Solana’s (SOL) price has rebounded sharply from recent lows, with traders piling into long positions ahead of a potentially pivotal decision from the U.S. Securities and Exchange Commission (SEC) on October 10 regarding a Solana exchange-traded fund (ETF).

After briefly dipping to $190.85, SOL surged nearly 12% over three days, reaching $213 on Monday and trading at around $208.49 at press time. The rally suggests that the sell-off was seen as a buying opportunity, with market participants positioning early for an ETF-driven breakout.

Retail Traders Dominate the Dip

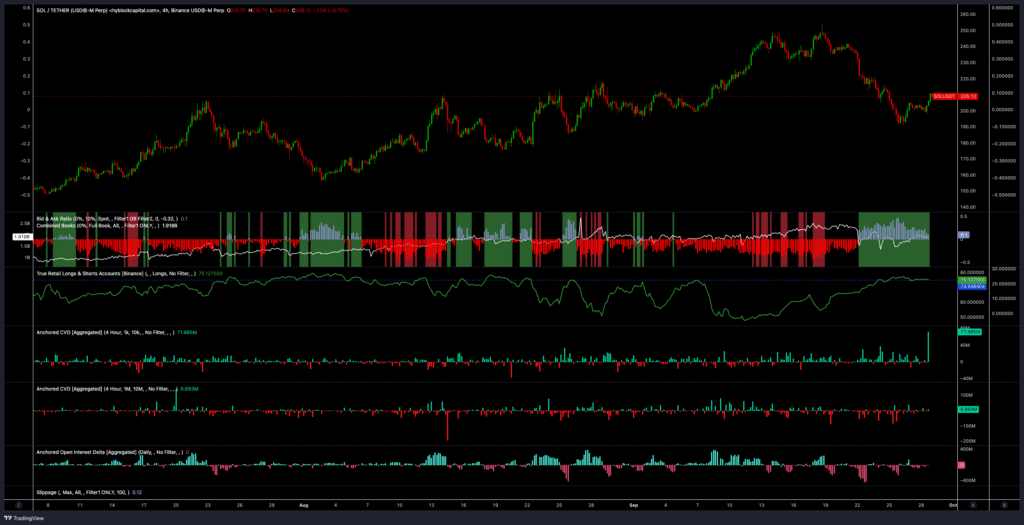

On-chain and exchange data shows retail traders were the backbone of the recovery. As Bitcoin and the wider crypto market slid last week, Binance’s cumulative volume delta (CVD) revealed that small-to-mid size retail traders were aggressively buying the dip. Coinbase’s institutional-size spot CVD also recorded similar inflows, showing that larger players joined the buying spree.

Hyblock’s True Retail Longs and Shorts metric supports this view, as the percentage of retail accounts holding long positions jumped from 54.3% to 78.2% during the sell-off. This surge in retail conviction tilted Solana’s order book in favor of buyers, with the bid-ask ratio climbing to 0.47.

Anchored 4-hour data further confirmed strong inflows, with nearly $72 million in buy-side volume recorded in a single session.

What’s Next for SOL Price?

The key question is whether this momentum can extend toward Solana’s yearly high of $253, set in mid-September. For that to happen, analysts point to derivatives activity as a crucial driver. On September 18, when SOL peaked at $253, CME futures open interest reached $2.12 billion, while daily volume hit $1.57 billion.

As of September 26, these figures have dropped to $1.72 billion and $400 million, respectively—suggesting there’s still room for institutional flows to return.

Aggregate open interest across centralized exchanges also remains below the levels seen before the last rally, when OI topped out at $3.65 billion. A resurgence in open interest could be the signal traders need to confirm that the current rebound has legs.

ETF Anticipation Builds

Another telling metric is Solana’s cumulative session returns across major global regions. Since Friday, U.S. session returns have turned positive, reflecting optimism around the SEC’s pending ETF decision. Analysts argue that if buying activity in Asia and Europe aligns with the U.S. trend, it would add more momentum to the bullish case.

The SEC’s final call on Solana ETFs is expected by October 10, and market watchers believe an approval could unlock significant new capital inflows into SOL. However, traders are also wary that the decision may already be partially priced in, raising the risk of a “sell the news” event.

For now, SOL’s recovery highlights the growing confidence of retail and institutional traders alike. If buying pressure persists and open interest builds toward September’s levels, Solana could once again challenge the $250 mark, just in time for its biggest regulatory catalyst of the year.