???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

1️⃣ Less Than Stellar Debut For Ethereum Futures Etfs By Vaneck, Proshares, And Valkyrie

2️⃣ Sam Bankman-Fried Pondered $5 billion Offer To Trump To Bow Out Of 2024 Race, Michael Lewis Reveals

3️⃣ Investors Left Disappointed As ‘uptober’ Hopes Are Quashed By Sudden Crypto Liquidation

4️⃣ Editor’s Wrap: Congress Must Take a Stand Against Gary Gensler

Less Than Stellar Debut For Ethereum Futures Etfs By Vaneck, Proshares, And Valkyrie

The inaugural trading day for Ethereum futures-based ETFs from VanEck, ProShares, and Valkyrie was met with a lukewarm response.

On Monday, nine ETFs that provide exposure to Ethereum futures were introduced to the market, as reported by CoinDesk. Five of these ETFs are exclusively invested in Ethereum futures, while the other four have stakes in both Bitcoin and Ethereum futures.

The Bitcoin Strategy ETF from Valkyrie, which has been trading for approximately two years, is diversifying its focus to include Ethereum. The rest of the ETFs are new entrants in the market.

Per Eric Balchunas, a Bloomberg ETF analyst, the Ether Futures ETFs experienced “Pretty meh volume…as a group.” VanEck’s Ethereum Strategy ETF (EFUT) saw nearly 25,000 shares traded, with each share averaging around $17. This amounted to a total dollar volume of just $425,000.

In stark contrast, the ProShares Bitcoin Strategy ETF (BITO), which was launched during a crypto market boom in October 2021, experienced over $1 billion in dollar volume on its first day.

The crypto industry is now eagerly waiting for the U.S. Securities and Exchange Commission’s (SEC) verdict on numerous applications for spot Bitcoin and Ether ETFs.

Adding to the suspense, Grayscale Investments recently disclosed its plans to convert its nearly $5 billion Grayscale Ethereum Trust (ETHE) into a spot ETF.

The tepid response to the launch of the Ethereum futures-based ETFs underlines the critical importance of the SEC’s upcoming decision. The approval of spot Bitcoin and Ether ETFs could significantly alter the investment landscape for these cryptocurrencies and potentially drive much higher trading volumes.

The decision by Valkyrie to broaden its Bitcoin Strategy ETF to include Ethereum reflects the growing interest in Ethereum as a viable investment option. However, the lukewarm response to the new ETFs suggests that investors may be adopting a wait-and-see approach, pending the SEC’s decision.

Sam Bankman-Fried Pondered $5 billion Offer To Trump To Bow Out Of 2024 Race, Michael Lewis Reveals

Sam Bankman-Fried, ex-CEO of FTX, reportedly contemplated offering Donald Trump a whopping $5 billion to abandon his potential 2024 presidential campaign. This startling revelation is detailed in a new book by well-known author Michael Lewis.

Michael Lewis, the brain behind “The Big Short” and now “Going Infinite: The Rise and Fall of a New Tycoon,” unveiled this shocking piece of news. Bankman-Fried, during his tenure at FTX, toyed with this unconventional political tactic and even arrived at a potential dollar amount.

During a discussion with Bankman-Fried, Lewis mentioned the ‘$5 billion’ figure. Yet, it is still ambiguous whether this sum was directly proposed by Trump or was just a hypothetical figure.

Bankman-Fried, once a crypto magnate with a net worth of $26.5 billion, has a track record of political donations. He gave $40 million to Democrats during the 2022 midterm elections but also has a history of large Republican donations.

The ex-FTX CEO is currently detained at a Brooklyn detention center on multiple federal charges, including wire fraud, conspiracy to commit securities fraud, and money laundering.

Investors Left Disappointed As ‘uptober’ Hopes Are Quashed By Sudden Crypto Liquidation

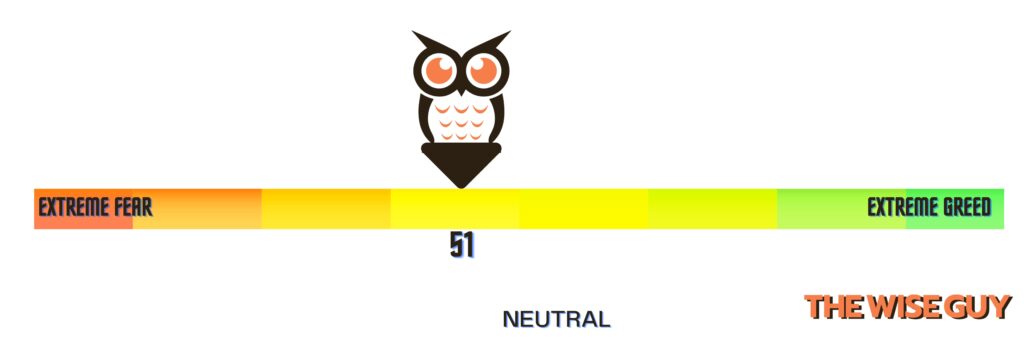

The start of October witnessed a sudden liquidation of over $70 million in cryptocurrency short positions. This event led to a temporary surge in Bitcoin and Ether, but the gains were quickly offset, casting a shadow on the anticipated prosperous ‘Uptober’ in the crypto market.

The significant liquidation of cryptocurrency short positions that took place on October 1 resulted in a momentary rally in Bitcoin and Ether, which soared by over 3% and 4% respectively. However, these gains were short-lived as they were soon wiped out.

Despite September’s turbulent market, crypto investors had high hopes for an ‘Uptober’ — a term derived from Bitcoin’s typically strong performance in October. However, Monday’s market performance failed to meet these expectations.

The report further highlighted that short positions still occupy about 50.5% of the futures market as of Monday. Meanwhile, Bitcoin (BTC) and Ether (ETH) saw drops of about 0.6% and over 4% respectively by Monday afternoon.

On a similar note, traditional stock markets like the S&P 500 and Nasdaq Composite indexes witnessed a disappointing end to the third quarter, losing 4.9% and 5.8%, respectively, in September.

Despite the market’s volatility, investors seem to be relying on the Federal Reserve to maintain steady interest rates at its next policy meeting, as per CME data.

The crypto market had been trending upward for several days before the sudden cooling off. This liquidation of short positions and the subsequent market dip could pose questions about the stability and predictability of the crypto market, especially for investors who were hoping for a lucrative ‘Uptober’. The swift reversal of fortunes within the crypto market highlights its volatile nature and the risks associated with it. The broader market trends and future Federal Reserve decisions could further influence the trajectory of the crypto market.

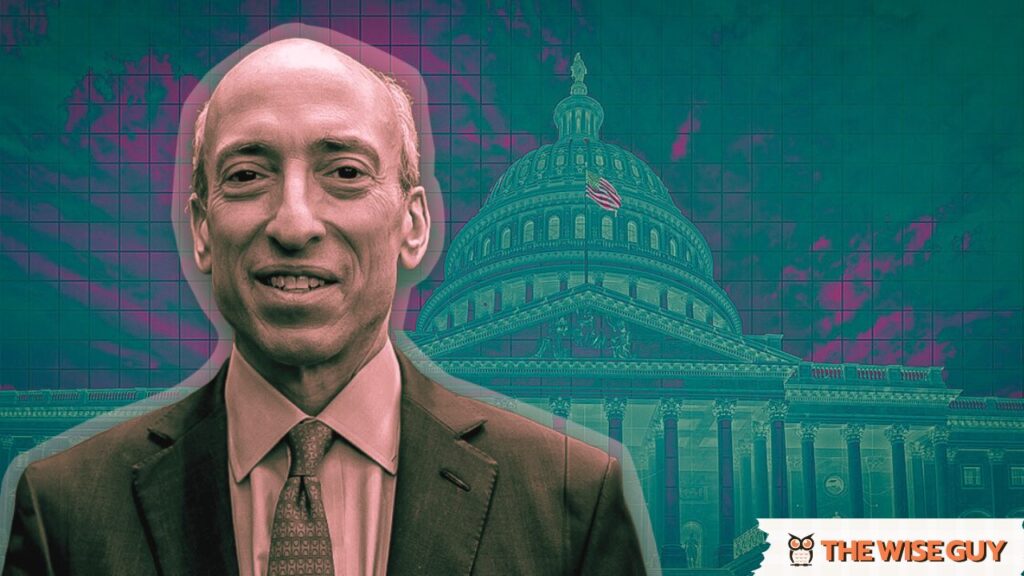

Editor’s Wrap: Congress Must Take a Stand Against Gary Gensler

The advent of blockchain technology and digital assets presents a tremendous opportunity for global economic transformation, providing access to financial services for the unbanked and driving innovation.

However, regulators like SEC Chairman Gary Gensler seem determined to stifle the growth of these technologies with misguided and excessive regulations that fail to grasp their full potential. Fortunately, recent court decisions have stood up against Gensler’s overreach, but it is now up to Congress to ensure that progress and innovation are not hindered.

Gensler’s intent to regulate digital assets “as far as [his authority] goes” is apparent, as he seeks to save transactions, products, and platforms from regulatory gaps, as stated at the 2021 Aspen Security Forum. However, his approach risks endangering American digital asset firms by burdening them with excessive rules that could force many to move their operations overseas or cease operations altogether.

So, what drives Gensler’s opposition to progress and innovation in the digital asset space? One possible motivation is the embarrassment stemming from his failure to prevent the infamous fraud scheme executed by Sam Bankman-Fried and FTX, one of the largest in US history. U.S. Representative Ritchie Torres even blamed Gensler for being “singularly responsible” for failing to expose the fraudulent activities of the FTX cryptocurrency exchange in 2022. Rather than addressing these failures adequately, Gensler seems to be on a mission to punish law-abiding individuals within the industry out of personal vendetta, rather than holding the guilty parties accountable.

However, recent victories in the federal appeals court have shown that the SEC’s attempts to hinder the progress of the digital asset industry can be curbed. In a notable case, the court ruled against the SEC’s efforts to prevent Grayscale Investments from transforming their Grayscale Bitcoin Trust into a listed Bitcoin exchange-traded fund (ETF). The decision rightfully pointed out that the SEC failed to justify its denial of the listing application and ordered a review of the case.

Despite these successes, there is no indication that Gensler and the SEC will back down from their crusade against digital assets. This is where Congress must step in and take action to prevent any future burdensome regulations. House Majority Whip Tom Emmer has led these efforts by introducing an amendment that would prohibit the SEC from conducting illegal enforcement actions against digital assets without clear legal authority, effectively protecting innovation in the sector.

The significance of this amendment cannot be overstated. It is crucial to ensure that Gensler’s overbearing nature does not stifle the potential of digital assets and blockchain technology. The Blockchain Innovation Project, a bipartisan advocacy organization dedicated to educating elected officials on digital assets, stands firmly in support of this rider. In a time when disagreement seems to be the norm, both Republicans and Democrats can agree that Gensler’s excessive regulations are simply unacceptable.

It is time for Congress to take a stand and protect the innovation and progress brought forth by blockchain technology and digital assets. By doing so, they can ensure that the United States remains at the forefront of this transformative industry, benefiting not only the economy but also the individuals who were once excluded from traditional financial systems.

CoinWestern Quixplaned????

????Elusive ‘Satoshi Nakamoto’ twitter handle springs back to life after years of dormancy

????Metaplex’s “Bubblegum” fuels the minting of Millions of compressed NFTs on Solana

????Dubai investor rues early exit from Shiba Inu investment; misses out on $70 million

Top Reddits This Week That Got Our Attention

JPMorgan says Ethereum’s activity post-Shanghai upgrade has been ‘disappointing’

I made new art for the Bitcoin Crab Market

Shrinkflation: a subtle way to hide inflation

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?