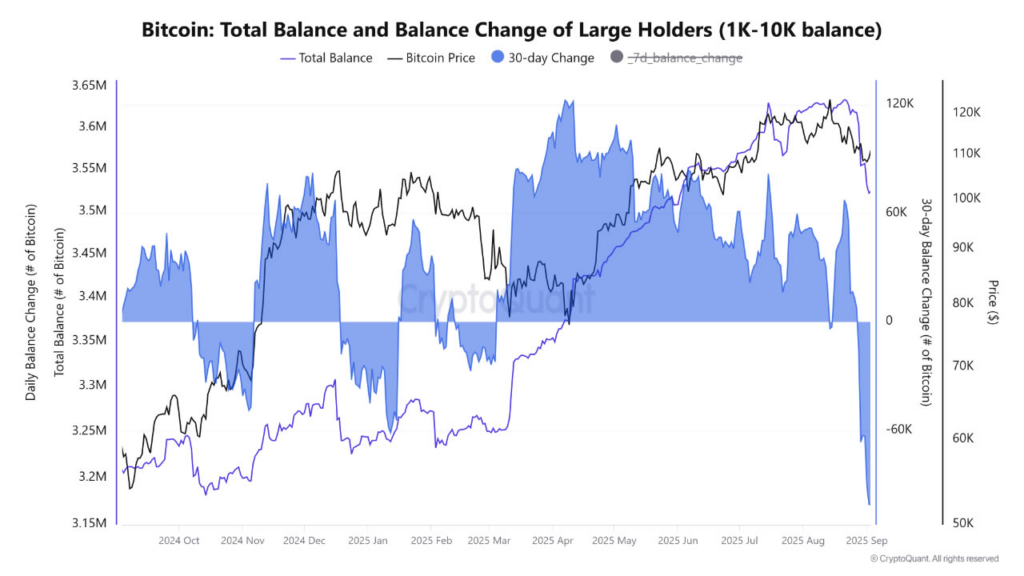

Bitcoin has come under pressure as whales unleashed the largest sell-off in more than two years, offloading over 115,000 BTC worth $12.7 billion in the past month. Analysts warn that the heavy selling may keep prices subdued in the coming weeks, even as long-term indicators remain constructive.

According to on-chain analytics platform CryptoQuant, whale reserves have dropped by more than 100,000 BTC in just 30 days, marking the most significant distribution since July 2022. The mass liquidation pushed prices briefly below $108,000, with Bitcoin trading around $111,400 at press time.

“The trend of reducing exposure by major Bitcoin network players continues to intensify, signaling intense risk aversion among large investors,” noted CryptoQuant analyst caueconomy.

Whale Activity Hits Multi-Year High

The selling surge peaked in early September, when the seven-day daily change in whale balances exceeded 95,000 BTC, the highest since March 2021. While weekly sales have since slowed to around 38,000 BTC, analysts say continued reductions in whale portfolios could weigh on the market near term.

CryptoQuant defines whales as entities holding between 1,000 and 10,000 BTC. Despite their influence, some industry leaders believe their impact may not last. Bitcoin entrepreneur David Bailey suggested last week that prices could rally to $150,000 if just two major whale sellers exit the market.

Institutions Step In as Counterbalance

The whale exodus has not gone unanswered. Institutional demand and ETF-driven buying have provided support during the downturn. Nick Ruck, director at LVRG Research, explained that while whale activity is curbing short-term momentum, “corporate accumulation during the same period has provided a structural counterbalance,” keeping the broader trend intact.

Traders, however, remain cautious, pointing to macroeconomic catalysts such as the Federal Reserve’s upcoming September rate decision as a potential driver of market direction.

Technical Picture: $100K as Key Support

Bitcoin has corrected roughly 13% from its mid-August all-time high, a far shallower pullback compared to previous cycles. Analysts highlight $100,000 as a critical “bounce zone,” with Fibonacci retracement levels suggesting that any further dip could bottom out around that mark.

Popular trader ZYN noted that Bitcoin often finds support at the 0.382 Fibonacci level: “For anyone wondering how low we can go, 0.382 Fibonacci level is currently around $100K. So the worst case scenario is a 10% drop before a 50% rally above $150,000.”

Market Sentiment Split

Short-term sentiment remains divided. While traders like Michaël van de Poppe see promise in Bitcoin holding $110,000 support, others warn that failure to reclaim $112,000–$113,000 could open the door to a retest of $100,000. Technical markers including the 50-day and 200-day moving averages at $115,035 and $101,760, respectively, add further significance to this range.

In the bigger picture, Bitcoin’s one-year moving average has surged from $52,000 a year ago to nearly $94,000 today, underscoring a steadily strengthening long-term trend. Even amid the heaviest whale sell-off since 2022, analysts argue that the broader market structure remains resilient, with institutional accumulation setting the stage for Bitcoin’s next major rally.