Welcome to The Wise Guy,

Where we take cryptocurrency seriously, but we also know how to have a good time.

That’s why we’ve curated the crème de la crème from not one, not two, but FIVE newsletters.

MilkRoad, Defiant, Messari, Bankless, and CoinDesk Node.

Defiant’s Top Story

Ethereum developers are swooping in like caped crusaders with a new proposal to shield token issuers from those dastardly bridge hacks.

Defiant introduces ERC-7281, the token standard with superpowers! This standard aims to protect issuers by allowing them to limit their tokens’ exposure to bridges and implement a nifty token burning and minting interface.

In a world filled with bridge exploits, this proposal is like a ray of sunshine breaking through stormy clouds. It’s a response to those nail-biting high-profile hacks that have left everyone on edge and emphasizing the dire need for improved security.

MakerDAO Is Earning 80% Fee From Real World Assets

Let’s jump over to the realm of MakerDAO, the third-largest DeFi protocol out there. These DeFi pioneers have discovered a secret formula to boost their fee revenue, and it involves real-world assets (RWAs). Yes, you heard it right! MakerDAO has found a way to earn a whopping 80% of its fee revenue from RWAs in the past year.

RWAs are like the digital versions of traditional finance assets, such as bonds and real estate. How’s that for bridging the digital and physical worlds?

Sure, there’s been some controversy within the protocol’s community about RWAs, but they’ve proven to be a lucrative gold mine for MakerDAO.

Messari’s Desk

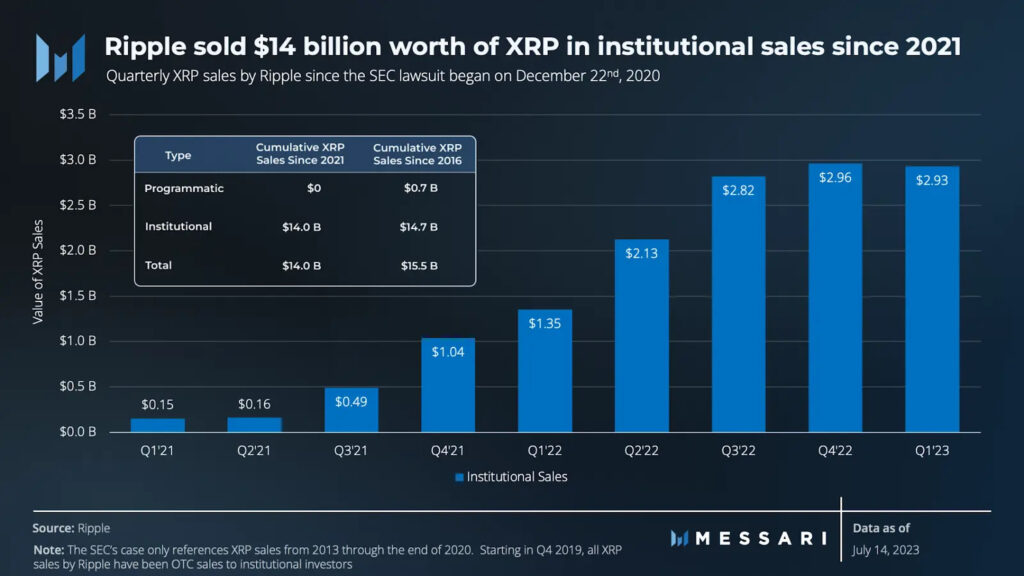

Messari’s desk did not celebrate the news of XRP winning the legal case against SEC, instead it shed light on some other findings of the case.

The court did find Ripple guilty of violating securities laws with their institutional sales of XRP. Yep, those sales made directly to institutions where the buyers knew they were investing in Ripple.

Let’s talk numbers, because that’s always fascinating, right? The total supply of XRP floats around a cool 100 billion tokens, initially divided between Ripple and the three founders. Ripple wrestled with the SEC over sales made from the 80 billion XRP that was allocated to the company.

According to the lawsuit, Ripple allegedly made a jaw-dropping $757.6 million from programmatic sales and another $728.9 million from institutional sales between 2013 and the end of 2020.

Now, here’s where the story takes a sharp turn. Ripple stopped programmatic sales back in 2019, but they continued with their institutional sales.

Unfortunately for them, the court ruled that these sales violated securities laws. Ouch! And guess what? This ruling could have ripple effects (pun intended) on sales made from 2021 onwards. Yep, that’s right, it’s not over yet!

Bankless’ Desk

For Bankless’ the biggest news was Binance reportedly laying off over 1,000 of its employees.

Ouch! It seems like the regulatory storm surrounding Binance and its founder CZ has finally taken its toll. The company has been quietly wielding the layoff ax, with sources suggesting that the casualties could reach nearly one-third of its global workforce.

That’s a serious blow to the Binance ecosystem. But CZ, being the quick-witted guy that he is, took to Twitter to deny those reports.

But wait, there’s one more surprise!

Polygon Labs is teasing us with something big. Get ready for Polygon 2.0, the next-gen upgrade that will take their network to new heights. They’re cooking up some zero-knowledge cryptography magic that will have the crypto community buzzing. Oh, and say farewell to MATIC because a brand new ticker, POL, will be gracing the stage.

Milk Road’s Educational Desk

Milkroad got some juicy intel about Ether (ETH) that played it cool at the beginning of the week, but boy did it finish strong!

With the Ripple news making waves, ETH rode the excitement and around 20% of all ETH is now staked. That’s a whopping 24 million ETH worth approximately $45 billion.

Just think about how far the ETH staking ecosystem has come in the past couple of years. It’s like witnessing the evolution of a crypto marvel. Let’s give a big shoutout to those brilliant ETH developers who made this possible. You rock! ????

What’s fueling the SOL rally, you ask?

Well, it’s all about the fundamentals and the high hopes for future profits. It seems like more and more folks are starting to believe that Solana is one of those altcoin projects that will not just survive but thrive when the dreaded “crypto winter” finally comes to an end.

Now, let’s dig into what’s on the Milk Man’s mind when it comes to Solana. We’ll start with the not-so-great stuff. First off, there’s still a lingering risk that SOL might get delisted from more exchanges.

The SEC put SOL on its “naughty list” back in June, claiming it was an unregistered security. That caused a few platforms, like Robinhood, to delist SOL. But fear not, Coinbase has stated that it doesn’t plan on delisting it, and considering they recently announced their intention to relist XRP, there’s hope they’ll do everything to keep SOL in the game. Phew!

Next up, we have the issue of SOL ownership being relatively concentrated. Alameda Research liquidators lay claim to around 13% of all the SOL tokens out there. Now, they can’t just dump them all at once thanks to some lock-ups until 2028, but still, having one entity hold such a substantial portion of a decentralized network’s token is far from ideal.

And let’s not forget about Solana’s ecosystem, which is still in recovery mode. The total value locked in Solana dApps reached a whopping $10 billion in November 2021, but it’s currently sitting at a mere $300 million. Ouch.

On top of that, NFT trading volumes on Solana have taken a hit, dropping from around $200 million per week to just double or single-digit millions throughout the year. Not exactly the kind of growth we’d hope for. And to make matters worse, they had to deal with SBF, crypto’s biggest villain, as their “poster child.” Yikes indeed.

Here’s another reason to smile: Solana is taking a different approach to blockchain scaling.

While Ethereum and others have jumped on the multi-chain and layer-2 scaling bandwagon, Solana has primarily focused on building one high-speed chain.

And guess what? It’s paid off! Despite its occasional downtime, Solana has outperformed major chains in terms of scalability, with transaction fees being just a fraction of a penny. Even if not many people are using Solana right now, it has the potential to support a wide range of use cases and attract more users than most other chains out there.

CoinDesk’s Best Story

CoinDesk’s Node newlstter had a solid opinion on how identifying the owners of crypto wallets may level the playing field for retail traders. But if taken too far it could be weaponized against the weak.

We have Arkham Intelligence, swooping in with an on-chain data analytics marketplace. Their grand mission? To unveil the secret identities of crypto wallet owners. They even declared, with a flourish, that “Deanonymization is destiny.” Turns out, Arkham inadvertently leaked its customers’ personal data. Cue the facepalm! Oh, the irony.

But wait, there’s more! Enter BlackRock, the asset management behemoth, with its grand plans for a spot bitcoin exchange-traded fund (ETF).

Our friends at CoinDesk uncovered an information-sharing agreement between BlackRock’s partners, Nasdaq and Coinbase. And guess what? It’s not just about sharing trade data, my friends. No, no. It goes way beyond that.

The Nasdaq and BlackRock have been given the green light to pull data from Coinbase, including folks’ personally identifiable information. Name and address, anyone? Who needs privacy, right?

Twice weekly crypto goodness, coming your way! Catch us every Monday, Tuesday and Friday. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?