Aave (AAVE) is back in the spotlight after a whale wallet acquired 50,000 tokens, worth roughly $15.07 million, at a time when the market is searching for direction. The buy comes as AAVE trades around $298.46, down 1.96% in the last 24 hours and 4.54% over the past week, with the token consolidating between $295 and $310.

While the purchase is raising bullish hopes, market data shows a delicate balance between whale accumulation and bearish positioning.

Spot Flows Show Accumulation

Exchange data highlights consistent outflows from spot markets, with four consecutive days of negative netflows. Around $613,000 worth of AAVE left exchanges today alone, suggesting investors are moving tokens to self-custody wallets rather than keeping them on trading venues. Historically, such moves ease immediate selling pressure and point to accumulation, though their impact depends on whether demand persists.

Futures Market Signals Mixed Sentiment

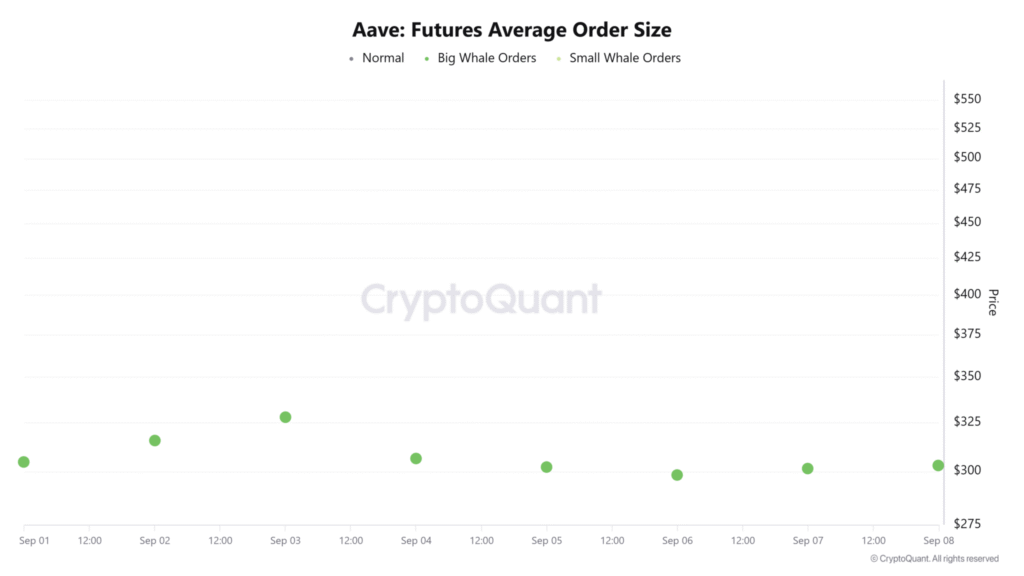

Derivatives trading has also intensified. Futures volume jumped 48.9% to $829.78 million, while open interest rose 2.6% to $624 million, signaling fresh positioning. CryptoQuant’s data shows that large players have dominated AAVE futures for seven straight days.

However, the long/short ratio sits near 0.94, with shorts slightly outweighing longs at 51%. This suggests that while whales are active, positioning remains cautious, possibly hedged rather than outright bullish.

Technical Levels to Watch

Technicals set the roadmap for the next move. Resistance stands at $331, the level where AAVE was rejected last week. Clearing that zone could open the door to $336, which aligns with the upper band of recent liquidity. On the downside, failure to hold the $300–$305 area risks a slide toward the mid-$290s, with $285 emerging as a deeper support zone.

Momentum indicators are also showing early signs of improvement. The Stochastic RSI recently made a bullish crossover near 21, hinting at recovery potential from oversold levels. Still, traders will look for confirmation through volume and daily closes above resistance.

Protocol Fundamentals Remain Strong

Despite short-term market volatility, Aave continues to dominate decentralized lending. The protocol manages over $39.4 billion in total value locked (TVL), with more than $10.9 billion in USDT and USDC loans on Ethereum alone. Its expansion efforts include the launch of “Stablecoin Earn Plus” with Bitget Wallet, offering yields up to 10% APY, and supporting Chainlink’s CCIP protocol on Aptos, enabling cross-chain access to its GHO stablecoin.

Outlook

The $15 million whale buy adds weight to bullish arguments, but the market remains at a crossroads. If demand sustains and shorts begin to cover, AAVE could break past $331 resistance and target $336. If not, consolidation or another dip toward $285 may follow. For now, the battle between whale accumulation and cautious derivatives positioning will decide the token’s next move.