’s approach of modifying an existing fund allowed it to have an earlier effective date than other proposed issuers.

It is expected that more ether futures ETFs will launch soon. Volatility Shares plans to launch its Ether Strategy ETF (ETHU) on October 12, and VanEck teased the upcoming launch of the VanEck Ethereum Strategy ETF.

The SEC may expedite the launch of ether futures ETFs before a potential government shutdown. The SEC has delayed decisions on various ETF proposals, including a spot bitcoin ETF, and it was not expected to make a decision on that proposal until November 11.

Valkyrie’s success in modifying its fund follows the launch of the first bitcoin futures ETFs in the US market two years ago. ProShares was the first to launch its bitcoin futures product, quickly accumulating $1 billion in assets under management. Grayscale Investments and other issuers previously filed for ether futures ETFs but halted their plans after the SEC indicated it was not ready to approve such products.

Zuckerberg’s Metaverse Is Coming to Life

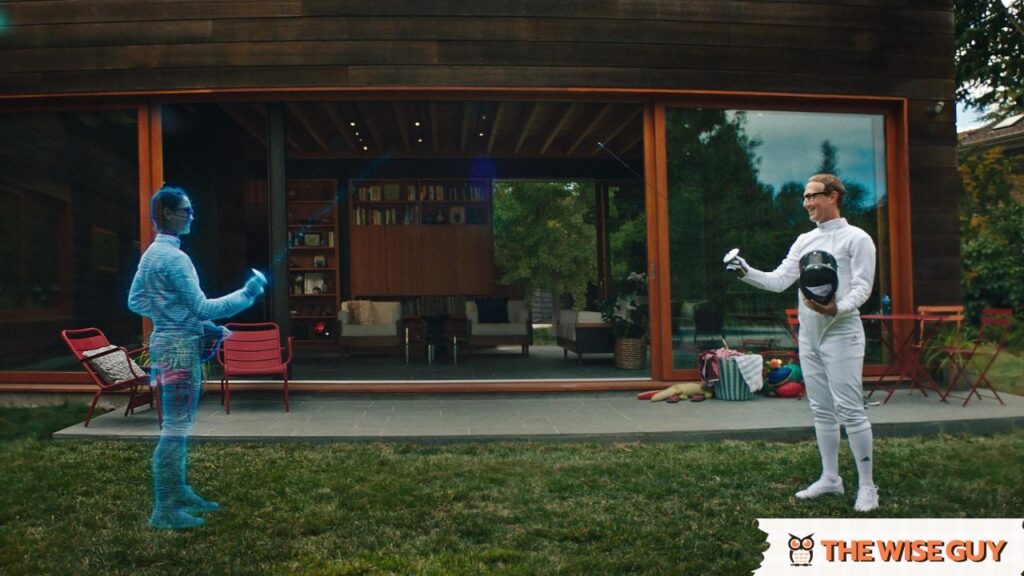

Meta’s metaverse dream may not be dead after all, as demonstrated by Mark Zuckerberg’s recent showcase of photorealistic avatars. During a podcast episode with computer scientist Lex Fridman, the entire conversation took place using these avatars in Meta’s Quest 3 headsets, creating a seemingly lifelike face-to-face interaction.

Critics have often mocked Meta for investing billions into metaverse research yet producing cartoonish avatars. However, this latest demonstration impressed many social media users, including those from Crypto Twitter, who acknowledged the sophistication of the technology. This positive reception was a rare moment of genuine praise, considering the typically satirical and sarcastic nature of the user’s comments.

Codec Avatars, Meta’s long-running research project, lies at the heart of this impressive technology. First unveiled in 2019, Codec Avatars aims to create fully photorealistic avatars in real-time, using headsets with face tracking sensors.

However, the technology currently relies on expensive machine-learning software and specialized equipment with over 100 cameras, making it inaccessible for everyday consumers. Zuckerberg estimated that it may take at least three years before the technology becomes more widely available, with hopes of reducing the barriers and enabling scans through regular smartphones in the future.

Just one day before the avatar demonstration, Meta introduced Meta AI, its new AI assistant, designed to enhance various chatbots, apps, and smart glasses. During the podcast, Zuckerberg discussed the significance of AI in Meta’s products, emphasizing its role in understanding metaverse content and context, improving platform quality, and advancing AI research.

Zuckerberg envisions a world where photorealistic avatars become the preferred means of expression, allowing people to transcend their physical reality and experience a greater sense of presence and connection. Photorealistic avatars could revolutionize remote work meetings, gaming experiences, and social interactions. The concept of “teleporting” into virtual spaces with realistic representations of loved ones has the potential to reshape human communication.

While the road to realizing the ambitious metaverse vision and ubiquitous AI poses challenges, Meta remains committed to addressing controversies such as censorship, privacy, security, and mental health. Zuckerberg welcomes constructive criticism and feedback, highlighting Meta’s responsibility and accountability for its impact on society.

Meta’s dedication to developing intelligent AI personas and extended reality hardware shows their determination to bring the metaverse to life.

Although initial metaverse demos received mixed reactions, Zuckerberg believes that AI-driven authenticity and realism will eventually win over skeptics. With each nimble step, Meta continues to lay the technological foundations for their sci-fi-inspired vision of a hybrid digital/physical world.

The latest demonstration by Meta showcasing photorealistic avatars is a significant stepping stone toward realizing the metaverse dream. It defies the criticisms of skeptics and reveals the immense potential of immersive technology. By bridging the gap between physical and digital realities, Meta’s vision could revolutionize how we work, play, and communicate.

However, challenges still remain, such as accessibility, user adoption, and addressing societal concerns. Despite these obstacles, Meta’s commitment to AI-driven advancements is commendable, and it will be fascinating to witness how this technology evolves in the coming years.

5 blows to Gary Gensler’s by Congress

Securities and Exchange Commission (SEC) Chair Gary Gensler faced intense scrutiny from Congress members regarding his agency’s approach to market oversight. Here are some of the key moments from the hearing:

Gensler was compared to Tonya Harding: Representative Andy Barr accused Gensler of “kneecapping” the U.S. capital markets with excessive regulatory red tape. He likened Gensler to Tonya Harding, the ice skater involved in a scandal where she hired an attacker to harm her competitor.

Calls for Gensler’s dismissal: Representative Warren Davidson expressed his hope that the Biden administration would fire Gensler. Davidson criticized Gensler for pushing a perceived “woke” political and social agenda and misusing his position as SEC chair. He also referenced a bill, the SEC Stabilization Act, that could potentially lead to Gensler’s removal.

Gensler’s stance on Bitcoin: Gensler reiterated that Bitcoin does not meet the criteria to be classified as a security based on the Howey test, a legal standard. When asked if Bitcoin could be considered a commodity, Gensler evaded the question, stating it falls outside the scope of securities laws.

Pokémon trading cards and securities: Representative Ritchie Torres questioned Gensler on whether purchasing a physical Pokémon trading card constitutes a securities transaction. Gensler responded that without context, he couldn’t provide a definitive answer. However, he implied that purchasing such cards from a store is not considered a security. Torres further probed Gensler about tokenized Pokémon cards on a digital exchange, which Gensler explained would depend on whether investors anticipated profits based on the efforts of others.

Coinbase logo catches attention: Observers noticed a backdrop with a Coinbase logo displaying the phrase “Stand With Crypto” during the hearing, adding a touch of defiance amid the intense exchanges between Gensler and Congress members.

Editor’s Wrap: Don’t lose life over price charts

When people learn that I work in Bitcoin, their first question is often about what went wrong. It’s not their fault – mainstream media tends to focus on sensational headlines rather than the broader context. But here’s the truth: Bitcoin is one of the most significant innovations in history, and its impact is far-reaching.

In the United States, Bitcoin has attracted a diverse group of individuals, including libertarians, technologists, and former finance professionals who were deeply affected by the 2008 financial crisis.

They see the flaws in the existing financial system and are fighting for change. However, around the world, it is those who truly need Bitcoin that are finding it.

Bitcoin represents an escape hatch for those in countries with unstable economies.

As a non-sovereign currency, it gives citizens the ability to save their money in a decentralized asset that their government cannot manipulate or seize. It is a harder form of money, meaning its supply is limited, making it more resilient against inflation.

Traditionally, economies transacted in gold, a hard money that was difficult to produce. But today, most economies rely on fiat currencies, which can be easily inflated by central banks. In the United States, the Federal Reserve makes decisions behind closed doors to expand the money supply, leading to the devaluation of existing dollars. This devaluation, known as inflation, is a hidden form of taxation.

Over the years, the money supply has steadily increased, but it has accelerated since 2008. The Covid pandemic triggered an unprecedented expansion of the money supply in 2020, resulting in the largest monetary expansion in U.S. history. As a consequence, the purchasing power of the U.S. dollar has rapidly eroded, and everyday goods and services have become more expensive. Inflation is not only dominating headlines, but it is also affecting every individual’s purchasing power.

This environment forces citizens to find ways to outpace inflation. They become capital allocators and investors, taking on greater risk to protect their savings and increase their buying power. It distracts them from their primary endeavors and contributes to a society that focuses more on consumption and short-term thinking.

Bitcoin provides a solution to this problem. With its hardcoded monetary policy, Bitcoin ensures that there will never be more than 21 million coins in circulation. New coins are created through a process called mining, and this issuance is halved every four years. As Bitcoin adoption grows, demand increases while the supply decreases. This creates a supply and demand imbalance that drives the price of Bitcoin higher over time.

It promotes a higher time preference, where people prioritize saving over spending, knowing that their savings will appreciate in value. No longer do individuals need to allocate extra time and effort to beat inflation; they can focus on their own goals and worry less about retirement.

Despite the negative headlines, Bitcoin is working. Mining activity and the number of unique addresses being used are at all-time highs. Adoption is growing, especially in countries like Turkey and Argentina, where inflation has spiraled out of control due to government mismanagement of their currencies.

While Bitcoin’s price in USD may not have reached its previous highs, it continues to make all-time highs when priced in Turkish liras and Argentinian pesos. Bitcoin is providing an escape hatch for those who need it most, allowing them to protect their savings and transact freely in a crumbling financial infrastructure.

I consider it a privilege to be part of this world-altering technology, pushing for its adoption and witnessing its transformative power. Bitcoin is steadily building the necessary infrastructure for the next billion adopters. Block by block, it is revolutionizing our financial system.

CoinWestern Quixplaned????

????Valkyrie takes lead in crypto space with Ether Futures Investment

????Meta unveils realistic avatars in Metaverse: CEO Zuckerberg and AI researcher Fridman demonstrate future of social interaction

????SEC charged Anthony Viggiano and three other for insider trading on Xbox Chat

Top Reddits This Week That Got Our Attention

JPMorgan says Ethereum’s activity post-Shanghai upgrade has been ‘disappointing’

I made new art for the Bitcoin Crab Market

Shrinkflation: a subtle way to hide inflation

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?