It’s been a wild ride for crypto this week!

- Instagram is all set to say adios to NFTs

- Shibarium is here but so are fake tokens

- Euler Finance chases security groups to help make sense of the whole mess.

- Pokemon is looking to foray into the web3 space.. Not kidding

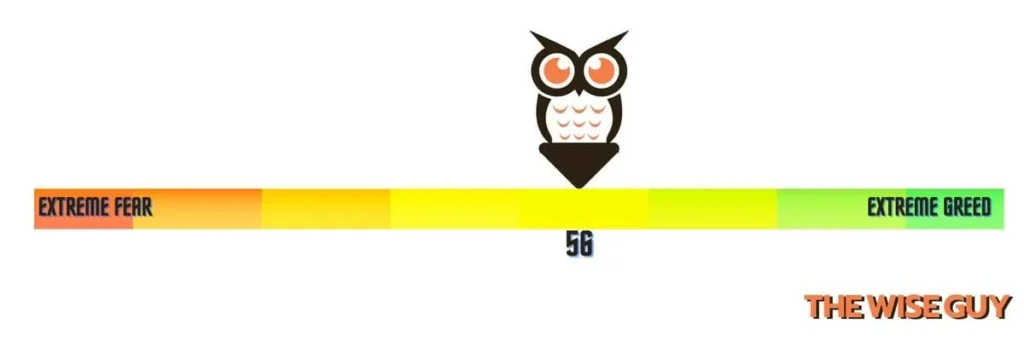

Owl says “Greed”

Instagram Dumps NFTs

Looks like Meta is “No Good, My Internet” (NGMI), as some might put it. After testing out NFTs and digital collectibles features on Instagram and Facebook for just a few months, they’ve decided to call it quits. The experiment had a good run, but like all good things, it had to come to an end. Sorry, no more NFTs for you, Meta fans – looks like you’re stuck with OG memes for now!

Last May, Meta took their first steps and opened the door for select Instagram creators to begin testing them, soon after opening the door for some lucky Facebook users in June. Before we could bat an eye, Meta had already expanded NFT support on Instagram for creators in 100 countries! But alas, after less than a year of living the NFT life, Meta is now waving goodbye to the wild world of digital collectibles.

Meta has been clumsily attempting to make its virtual reality metaverse dreams come true, and it definitely has cost them a pretty penny. Reality Labs has seen a whopping $13.7 billion loss last year! The company had to lay off 11,000 employees in November too, making it the biggest layoff in Meta’s history.

But even though it seems like Meta’s dreams of having virtual clothing be minted as NFTs might not happen, they’re still keeping an eye on crypto for the long term.

Shibarium Is Live But Tokens Aren’t…

Shiba Inu’s lead developer Shytoshi Kusama has a timeline for when we can expect to see Puppynet, the Shibarium testnet, up and running. He predictably ‘woofs’ that it could be ready for beta-testing in no time… as in two months! But just to be sure, he has set aside up to July of this year to make sure everything is purrfectly running.

Last week, Shibarium, the Shiba Inu’s layer-2 ecosystem protocol, built on top of Ethereum (ETH), and similar to Polygon (MATIC) officially released its beta version. Now beta testers can take a dive and explore the testnet.

Kusama warns that the coins in the Shibarium beta form are not real – so don’t even try it! But hey, don’t let that put a damper on this awesome news – once the testing of the beta is complete, we’ll have a whole new ecosystem of custom coins ready to be traded and paid for with Bone ShibaSwap (BONE) to save on the gas fees! So what are you waiting for – strap on your dogecoin hat, buckle up.

Euler Finance Misses The Boat

On March 13, decentralized finance (DeFi) lending protocol Euler Finance became the victim of the biggest hack of 2023 – with a whopping loss of nearly $197 million! It’s like someone waved a magic wand and poof! The money was gone!

Euler Finance today released an update encouraging users to remain calm. They had disabled the vulnerable etoken module and the vulnerable donation function to prevent further damage. Additionally, they said that they’d worked with security groups which had given their protocol the stamp of approval… which obviously didn’t mean much in hindsight.

It took eight months and a $1 million bug bounty for someone to have enough motivation to exploit the vulnerability that mysteriously lingered on Euler Finance. Finally, Sherlock, one of their audit groups who had been working with them, stepped in to help make sense of the whole mess. After a tedious audit process and votes being cast, the protocol ultimately agreed to make a payment of $4.5 million, executing the payment of $3.3 million on March 14.

What Sherlock uncovered in the report was a missing health check in the “donateToReserves” function added in EIP-14. Although, attempting such an attack would have still been technically possible before EIP-14 as well.

$1: This Is What HSBC Bank Paid To Buy Silicon Valley Bank’s UK Arm

If you think the economy has been shocking lately, wait until you hear what just happened in the world of global banking! It seems that HSBC Holdings has acquired the UK subsidiary of Silicon Valley Bank for the super low price of just one dollar – that’s right, one single dollar !

The dramatic fall of the California-based lender has left shock waves reverberating around the world; regulators have been working hard over the weekend to contain the damage.

You may ask, why $1, the simple reason as at 10 March 2023, SVB UK had loans of around £5.5 billion. The assets and liabilities of the parent companies of SVB UK are excluded from the transaction, HSBC said.

Crypto Market Watch Ft. Goldman Sachs

Woohoo! The crypto world has seen a massive surge—Bitcoin breached $26,000 for the first time in the last two week, and Ethereum reached $1700! But what made it happen? Well, okay, here’s your answer: US regulators saving the day and depositors’ money as Silicon Valley Bank and Signature Bank collapsed.

Goldman Sachs’ prediction that the Federal Reserve (Fed) will pause rate hikes this month instead of the previously expected 25 basis point rise is likely due to the current economic crisis. Stocks and crypto markets fared gains after the latest CPI report, which showed inflation was in line with economists’ expectations.

Honorable Mentions

Ahhh… Pokémon on the blockchain? Could it really be true? It seems that The Pokémon Company is hoping to make a splash in the Web3 world, but so far their attempts haven’t been quite so successful. We’ve all heard stories of epic battles between Pokémon-enthused developers, but all we’ve gotten out of it has the monster battles ending in some seriously misfired moves.

Still, The Pokémon Company hasn’t given up hope – they’re looking for Corporate Development Principles to join the team to advise their leadership on strategy and to explore possibilities in the Web3 world.

A solo Bitcoin miner made headlines this week when they won the jackpot by successfully mining block 780,112 on Bitcoin’s blockchain – beating the odds and out-mining countless other miners in the race for the same goal! With 6.25 BTC and a fee reward of about 0.63 BTC, the miner is sitting on a pile of crypto-cash worth about $148,000 – which is a pretty impressive haul for a single lucky miner