XRP is showing compelling signs of bullish momentum, according to on-chain analytics provider Santiment, as retail fear and uncertainty hit elevated levels. The data suggests that despite a spate of negative commentary, XRP may be primed for a strong rally, with technical analysts eyeing a $4 price target in the near term.

Retail FUD Signals a Buying Opportunity

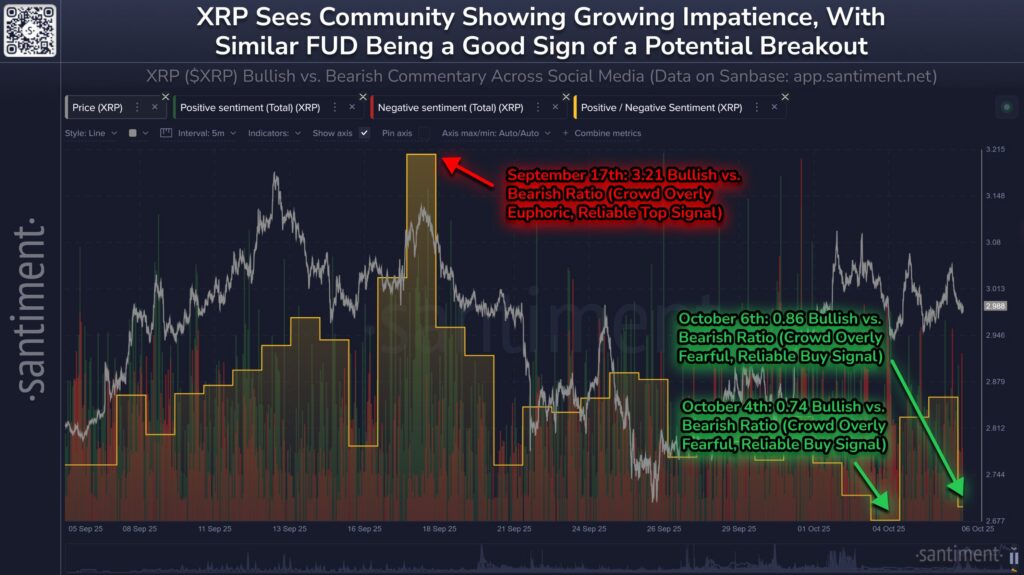

Santiment highlighted that XRP is currently experiencing the highest level of retail fear, uncertainty, and doubt (FUD) since significant market events earlier this year. Many traders have been posting bearish comments on social media, creating an environment that historically signals a potential “buy-the-dip” opportunity.

The lack of immediate whale accumulation, attributed to profit-taking by Ripple co-founder Chris Larsen and delays in spot ETF approvals, has contributed to the short-term bearish sentiment. Nevertheless, Santiment notes that historically, a surge in retail FUD often precedes price rebounds, particularly when institutional support remains stable.

XRP whales, along with the broader XRP Army, have been stepping in at key support levels, particularly around $2.80, preventing further declines. This collective investor activity is creating a structural foundation for a potential upward breakout, defying the expectations of short-term retail traders.

Institutional Support and Inflows

Institutional interest in XRP continues to grow, as seen in the latest Crypto Funds Inflow report by CoinShares. Ripple’s token recorded $219 million in inflows, pushing total assets under management (AuM) to $3.266 billion. This institutional activity adds weight to the bullish thesis, reinforcing that long-term investors are accumulating XRP despite temporary retail pessimism.

Technical Indicators Point to $4

From a technical standpoint, XRP is trading within a falling wedge pattern, a formation that often signals a bullish reversal. Analyst Lark Davis noted that Ripple “keeps getting smashed down on attempts to break the descending resistance line,” indicating that a successful breakout could trigger a significant rally toward $4.

Traders are also keeping an eye on the 20-day EMA at $2.94, which may serve as short-term support if XRP fails to break higher. Meanwhile, spot ETF anticipation remains a critical catalyst; approval by the U.S. SEC could accelerate momentum even further, potentially paving the way for XRP to test $5.

Market Activity Reflects Growing Interest

Despite a minor 1% drop over the past 24 hours, XRP is trading around $2.96, with a 24-hour high of $3.05 and low of $2.95. Trading volume increased 31% in the same period, signaling heightened market activity. On the derivatives side, total XRP futures open interest rose 2% to $9.12 billion, while CME 4-hour open interest climbed 1.55%, reflecting active positioning among traders.

XRP appears poised at a critical juncture, with elevated retail FUD, strong institutional inflows, and favorable technical patterns converging to set the stage for a potential breakout. Analysts remain confident that a move toward $4 is on the horizon, with the broader market closely watching ETF developments and key support levels to gauge the next leg of the rally.