???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

1️⃣ Thailand Delays Plan to Distribute $15 Billion in Crypto

2️⃣ Bitcoin pioneer Hal Finney can’t be Satoshi Nakamoto, new analysis suggests

3️⃣ Microstrategy is finally in profts now

4️⃣ Editor’s Wrap: How FOMO Around Bitcoin ETFs Can Change the Tide of History

Thailand Delays Plan to Distribute $15 Billion in Crypto

Let’s talk about Thailand’s plan to distribute digital currency to its citizens. It’s an ambitious initiative with a total value of around $15 billion. The goal was to give each Thai citizen over the age of 16 a sum of 10,000 baht (about $280) to help boost the country’s economy.

However, there’s been a little hiccup in the program. Deputy Minister of Finance Julapun Amornvivat recently announced a delay in its launch. The reason behind the setback is the need for a more robust and secure system to protect both funds and user data. It’s an understandable concern because when it comes to handling money digitally, security is a top priority.

The original plan had set the launch for an earlier date, but now it’s been pushed to the first quarter of 2024. Thailand’s Prime Minister, Srettha Thavisin, who also has ties to the crypto sector, had high hopes for this program. He believed it would not only increase consumer spending but also stimulate the overall economy, aiming for a 5% growth in the coming year. That’s quite an ambitious target!

As with any significant initiative, there are mixed opinions about how the digital currency should be distributed. Some experts suggest targeting only those in genuine need by issuing “e-wallets” to specific groups. This way, the funds would be directed where they can make the most impact. They also propose excluding those who are financially self-sufficient, avoiding duplication of benefits.

On the other side of the discussion, former Thai senator Rosana Rositrakul has raised concerns about the potential negative effects of such large-scale distribution on the economy. She advocates for a careful review by Thailand’s National Audit Office to assess the risks and benefits.

The delay in the program highlights the ongoing debate within Thailand about how funds should be allocated, especially given the country’s public debt and economic challenges. It’s important to weigh the potential risks and benefits of such a significant initiative before moving forward.

Bitcoin pioneer Hal Finney can’t be Satoshi Nakamoto, new analysis suggests

So, it looks like some new evidence has emerged regarding the speculation surrounding Hal Finney’s involvement with Bitcoin. For a long time, there have been theories that Hal Finney, a computer scientist, may have been the creator of Bitcoin. However, both Finney and Jameson Lopp, a cypherpunk and co-founder of a Bitcoin custody firm, have denied these claims.

Now, Lopp has come forward with some interesting findings that cast doubt on the theory. He points to a 10-mile race that Finney participated in on April 18, 2009, in Santa Barbara, California. According to race data, Finney started the race at 8:00 am and finished 78 minutes later. During this time, there are timestamped emails between Satoshi Nakamoto (the pseudonymous creator of Bitcoin) and one of the first Bitcoin developers, Mike Hearn. Lopp points out that Satoshi sent an email to Mike at 9:16 am Pacific time, just two minutes before Finney crossed the finish line.

This suggests that, during the hour and 18 minutes of the race, Finney was likely not interacting with a computer.

In addition to this race evidence, Lopp also mentions on-chain data that supports his claim. He highlights an email from Hearn that shows Nakamoto sent him 32.5 BTC in one transaction, which was mined at 8:55 am PST, just 55 minutes into Finney’s race. Nakamoto confirmed this transaction in a later email sent at 6:16 pm, while Finney was still running.

Furthermore, it’s worth noting that Finney had health issues, including Amyotrophic Lateral Sclerosis (ALS), which affected his ability to use a keyboard. Lopp mentions that during a conference in August 2010, Finney’s wife stated that his ability to type had slowed significantly. However, during that same time, Nakamoto was actively posting on forums and working on Bitcoin’s code, suggesting that they were two different individuals.

Now, it’s important to keep in mind that there may be objections to this evidence. The emails were published by Hearn seven years after the fact, and it was around a time when trust in him was eroding within the Bitcoin community. Additionally, it’s possible that Finney could have scripted the emails and transactions in advance, or that there were multiple individuals using the pseudonym Satoshi Nakamoto.

However, Lopp argues that based on his research, there is no evidence supporting the theory of a group creating Bitcoin. He believes that it was the work of a single developer.

Sadly, Hal Finney passed away in 2014 due to complications from ALS. The mystery of Bitcoin’s creator may never be fully solved, but the new evidence provided by Lopp adds another layer to the ongoing discussions and speculations.

Microstrategy is finally in profts now

Let’s talk about MicroStrategy and its relationship with Bitcoin. MicroStrategy, a business intelligence firm, made its first investment in Bitcoin back in 2020 when it bought $250 million worth of tokens.

Ever since then, the company has remained bullish on Bitcoin.

About a month ago, MicroStrategy filed a document with the U.S. Securities and Exchange Commission (SEC) stating that it had added another 5,445 BTC to its portfolio, purchasing them for $147.3 million. The average price at which they acquired these coins was approximately $27,053 per BTC.

This latest acquisition brought MicroStrategy’s total Bitcoin holdings to 158,245 BTC, valued at $4.68 billion, with an average purchase price of $29,582 per BTC as of September 24th. Now, since then, the price of Bitcoin has increased by around 15% to $30,514 at the time of writing.

So, if we do some quick math, MicroStrategy’s Bitcoin holdings have put the company in a pretty strong position. Their average purchase price of $29,582 means they have made a profit of $147 million on their investment so far. Not too shabby!

MicroStrategy’s co-founder and executive chairman, Michael Saylor, has been quite enthusiastic about their Bitcoin holdings as well. He even pointed out that Bitcoin’s growth has outpaced that of the Nasdaq stock market.

Now, with this recent Bitcoin rally, MicroStrategy has definitely made some substantial profits. It’ll be interesting to see how their Bitcoin investment continues to perform in the future and how it could potentially impact the market.

Editor’s Wrap: How FOMO Around Bitcoin ETFs Can Change the Tide of History

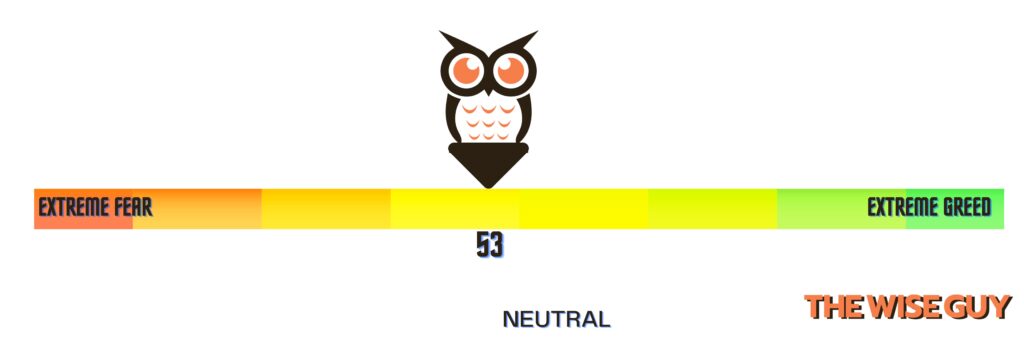

The optimism surrounding potential Bitcoin ETF applications could have a significant impact on the future of the cryptocurrency. In the past, such optimism has led to a correction, but this time, it might be different.

Bitcoin’s recent price increase to $30,000 has resulted in a period of high-profit potential. Data analyst and Bitcoin research specialist, Alex Alder Jr, revealed this information based on the Bitcoin Realized Profit/Loss metric.

Realized profit or loss occurs when a cryptocurrency is sold for a higher or lower price than its purchase price. Alder’s analysis showed that many market players have made substantial profits.

Traditionally, this surge in profits would trigger a significant correction in the market. However, Alder suggests that due to the fear of missing out (FOMO) around potential Bitcoin ETF approvals, this cycle might not follow the usual pattern.

While the U.S. SEC has indicated that approval might be delayed until next year, optimism remains that one of the numerous ETF applications will receive the green light before the end of 2023.

This positive sentiment has encouraged market players to remain active, subsequently preventing a sharp decline in the BTC price. Additionally, Bitcoin’s liquidation levels data from HyblockCapital indicates strong buying support at around $29,886.

However, despite this optimistic outlook, it is possible that Bitcoin’s price may experience a full retracement, leading to a bearish bias. If the price falls to $29,000 and liquidity increases, it could be an opportune time to open more long positions.

Furthermore, Alder suggests that the number of active addresses on the Bitcoin network may continue to increase. This metric serves as a measure of the level of interaction within the Bitcoin community.

While the network’s activity has decreased compared to last week, Alder anticipates that active addresses might resume their speculation due to the FOMO surrounding ETF approvals.

If activity levels surge once again, volatility may intensify and Bitcoin could break through the $30,000 resistance level. In such a scenario, the cryptocurrency may experience a significant surge in value.

CoinWestern Quixplaned????

????Tesla’s $312M Bitcoin hoard remains untouched in Q3 2023

????Binance sees over $500M withdrawn amid ongoing regulatory troubles

????Dubai investor rues early exit from Shiba Inu investment; misses out on $70 million

Top Reddits This Week That Got Our Attention

JPMorgan says Ethereum’s activity post-Shanghai upgrade has been ‘disappointing’

I made new art for the Bitcoin Crab Market

Shrinkflation: a subtle way to hide inflation

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?