???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

????Coinbase Dives into Stablecoin Market with USD Coin Acquisition

????OpenSea Can No Longer Sells BAYC NFTs

????Jackson Hole Meeting: Bitcoin Enthusiasts Await Powell’s Statement!

????Editor’s Wrap: Our Take on the Exciting Friend.tech App!

Coinbase Acquires Stake in USD Coin, Marks Entry Into Stablecoin Market

???? Coinbase and Circle Internet Financial, the companies behind USD Coin (USDC), are shaking things up in the cryptocurrency world!

Coinbase is acquiring a minority stake in Circle, and the two companies are dissolving their Centre Consortium partnership. As a result, Circle will take full control of issuing and governing USDC. Exciting news, right? ????

But that’s not all! USDC will now be supported on six more blockchains, bringing the total number of supported blockchains to 15. Although the additional blockchains haven’t been revealed yet, Circle had previously mentioned plans to add Polkadot, Near, Optimism, and Cosmos in 2023.

And guess what? Coinbase has even launched its very own blockchain called Base! ????

Recently, there have been some interesting developments in the world of stablecoins pegged to the US dollar. PayPal, the fintech giant, introduced its own PYUSD token in partnership with Paxos, aiming to challenge the dominance of Tether’s USDT and USDC. PayPal’s entry into the market could certainly shake things up, given its extensive experience in payments and remittances.

But Coinbase isn’t fazed by the competition. Phil McDonnell, the senior director of product management at Coinbase, believes that PayPal’s involvement will actually benefit the entire crypto industry. He sees the future of USDC extending beyond crypto trading, with potential applications in foreign exchange, cross-border fund transfers, and financial inclusion.

McDonnell emphasizes that crypto is still relatively small compared to the overall financial world, and any newcomers to the space will eventually explore other crypto offerings, including Coinbase. ????

As for regulation, the stablecoin landscape is still evolving, but there are some positive signs. Circle’s Chief Strategy Officer, Dante Disparte, mentioned the Clarity for Payment Stablecoins Act of 2023, which has gained bipartisan support in the U.S. House of Representatives. Disparte also highlighted that Circle recently obtained a Major Payment Institution License in Singapore. These developments provide more clarity and make the dissolution of the Centre Consortium a sensible move, as stablecoins become subject to clearer regulations.

In other news, Circle attracted significant investment last year by selling stakes to asset managers BlackRock and Fidelity Investments. Both companies have recently made headlines with their attempts to launch spot bitcoin ETFs. Circle also made adjustments to its workforce last month, aiming to maintain a strong balance sheet and focus on core business activities.

Now, let’s talk revenue!

Coinbase and Circle will continue to generate revenue from the interest income on USDC reserves. Under their new arrangement, this revenue will be shared based on the amount of USDC held on each platform. Additionally, they will now equally share in interest income generated through the broader distribution and usage of USDC.

You Cant Buy BAYC NFTs From OpenSea Anymore

???????? Bored Ape Yacht Club (BAYC) creators, Yuga Labs announced that they will be winding down support for OpenSea, one of the biggest NFT marketplaces.

Why?

Well, it all started with OpenSea’s decision to remove the Operator Filter, a tool that allowed creators to restrict the sale of their NFTs to platforms that enforce creator royalties. This move didn’t sit well with Yuga Labs and many others in the NFT community. ????

OpenSea cited a lack of “opt-in by the entire ecosystem” and pushback from creators as the reasons for discontinuing the Operator Filter. But Yuga Labs CEO Daniel Alegre wasn’t going to let this go unnoticed.

In a announcement on X (formerly Twitter), he stated that Yuga Labs will gradually wind down its use of OpenSea’s Seaport marketplace smart contract. They aim to complete this process by February 2024, aligning with OpenSea’s approach.

Protecting creator royalties is a fundamental belief of Yuga Labs. They want creators to be properly compensated for their work, and they’re taking a stand to make that happen. This move has garnered a positive reaction from the BAYC community and has been praised by prominent content creators and NFT project founders like EllioTrades and Alex Becker.

Even the CEO of the Forgotten Runes Wizards Cult NFT project, dotta, supported Yuga Labs’ decision, seeing it as a spark that could ignite change in the NFT ecosystem. ⚡️

The topic of creator royalties has been a divisive one in the NFT world. In the early days of the NFT boom, enforcing creator royalties was the norm. However, platforms like Blur entered the scene and disrupted the market by offering zero trading fees and an optional creator royalty payment model. This led to a decrease in trading fees and royalty percentages across the board as marketplaces competed for users.

Now, the NFT community finds itself split between those who support the cheaper trading model of platforms like Blur and those who advocate strongly for the need to pay royalties to creators.????

All Eyes on the Jackson Hole Meeting: What Will Powell Say About BTC,ETH?

It’s time for the Jackson Hole meeting, held annually in Wyoming (yes it’s a place)????️.

This meeting brings together central bank representatives from developed and developing countries to discuss changes in monetary policies. And guess what? This year’s meeting is just around the corner, happening Friday, August 25th! ????️

Why is this meeting so important? Well, it’s where the banking industry keeps a close eye on the discussions surrounding monetary policies. And let’s not forget, Federal Reserve Chairman Jerome Powell will be delivering a speech at the meeting. You can bet that his words about inflation, the economic outlook, and potential interest rate increases will be closely watched by market participants, along with other central bank governors in attendance. ????????

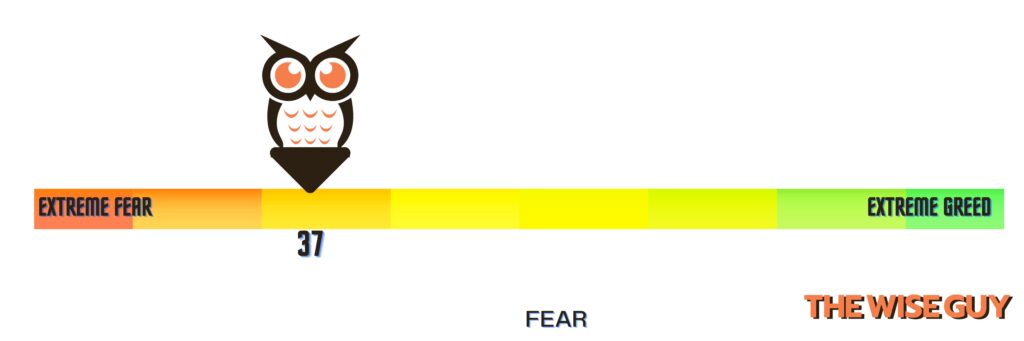

Let’s take a quick look back at last year’s Jackson Hole meeting. When Powell spoke then, Bitcoin was trading at $21,500, and the US inflation rate stood at a whopping 8.5%, with interest rates at 2.5%. Quite the different landscape, right? Fast forward to this year, and Bitcoin currently sits around $26,000, while US inflation has dropped to 3.2%, and interest rates have climbed to 5.5%. ????????

So, what did Powell say at the meeting last year? He made a few notable statements: he emphasized that the longer high inflation persists, the more likely it is to become deeply rooted. He also explained that a rate hike in September would depend on the incoming data, and low inflation numbers in July were not sufficient to sway the Fed’s stance. Lastly, Powell mentioned that, at some point, the pace of rate hikes by the Fed would slow down. ????️????

But what message will Powell deliver this year at Jackson Hole? Recent growth data has sparked discussions about the US economy potentially outperforming the Fed’s expectations, which could increase pressure on inflation. Bank of America analysts expressed the view that Powell may adopt a more cautious policy stance in response to the risks of rising inflation. ????????

Editor’s Wrap: What We Think About Friend.tech

Friend.tech, the new app that’s taking the crypto trading scene by storm! ???????? With a star-studded user base including an NBA player and an e-sports powerhouse, and the backing of venture capital heavyweight Paradigm, Friend.tech is aiming to challenge Big Tech giants like Facebook and TikTok. And it’s already making waves, even just two weeks after its launch! ????

Now, keep in mind, the number of unique addresses interacting with the app is impressive at a whopping 64,500. However, with the nature of pseudo-anonymous blockchains, it’s hard to determine if that means 60,000, 600, or just 60 actual users.

Some people rushed to create accounts in anticipation of a rumored airdrop, which hasn’t been confirmed yet. But regardless, Friend.tech is already leaving its mark on the crypto world.

In fact, on Sunday, the app generated a $1.12 million in fees within a mere 24 hours! ???????? Since its beta launch on August 11th, the total fees have reached a staggering $2.8 million. That’s more than what the entire Bitcoin network generated during the same timeframe!

The driving force behind Friend.tech’s success is its unique concept. Think of it as a monetary layer for Twitter profiles, designed for fans who want to invest in their favorite social media friends and influencers. Celebrities, or “celebs” as we like to call them, earn a portion of the trading fees, while the app itself takes a hefty 5% cut. And speaking of the app, it’s been showered with praise from crypto enthusiasts for its user-friendly experience and sleek design. Trust us, that’s a rarity in an industry known for Windows 95-style interfaces! ????

For now, Friend.tech is only available on mobile devices. But here’s the best part: users can slide into the DMs of the celebs they’re backing! It’s a unique feature, especially when compared to Elon Musk’s restrictive messaging settings on his X platform.

Some lucky users have already struck gold, with their accounts valued at over 3 ETH, which is approximately $5,200. And there’s one profile, “Racer,” who is speculated to be the creator of Friend.tech, that’s reached incredible heights.

Close to 150 people currently own a tokenized share in this valuable profile. Not to be left behind, other Twitter influencers like Cobie, Hsaka, and Ansem are also making quite the splash. It’s truly a race for the top!

CoinWestern Quixplaned????

????XRP sends shockwaves as unexpected u-turn dashes investor hopes

????Crypto veteran reveals next 100x opportunities for investors

????Ethereum co-founder Vitalik Buterin transfers $1 million ETH to Coinbase, here’s why

Top Reddits This Week That Got Our Attention

Bitcoin Developers Say Craig Wright May Be Admitting That He Stole 80,000 Bitcoin from Mt. Gox

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?