Good day to all you fine folks! May your coffee be strong, your wifi be speedy, and your memes be dank. ????????

???? This week, we’ve got some exciting and thought-provoking stories to share with you. So block off some time, grab a coffee ☕ and dive into our weekly roundup. (Next again on Tuesday)

- ???? Telegram has added support for USDT stablecoin on its wallet bot.

- ???? The SEC’s action against Coinbase could have a significant impact on the crypto industry in the US.

- ???? Let’s hope the CBDC saga doesn’t become a political circus.

- ???? Justin Sun and three of his companies are under fire for allegedly breaking U.S. securities laws.

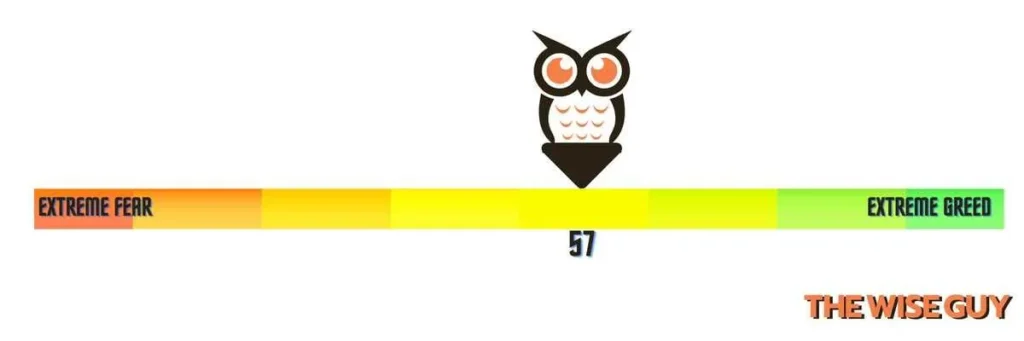

Owl Says “GREED”

Telegram adds USDT support – but watch out for scammy snakes in your chats

Hey there Telegram enthusiasts!

Great news! ???? The popular messaging app just got even better by adding support for USDT stablecoin on its wallet bot. Now you can buy and sell USDT without leaving the app.

What does this mean for you? Well, in theory, using cryptocurrency payments on messaging apps makes sending money as easy as texting or sending a pic ????. You can keep track of your crypto holdings and conduct P2P transactions using USDT without ever leaving Telegram. This is a huge win for crypto adoption, and USDT specifically.

But hold on just a minute – we want to give you the heads up ????️ on a few things to keep in mind when using USDT on the platform, like:

- ???? Counterparty risk: You’re basically trusting Telegram with your crypto when using the wallet bot. So, let’s hope they have some excellent security measures in place to keep your funds safe.

- ???? Network congestion: Blockchain networks can get bogged down, which can lead to delayed processing times and increased fees. Something to keep in mind when using stablecoin transactions.

- ????️ Scam activity: Of course, where there’s money involved, there’s always a risk of fraud.

Coinbase caught in the crypto crosshairs as SEC signals new regulations

???? News of the U.S. Securities and Exchange Commission’s action against Coinbase, the number one cryptocurrency exchange in the United States, spread like wildfire through the crypto community, prompting an existential debate over what it could mean for cryptocurrency in the United States.

“It should be crystal clear by now that the Biden Administration wants all crypto—even the legit parts of it—run out of the U.S.,” said Custodia Bank founder and CEO Caitlin Long. “See also yesterday’s White House economic report, which dunked on all financial innovation while espousing the “stability” of traditional banks.”

Long and others called into question the SEC’s sudden delivery of a so-called “Wells Notice” after it allowed Coinbase, a publicly traded company, to offer staking rewards for several years and only now threatening to sue Coinbase on claims of offering unregistered securities.

A Wells Notice is a notice from the SEC informing a company the agency intends to bring an enforcement action against them.

???? We worry that the SEC’s action against Coinbase could signal an approach to regulate cryptocurrencies to the point of being driven out of the United States. However, while innovation is essential, it’s also critical to protect consumers and maintain market stability. Hopefully, regulators and innovators can work together to achieve both.

Governor DeSantis takes on ‘Big Brother’s digital dollar’, but will it be a losing battle?

This week, Florida Governor Ron DeSantis ???? went on a crusade against the big, bad central bank digital currency (CBDC) and tried to prevent the federal government from deploying it in his state.

He’s worried that such a currency could enable the federal government to conduct massive surveillance, snooping on individuals’ daily purchases and movements. He’s calling for other states to join him in fighting back against this “concept nationwide.” I guess he’s worried about becoming a victim of “Big Brother’s digital dollar.”

While DeSantis’ concerns aren’t wholly unfounded, his proposed bill might not ultimately stop the feds from pursuing a CBDC. Fed Chair Jerome Powell ???????? has given the green light ???? to certain CBDC research but emphasized that any plans would require congressional authorization and public support. So, no need to panic just yet!

Around the world ????, over 114 countries, including 18 G-20 countries, are exploring CBDCs, but it remains uncertain if the US will adopt a consumer-facing CBDC or focus on improving technology for bank-to-bank transfers. In the meantime, let’s hope the CBDC saga doesn’t become a political circus. ????

Crypto Promoter Justin Sun Draws the Spotlight, This Time From Regulators

Remember Justin Sun ????️, the guy who splurged millions for a meal with Warren Buffet? Yeah, he’s back in the news, and it’s not for something pleasant. ????

It turns out that Sun and three of his companies are under fire ???? for allegedly breaking U.S. securities laws by offering and selling two unregistered crypto tokens, Tronix (TRX) and BitTorrent (BTT). Moreover, the SEC claims that they artificially inflated TRX prices between April 2018 and February 2019.

Here’s a summary of what went down:

- Justin Sun and three of his companies are in hot water ???? with the SEC for allegedly selling two unregistered crypto tokens: TRX and BTT.

- The SEC accused them of manipulating TRX prices. ???? However, Justin Sun denies it all. ????♂️

- The SEC also charged eight celebrities ???? with illegally promoting the two unregistered crypto tokens.

- One of those celebs, Lindsay Lohan, was reportedly paid $10,000 ???? to tweet about TRX.

Honorable Mentions

The founder of Terra blockchain, suspected to be Do Kwon, has been arrested in Montenegro (details unclear) following a tumultuous year for the platform which suffered monetary losses and shut down. ????

Mick Mulvaney ???????? predicts strong bipartisan support for digital assets legislation in the US, leading to possible regulations and legitimization of the crypto industry. ????

Crypto Market Watch ft. WiseGuy

Hold on to your Bitcoin wallets, folks! ???????? The digital currency is facing a challenge that even Mario couldn’t handle – major resistance at the $30,000 level. ???? It’s like trying to jump over a skyscraper in a single bound! ????️ But why the sudden halt in its upward trajectory? ????

Well, turns out the recent surge in Bitcoin’s popularity can be attributed to people getting worried about traditional banking. ???? You know, with all the potential risks of banks failing and deposit flights happening. It’s enough to make anyone paranoid! ???? So, Bitcoin stepped in to save the day (or so it thought). ???? But now, it seems like it needs a little boost of its own. An injection of caffeine ☕, if you will, to push it past the $30k mark.

The question is, what could that catalyst be? ????