Two new crypto exchange-traded funds (ETFs) are edging closer to launch as 21Shares’ Sui (SUI) and Polkadot (DOT) funds were listed on the Depository Trust & Clearing Corporation’s (DTCC) National Securities Clearing Corporation (NSCC) list. While not a formal greenlight from regulators, the listing signals that issuers are preparing for approval and settlement of the ETFs.

DTCC Listing Clears Operational Step

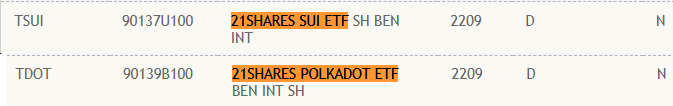

According to the DTCC’s updated clearing list, the SUI ETF appears under the ticker TSUI, while the Polkadot ETF is listed as TDOT. The inclusion allows the funds to be cleared and settled through the NSCC system, an essential operational step prior to launch.

A DTCC listing does not mean automatic approval from the U.S. Securities and Exchange Commission (SEC). However, it is often viewed as a sign that issuers are confident the approval process is moving forward. In recent weeks, the DTCC has also added multiple crypto ETFs tied to Solana, XRP, Hedera, and Dogecoin, reinforcing the sense that the ETF pipeline is accelerating.

As of October 1, neither the Sui nor the Polkadot ETFs has received SEC approval, but the groundwork suggests issuers are anticipating favorable decisions soon.

Analysts Raise Approval Odds

Bloomberg ETF analysts James Seyffart and Eric Balchunas had previously placed approval odds at around 90% for Polkadot and 60% for Sui. But following recent regulatory moves, those numbers are believed to have improved.

On September 29, the SEC withdrew delay notices for at least 16 crypto ETF applications, including funds linked to Solana and XRP. This came just after the Commission adopted new generic listing standards for crypto-based ETFs, effectively streamlining the approval process.

According to Balchunas, issuers now only need SEC sign-off on their S-1 registration statements from the Division of Corporation Finance, avoiding the slower 19b-4 process that previously bogged down approvals. “The long wait for crypto ETF approvals may finally be over,” he noted in a recent X post, predicting Solana ETFs may be approved first, with others such as Sui and Polkadot following closely.

Market Reaction Muted

Despite the progress, both tokens saw muted price action. SUI briefly gained over 3% and DOT climbed nearly 2% on the news, but both retraced and turned red as broader market sentiment remained cautious. The ongoing U.S. government shutdown has weighed heavily on risk appetite, offsetting the optimism around ETF listings.

Still, analysts argue that ETF approval could be a long-term catalyst. For now, the DTCC listing underscores that issuers like 21Shares are laying the operational foundation, with regulatory approval appearing closer than ever.

If approved, the SUI and DOT ETFs could join a growing roster of altcoin-based funds, further integrating these networks into mainstream financial products and offering investors new exposure avenues.