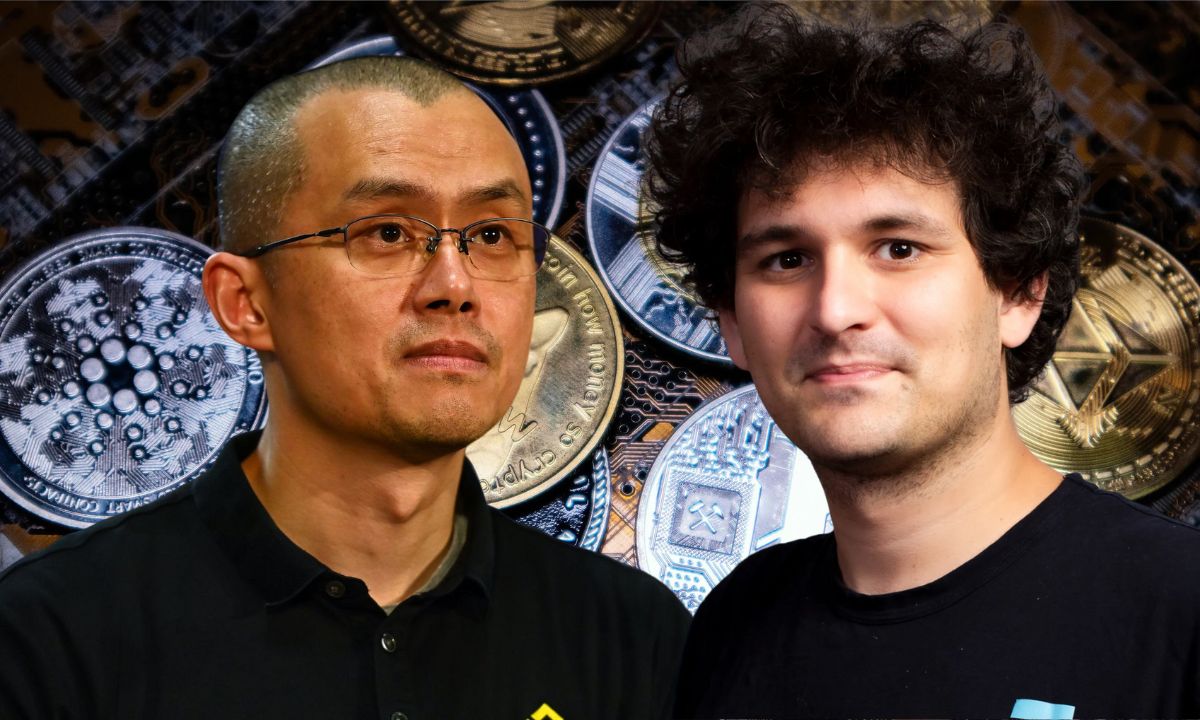

In a surprising revelation from 2019, it has been disclosed that Binance CEO Changpeng “CZ” Zhao declined a $40 million proposal from then FTX CEO Sam Bankman-Fried to establish a cryptocurrency futures exchange.

The offer from Bankman-Fried came in March 2019, as chronicled in Michael Lewis’ book “Going Infinite.” Binance at that time was operating solely as a spot crypto exchange, hence a futures-oriented platform represented a shift from its regular business model. Zhao, after examining the proposition, decided against the $40 million offer, choosing instead to develop a futures exchange internally.

Undeterred by Zhao’s rejection, Bankman-Fried went on to create the infamous FTX exchange in May 2019, which later declared bankruptcy in November 2022. The failed exchange is now at the heart of Bankman-Fried’s ongoing criminal trial in New York.

Bankman-Fried initially proposed to Zhao a futures platform model where Alameda would supply the technology and existing exchanges would provide the clientele. However, Zhao expressed concerns over the proposal, worried that a bad futures transaction could wipe out the posted collateral, thereby making the exchange responsible for any losses.

Regardless of this setback, Bankman-Fried remained committed to his vision of an easy-to-use crypto futures exchange for both retail and professional traders. To fund the venture, Bankman-Fried introduced the FTX token (FTT), a digital asset that indirectly offered holders a portion of FTX’s annual earnings via a token buyback and burn mechanism.

Despite facing U.S. regulatory hurdles, FTX issued 350 million FTT tokens for international investors in May 2019. While the response was initially tepid, the tokens garnered considerable interest, with prices varying between 20 to 70 cents.

A few weeks before the FTT listing, Zhao proposed to acquire a 20% stake in FTX for $80 million, an offer that Bankman-Fried accepted.

Read Now: