???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

????Bitcoin’s Surprise Dive: 3 Factors Behind the Drop!

????Shiba Inu’s Shibarium Launch Was Nothing Short of Disaster

????Not Bitcoin But ETF Futures ETFs Are Being Approved by SEC

????Vitalik Buterin’s Take on Community Notes Is Close to What We Think

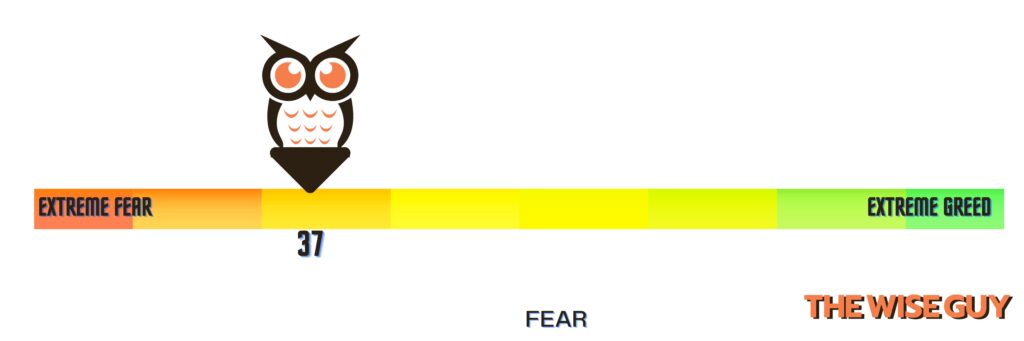

Who’s Responsible For BTC Drop? Top Theories That Are Floating

It’s been a bad day for Bitcoin , with the price taking a sudden dip and leaving everyone wondering what’s going on.

Let’s dive into some of the theories floating around.

????One theory points the finger at Elon Musk’s SpaceX, suggesting that their reported sale of $373 million worth of Bitcoin could have caused the price to take a nosedive. ???????? Who knew that even space exploration could influence BTC?

Another theory points to concerns about future interest rate hikes by the US Federal Reserve. The expectation of higher rates, combined with the recent weaknesses in global markets, might have created a recipe for a Bitcoin pullback. With Bitcoin trading in a relatively tight range without any major positive news, it’s possible that this sell-off was simply overdue.????

On the other hand, some analysts attribute the sell-off to the rise in government bond yields, which reduces liquidity in the broader market. This reduction in liquidity could have had an impact on cryptocurrencies, including Bitcoin.

While some experts dismiss the recent crisis involving Chinese property giant Evergrande as a major factor in the price drop, others believe the risk of a Chinese Yuan devaluation played a significant role.

The potential devaluation of the Yuan, coupled with historical evidence of Bitcoin prices declining during such events, could have influenced the sell-off.????????

Interestingly, there’s speculation that a single large player in the market may have triggered the downward movement by making a sizable sell. This could have put additional pressure on derivatives and sparked a chain reaction. Several hundred million dollars’ worth of Bitcoin long positions were liquidated during this period, indicating significant market activity.. ????

As for Bitcoin’s recovery, it has made a slight bounce back since the crash. At the time of writing, Bitcoin is changing hands at around $26,619. The news of the SEC considering approving an Ethereum Futures ETF in the near future seems to have provided some support for the price.

It’s important to remember that these explanations are just theories, and the exact cause of the price dip remains uncertain.

Shiba Inu’s Shibarium Launch Was a Disaster

It’s been quite a journey for the Shiba Inu community, with months of meticulous testing leading up to the final launch of SHibarium. However, after the grand unveiling, things haven’t been going as smoothly as hoped. ????

Shortly after the launch, the Shibarium network experienced a sudden halt in block production. While the issue was resolved after some time, unfortunately, the problems persisted, causing another interruption. This recurring stop-and-start situation has left many in the crypto community scratching their heads. ????

As a result, the value of Shiba Inu tokens has taken a bit of a dip, declining by approximately 12% in the past 24 hours.

???? This response aligns with the reports circulating about the hiccups during the Shibarium network’s early hours. These issues primarily revolve around the bridging infrastructure, which plays a crucial role in connecting different networks and facilitating the smooth transfer of tokens. ????

Delving deeper into the blockchain data uncovered by Shibariumscan, we discovered a fascinating story. Transactions on the network came to a complete standstill for a whopping five hours. Among the notable endeavors affected was an ambitious attempt to transfer a staggering 954 Ethereum, valued at around $1.7 million, along with an additional $750,000 worth of BONE, Shibarium’s governance token.

One unfortunate Shibarium user shared a screenshot that shed light on the technical quagmire they faced while trying to interact with the block scanner. This issue prevented them from accessing their bridged balance using RPC (Remote Procedure Call).

In response to these challenges, Beosin, a prominent player in the blockchain space, has suggested temporarily halting the utilization of Shibarium. This is a precautionary measure to prevent any potential loss or mishandling of the $1.7 million worth of ETH stuck in the bridging mechanism. ????

Ether Futures ETFs Are Poised for U.S. Approval: Why You Should Be Happy

???? Big news alert in the crypto world! It looks like Ethereum (ETH) futures exchange-traded funds (ETFs) may soon get the green light for trading in the U.S. How exciting is that? Let’s dive into the details and understand why this matters! ????

Currently, we already have ETFs in the U.S. that hold crypto derivatives, like Bitcoin futures ETFs, which have gained considerable attention and investment. But what’s got everyone on the edge of their seats is the question of whether ETFs holding the actual cryptocurrency, like Bitcoin itself, will also receive approval from the SEC. This is a game-changer, folks! ????

Notably, we thought SEC Chair is fond of BTC more than ETH, let’s not forget his comments on everything but BTC is a security, but this definitely is a surpise to us too!

Just imagine if Wall Street giants, such as BlackRock, are given the go-ahead to create ETFs that hold Bitcoin directly. It would open the floodgates for more institutional investors to jump into the crypto market and bring in a wave of fresh capital. This increased participation and investment could have a significant impact on the prices and overall stability of cryptocurrencies.????????

But let’s get back to Ethereum. If ETH futures ETFs are given the thumbs up by regulators, it would create an entirely new realm of possibilities for Ethereum. It would offer another investment avenue for those keen on being part of the Ethereum ecosystem without directly holding ETH. ????

What’s exciting is that this could drive up the demand for ETH derivatives, which in turn might push the price and liquidity of ETH itself to new heights.

Editor’s Wrap: Vitalik Buterin’s Take on Community Notes Is Our Take Too!

When the co-founder of Ethereum, Vitalik Buterin, speaks about something being the “closest thing to an instantiation of ‘crypto values’ in the mainstream world,” you know it’s worth paying attention to!

???? In this case, he was referring to X’s Community Notes feature, originally called Birdwatch, which is a crowdsourcing tool on Twitter that allows users to add context and rate the truthfulness of posts. ????✅

???? It’s quite amusing because throughout the blog post, Buterin didn’t hold back from criticizing Musk, who is known for running companies like autocracies. Despite their differences, Musk has yet to dismantle Community Notes, which has disrupted the traditional nature of Twitter.

For Buterin, Community Notes represents a case study in decentralized governance. It operates like a Wikipedia-like system, where anyone can join, write, and vote on posts. The entire process is managed by an open-source algorithm, making it transparent and consensus-driven.

By utilizing machine learning, this algorithm is capable of bridging deep ideological divides and surfacing non-partisan, reliable information. ????????

While it’s not perfect, Buterin believes Community Notes comes impressively close to achieving credible neutrality, a term widely associated with blockchains.

Credible neutrality refers to systems built to avoid any form of discrimination. It aligns with Ethereum’s goal of creating a universally trusted machine that transcends trust and becomes trustless. When Buterin sees a Community Note, he can generally trust that the information is not manipulated or influenced by hidden agendas. ????????

While Elon Musk has presented himself as a “free speech absolutist” and promoted Twitter as a platform for all legal forms of expression, his leadership at Twitter/X has deviated from this ideal.

This disconnect between the rhetoric and reality only reinforces the value and importance of crypto, highlighting the need for true neutrality and credibility that can be achieved through decentralized systems.

As Buterin points out, neutrality doesn’t have to be hardwired into the real world, but it certainly helps establish credibility when the code remains unchangeable by an owner-investor. ????✨

Community Notes may be transparent and consensus-driven, but it’s still not entirely crypto. Buterin acknowledges some evidence suggesting that Musk may have influenced a corrective note mentioning the Uyghur genocide due to his business interests in China.

However, Buterin doesn’t take a firm stance on the matter. He notes that public votes can be manipulated in various technical and social ways, which remains a challenge in the crypto space as well. Issues such as Sybil attacks, brigading, and money in politics have yet to find a perfect solution in the crypto world too. So, the quest for improvement continues! ⚙️????

CoinWestern Quixplaned????

????Why Bitcoin crashed to $26,000: Elon Musk’s SpaceX, Interest Rate fears, or something else?

????$1 billion crypto liqudiations in 24 hours: who’s responsible?

????Why no one is buying Bored Ape Yacht Club NFTs anymore

Top Reddits This Week That Got Our Attention

Chinese man sentenced to 9 months in prison for buying 13K in USDT

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?