- Amazon NFTs launched: Could it change our shopping experience forever?

- Binance and Binance.US: closer than you’d think!

- ETHDenver: SporkDAO LCA generates modest profit for first time in History

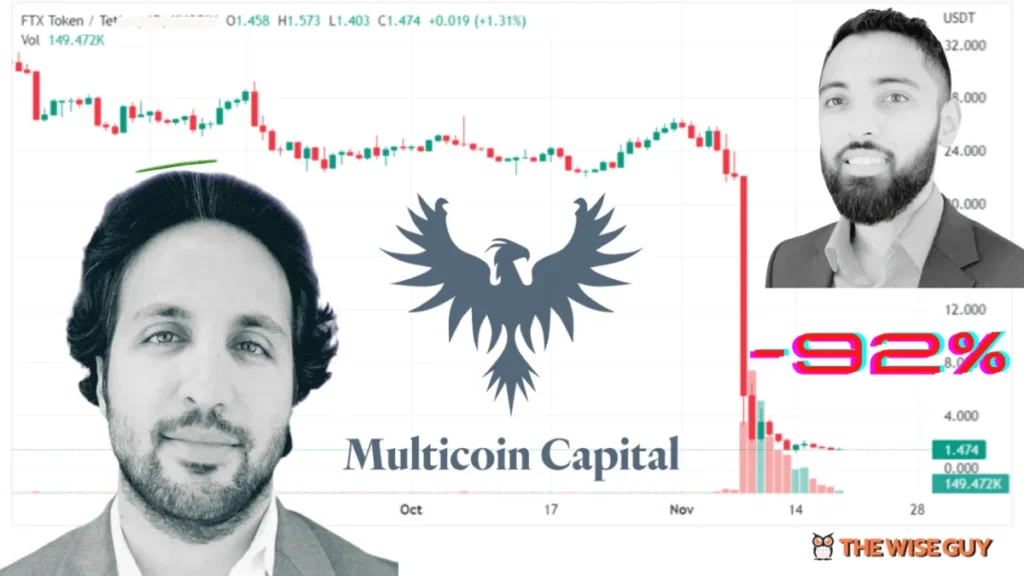

- An unlucky year for Multicoin Capital: Hedge Fund records 91.4% value drop in 2022

Amazon Entering the NFT Frenzy – Marketplace Expected Next Month

Rumors of a new Amazon NFT marketplace taking the internet by storm, people wondering if it’s gonna be the biggest consumer brand to enter the space and how it will remake their shopping experience, and us all wondering if this is a long-term vision or just another hype-builder. Who knows?

What we do know is that Amazon’s NFT adventure will be anything but boring. Could this be the start of sassier shopping experiences? Will a brand-new way of buying and selling products come out of it?

Amazon is also looking to use NFTs for customer deliveries and may even consider creating its own blockchain. This year could be the year Amazon settles on a crypto interface – and it’s no surprise, with CEO Andy Jassy asserting that Non-Fungible Tokens (NFTs) will continue to be big news.

However, despite Amazon’s partnership with Avalanche, it’s still unclear which blockchain they will choose for their next venture. Nevertheless, Jassy has noted that it’s “possible” Amazon may integrate crypto payments in the future. Who knows, this could be the year Amazon revolutionizes payments – although, only The Wise Guy can tell.

Gary Gensler Passes Up Binance.US Offer

Binance.US was set up shortly after Binance, aiming to separate the business processes required to meet US regulations from the rest of the world. That way, US regulations could be applied only to those offerings available in the US, like derivatives, which fall under the purview of the SEC.

But it looks like the lines between Binance and Binance.US weren’t as rigid and separate as you’d expect. According to messages seen by WSJ reporters, it seems Binance’s team were in charge of maintaining Binance.US’s software, with updates sometimes even accidentally pushed to the live platform too early.

If you haven’t heard, Gary Gensler, the current SEC chairman, was approached with a tentative offer in an advisory capacity back in 2018 … during his days at MIT. This was further confirmed in a Twitter live, held by CZ, giving the story an air of witty intrigue!

Will DAO Members Reap the Rewards from ETHDenver 2023’s Profits?

The organizers of this year’s ETHDenver have a good problem to tackle now that the world’s biggest Ethereum conference has wrapped – what to do with its modest, yet impressive, profit?

For the first time in the history of SporkDAO LCA (Limited Cooperative Association), the Colorado collective that owns ETHDenver LLC and a handful of other Ethereum-focused entities, a surplus cash was generated from their flagship conference that could mean members of the decentralized autonomous organization (DAO) might receive some of the money back.

In an interview, ETHDenver Conference Chief John Paller said that a not-so-formal “back of the napkin math” revealed the conference was a success, with the conference estimated to be between $500,000 to $1 million. Even more impressive, this was achieved during the throes of a bear market.

Multicoin Capital’s Hedge Fund Has Not Had a ‘Singing in the Rain’ Moment

It was a turbulent year for Multicoin Capital’s hedge fund in 2022, as revealed in its annual investor letter – one that saw a jaw-dropping 91.4% decline in value. Contributing to the unfortunate outcome were cryptocurrencies’ turbulent year, along with the fallout from FTX’s collapse.

It’s definitely been a wild ride for Multicoin Capital, and no one has been along for the ride more than Kyle Samani and his team. Multicoin’s 2022 losses stem from the assets stuck on FTX and holdings in tokens directly impacted by FTX, including the exchange token FTT.

Knight Watch ft. Van de Poppe

Bitcoin dropped a dizzying 4% from its record-breaking $24,000 high, all the way down to its current price of $22,420. You can blame SilverGate Capital for this one! But it’s not just Bitcoin feeling the burn – Ethereum was down 3% too, no doubt for much of the same reason. What a wild ride!

Analyst Michael Van de Poppe had us moving southward last week, as we hit the $22,000 mark. But, don’t worry – there’s still plenty of room to the upside! Van de Poppe’s advice is quite clear: stay calm in trading until the markets provide clear setups. It may seem counterintuitive, but markets are in balance and until something changes, there isn’t much action to be taken.

Honorable Mentions

Babel Finance, the Hong Kong-based crypto lending platform, plans to introduce a decentralized stablecoin that will be used to repay the firm’s creditors, according to a Bloomberg report.

The firm’s restructuring efforts are helmed by Babel co-founder Yang Zhou, who is now the company’s sole director, and revolve around a decentralized finance (DeFi) project called “Babel Recovery Coins.” The plan outlined in the filing will see Babel creditors repaid with revenue generated through the “Babel Recovery Coins” project, where the HOPE stablecoin will be initially backed by Bitcoin (BTC) and Ethereum (ETH), with more coins to be added at later stages.

When pressed about Silvergate Bank on March 6, White House Press Secretary Karine Jean-Pierre responded about the President’s continued call for congressional action to protect everyday Americans from the risks posed by digital assets.