As the U.S. national debt surges toward $38 trillion, the world’s leading hard assets , gold and Bitcoin, have simultaneously hit new all-time highs. With the U.S. adding nearly $6 billion in debt every day and the dollar facing its worst annual performance since 1973, the markets appear to be voting for alternatives, and Bitcoin is emerging as the real safe haven.

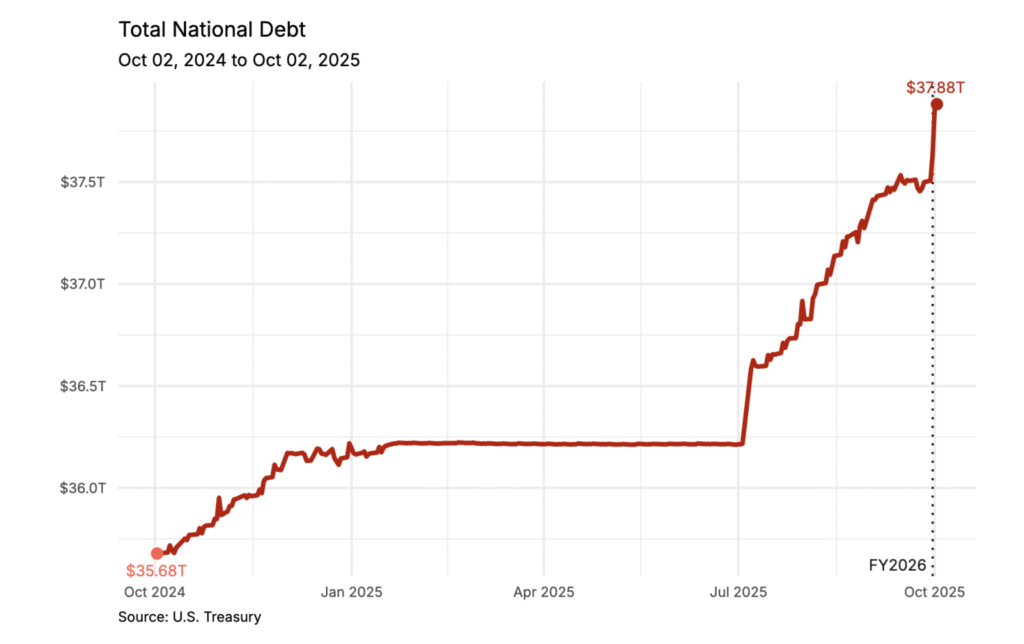

According to Congressman David Schweikert’s Daily Debt Monitor, the national debt reached $37.88 trillion as of October 2, 2025, ballooning by $2.2 trillion in just one year. That equates to roughly $283,000 per household, with interest payments now topping $241 billion annually.

Meanwhile, nearly a third of U.S. debt is set to mature within the next 12 months, creating serious rollover risks amid political gridlock and a government shutdown that has already sidelined 1.5 million federal workers.

The Dollar’s Decline and the “Debasement Trade”

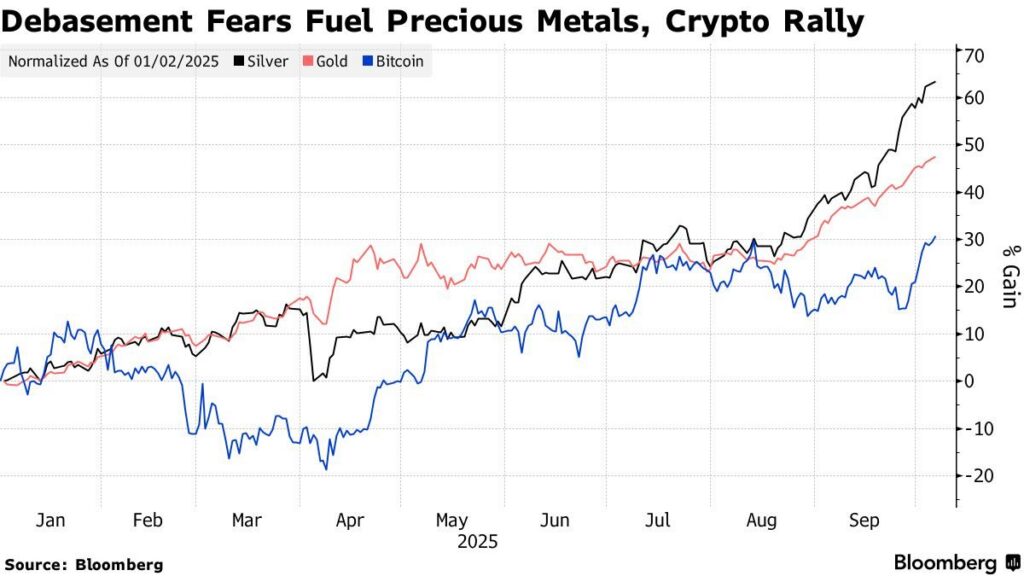

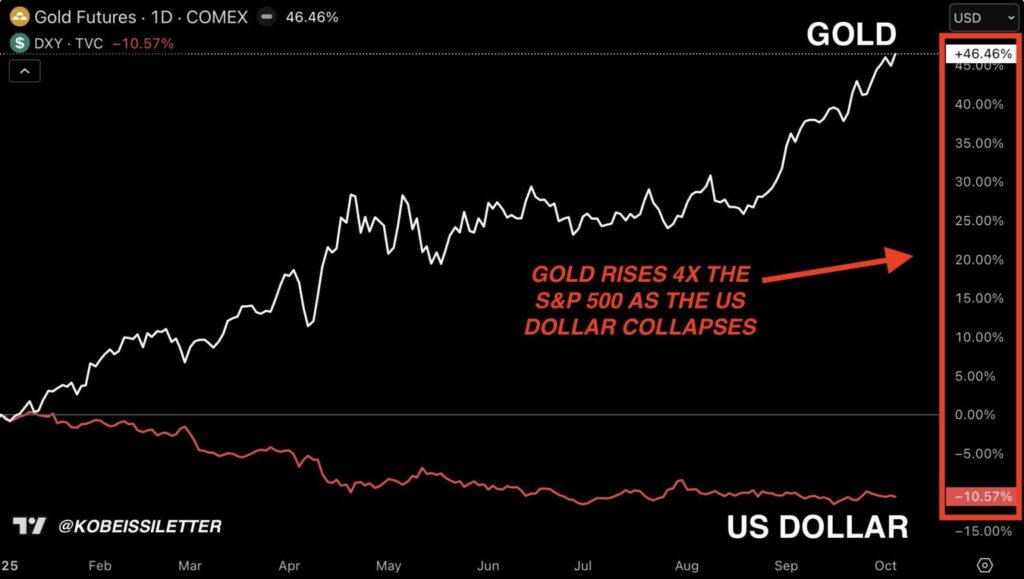

This accelerating debt crisis has come alongside a historic surge in gold and Bitcoin. Gold soared to an all-time high of $3,924 per ounce, while Bitcoin broke past $125,000, pushing its market capitalization to $2.5 trillion. Bloomberg analysts dubbed the shift a “debasement trade”, a mass exodus from fiat currencies into hard assets that can’t be printed or politically manipulated.

The U.S. dollar has fallen more than 10% year-to-date and lost over 40% of its purchasing power since 2000, sparking fears of long-term currency erosion. JPMorgan strategists warned that “Washington dysfunction” is once again fueling the same dollar debasement pattern seen after the 2008 financial crisis and years of quantitative easing.

Why Bitcoin Is Winning the Safe-Haven Race

While both gold and Bitcoin are benefiting, Bitcoin’s mathematical scarcity, global liquidity, and decentralized design make it uniquely suited for the digital age. A $100 investment in Bitcoin in 2020 would now be worth $1,473, compared to just $209 in the S&P 500 — proof that BTC not only preserves value but also compounds it faster than any other major asset.

Unlike gold, Bitcoin’s 21 million coin limit makes it immune to supply inflation. Institutional adoption continues to expand, with ETFs and corporate treasuries accumulating at record pace. Analysts predict a potential blow-off top between $140,000 and $155,000, but even a correction would likely leave BTC far above its previous cycle highs — signaling lasting structural demand.

A Global Flight to Scarcity

With central banks cutting rates, inflation expectations rising, and geopolitical uncertainty spreading across the U.S., Europe, and Japan, investors are rebalancing portfolios toward assets that exist outside traditional monetary systems. Gold, silver, and Bitcoin now rank among the top 10 largest global assets, together representing a monumental shift in capital away from debt-driven economies.

As the dollar weakens and debt soars, Bitcoin’s transparent, finite, and borderless nature positions it not just as an investment — but as a lifeboat in a sinking fiat system.