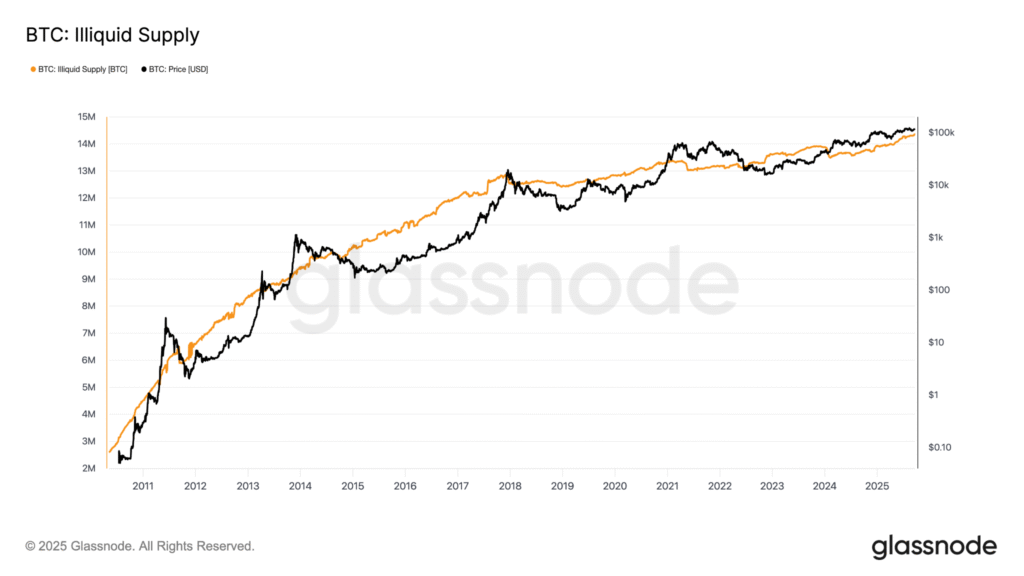

Bitcoin’s supply dynamics are tightening at historic levels, with new data showing a record surge in illiquid holdings and aggressive accumulation by large investors. According to Glassnode, Bitcoin’s illiquid supply—coins held by wallets with little to no history of spending, has climbed to an all-time high of 14.3 million BTC.

With Bitcoin’s circulating supply currently around 19.92 million BTC, this means more than 72% of all mined coins are now considered illiquid, effectively locked away from trading on exchanges. The figure underscores a decisive trend among long-term holders (LTHs) and whales who appear increasingly unwilling to part with their Bitcoin, reflecting rising conviction in the asset’s future value.

Long-Term Holders Drive Historic Supply Lock-Up

The number of Bitcoin held by entities who have not sold for over seven years has risen by more than 422,000 BTC since January 1, highlighting the persistent accumulation trend. Asset management giant Fidelity forecasts that LTHs and corporate treasuries could collectively lock up more than 6 million BTC by 2025, equivalent to over 28% of Bitcoin’s fixed 21 million supply.

That projection is supported by the surge in corporate and institutional adoption. As of September 2025, publicly traded companies and exchange-traded fund (ETF) issuers collectively hold 2.88 million BTC, up from 2.24 million at the start of the year, a 30% increase in less than nine months.

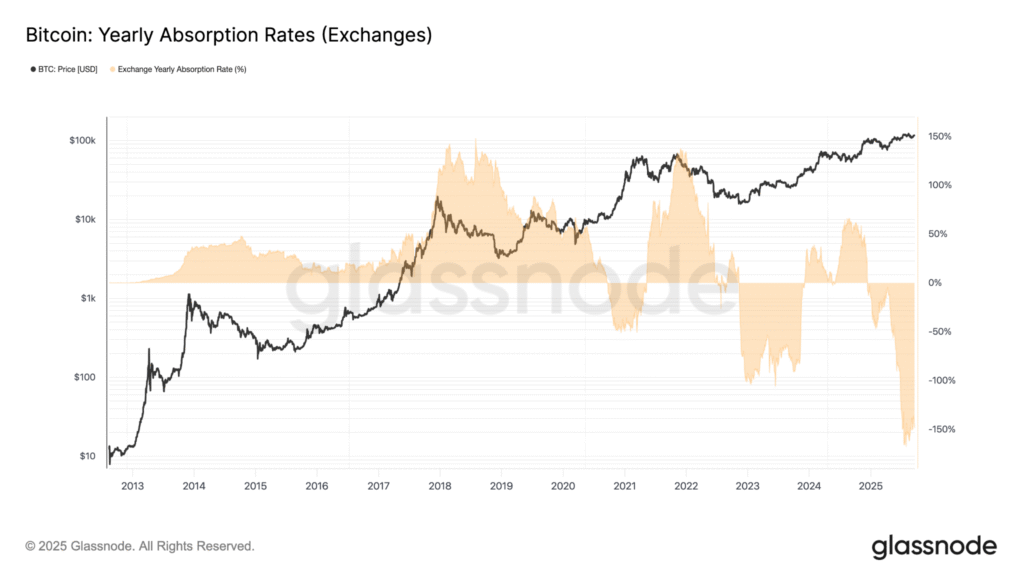

Whales Absorb Nearly 300% of Yearly Bitcoin Supply

Adding to the supply squeeze, whales, wallets holding between 100 and 1,000+ BTC, are accumulating at an unprecedented pace. Glassnode data shows that these large holders are absorbing nearly 300% of the yearly mined Bitcoin supply, meaning they are buying almost three times the new issuance hitting the market.

At the same time, exchange balances are dwindling, with net absorption rates by exchanges plunging below -150%. This suggests investors are increasingly moving coins off centralized platforms, either for self-custody or for long-term storage, further reducing available liquidity.

Structural Shift in Bitcoin Markets

This trend marks a structural shift in Bitcoin’s investor base. Once dominated by speculative short-term traders, the market is now consolidating in the hands of institutional players, corporate treasuries, and high-net-worth individuals.

With ETFs and treasury allocations adding to demand, the available liquid supply continues to shrink, potentially creating the conditions for a supply shock in the coming quarters.

Analysts believe this combination of heightened accumulation, declining exchange reserves, and long-term holding could set the stage for another sharp rally. With Bitcoin trading at around $116,411, supply constraints may amplify price movements if demand continues to grow.

As whales tighten their grip on the market and more BTC disappears into long-term storage, the stage is being set for a new chapter in Bitcoin’s monetary evolution, one defined not just by speculation, but by scarcity-driven conviction.