???? GM,

Grab your favorite beverage (even if it’s a little early, we won’t tell), and get ready for the juiciest headlines that have been lighting up the Internet this week! ????

1️⃣ Binance CEO CZ and Exchange File Motion to Dismiss SEC Lawsuit

2️⃣ Crypto Traders Are Yelling at Each Other on Elon Musk’s X

3️⃣ Bitcoin Holders Underwater as Market Sentiment Sours, but Hope for Reversal Emerges

4️⃣Editor’s Wrap: NFTs Aren’t Dead Just Yet

Binance CEO CZ and Exchange File Motion to Dismiss SEC Lawsuit

Changpeng “CZ” Zhao and Binance have joined forces to file a motion to dismiss the lawsuit brought against them by the U.S. Securities and Exchange Commission (SEC). In a recent filing with the U.S. District Court for the District of Columbia, both Binance Holdings and Zhao argued that the SEC had overstepped its bounds in the lawsuit.

In their 60-page petition, Binance’s legal representatives accused the SEC of failing to provide clear guidelines for the cryptocurrency sector prior to instigating the lawsuit. They argued that the regulatory authority was attempting to retroactively impose its rules on the crypto industry.

“The SEC distorts the text of the securities laws, reading the word ‘contract’ out of the statutory phrase ‘investment contract’,” the filing stated. “The SEC also seeks to enlarge its jurisdiction globally to include transactions on foreign cryptocurrency platforms, defying Supreme Court precedent that the agency’s regulatory authority ends at the U.S. border.”

Furthermore, the petition highlighted that the SEC was seeking to impose liability for sales of crypto assets that took place as far back as July 2017 without providing adequate public guidance on digital assets during that period.

Asserting that the SEC lacks the authority to do so, Binance Holdings Limited and CZ are seeking to have the complaint dismissed.

Also named as defendants in the lawsuit is BAM Trading Services, the American subsidiary of Binance, which operates the Binance.US exchange.

The legal action against Binance by the SEC was initiated in June, with allegations that the exchange had offered the sale of unregistered securities and operated unlawfully in the United States. In its initial complaint, the SEC also claimed that billions of dollars of customer funds were commingled in an account controlled by Merit Peak, an entity owned by CZ.

Following the lawsuit, the SEC sought an emergency order to freeze Binance US’s assets to safeguard customer funds. In recent weeks, the regulatory pressure on Binance has increased, with the SEC accusing the crypto exchange of lacking transparency.

However, a deal was struck between Binance.US and the SEC, whereby assets would not be frozen in exchange for greater transparency and oversight. One stipulation of the agreement was that CZ and any entities he owns or controls would not have access to the funds.

Additionally, a district judge recently approved the SEC’s motion to unseal certain documents in the ongoing lawsuit against Binance.US.

It is important to note that the regulatory actions have had a significant impact on trading activity at Binance.US, as daily trading volumes have plummeted by over 98% since September 2022.

The repercussions of the legal battle were also felt within the company, with Binance.US announcing a new round of layoffs, resulting in a reduction of around one-third of its workforce. This was accompanied by the departure of its former president and CEO, Brian Shroder.

Crypto Traders Are Yelling at Each Other on Elon Musk’s X

What began as a seemingly innocuous panel discussion quickly escalated into a public feud on Elon Musk’s social media platform, X (formerly Twitter). Andrei Grachev, representing DWF Labs, a prominent presence in the crypto space, shared a photo of himself alongside fellow industry competitors, expressing gratitude for the panel.

However, the situation turned sour when Cristian Gil, co-founder of market-making giant GSR, criticized Grachev’s presence, deeming it insulting to their respective companies.

The exchange of words continued as Evgeny Gaevoy, CEO of market maker Wintermute, supported Gil’s sentiment by “liking” his post. Grachev responded defiantly, asserting DWF’s superiority in terms of technology, trading, and business development. The feud reached a comical climax as both sides exchanged taunts, with Grachev proclaiming DWF’s dominance and Gaevoy responding with a sarcastic “lol” and a dismissive It started quietly.

Andrei Grachev, whose firm, DWF Labs, emerged as a newsworthy – albeit controversial – presence in the crypto industry this year, posted on Elon Musk’s social media platform, X (formerly Twitter), a photo of himself sitting beside some competitors. “Thanks boys for the panel discussion,” he wrote alongside the picture of five people on stage.

Then came the trash-talking. Cristian Gil, co-founder of market-making giant GSR, posted days later on X, declaring that Grachev “had absolutely no business to be on that panel.” He further stated it was “insulting” for GSR, crypto exchange OKX, and Wintermute to be in the same room as DWF. Evgeny Gaevoy, the CEO of massive market maker Wintermute, showed his support by clicking the “Like” button on Gil’s post.

Grachev, not one to back down, fired back with a response that revealed his confidence: “I never thought that you could be THAT scared of us. Yeah, we are stronger than you in terms of tech, trading, BD, and everything. … If I were you – I would also be crying all the time.”

This exchange was followed by another Grachev post seemingly directed at the Wintermute executive: “We are eating your market share like a birthday cake and you can do nothing.” Gaevoy’s response was a nonchalant “lol” and a dismissive “go ‘invest’ more, we are trembling in your presence.”

While it may seem like just a battle of words, this public quarrel sheds light on DWF’s sudden rise earlier this year. The company made a splash as a backer of startups, but questions arose regarding its venture capital investing approach. Some speculate that DWF acted more like an over-the-counter trading desk, acquiring tokens from projects and attempting to sell them for profit instead of long-term investment.

Bitcoin Holders Underwater as Market Sentiment Sours, but Hope for Reversal Emerges

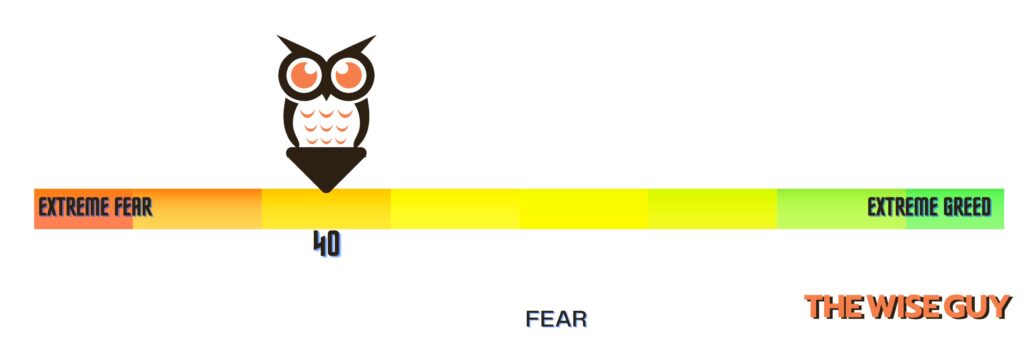

A significant number of short-term Bitcoin holders are currently experiencing losses, with over 97.5% of their holdings in the red since the recent drop below $26,000. This statistic, highlighted in a recent analysis report by Glassnode, reveals that the proportion of underwater short-term holders is at its highest level since the collapse of FTX.

While this news may not be appealing to Bitcoin investors, there is a silver lining to the situation. During bear markets, when over 97.5% of short-term holders are at a loss, there is a strong likelihood of seller exhaustion. This means that the current conditions do not provide any incentive for holders to exit the market.

However, it’s important to note that the exhaustion of selling pressure does not guarantee a reversal in price trends. It simply implies that the asset will be able to recover from its losses. For an uptrend to take hold, the accumulation trend needs to strengthen, and investor sentiment must become more favorable.

Currently, the BTC market is characterized by panic and negative sentiment, as reflected in the confidence ratio, which has remained in negative territory around -0.075. In order for capital to start flowing back into the market, the confidence ratio will need to rise back towards neutral and ultimately reach positive territory (> -0.05). This would indicate a shift in sentiment and a more favorable position for holders.

Looking at the daily timeframe, Bitcoin has broken below its ascending channel and has been consolidating in the $26,000–$27,000 range over the past few days. If the asset loses support around $26,600, there is a possibility of a short-term drop to $24,800.

On the weekly timeframe, Bitcoin has formed a bearish fractal pattern similar to what was observed in 2021–2022. During that period, BTC experienced three local tops, with the second being the highest and the third being the lowest, resulting in a significant decline in value. In 2023, Bitcoin has followed a similar pattern, reaching highs at $31,000, $31,804, and $27,483.5. If history were to repeat itself, BTC’s downtrend could potentially begin in the coming days, with a mid-term target around $20,000, which coincides with an unfilled CME gap.

Editor’s Wrap: NFTs Aren’t Dead Just Yet

Rollingstone.com sent shockwaves through the internet today with a captivating article declaring the end of non-fungible tokens (NFTs). Entitled “Your NFTs Are Actually – Finally – Totally Worthless,” the piece, based on a new study by dappGambl, a community of finance experts, quickly gained traction and stirred up quite the frenzy.

As of lunchtime Thursday, the post has skyrocketed to the top of both the website’s trending list and Google’s search results for the term “NFTs.” ????????

Now, before we dive into the nitty-gritty, it’s important to note that the headline, while attention-grabbing, isn’t entirely accurate by stricter standards. Yes, it’s true that a significant number of NFTs hold little to no value. The study revealed that out of a sample of 73,257 NFT collections, a staggering 95% have a market cap of zero ETH. That’s right, nearly all of them! The study further highlighted that 23 million people currently possess NFTs with no monetary worth, undoubtedly a harsh reality for those hopeful investors. ????????

According to Miles Klee, the writer of the Rolling Stone piece, only 21% of the collections analyzed in the study can claim full ownership, leaving four out of every five collections unsold. Klee aptly observes that “projects lacking clear use cases, compelling narratives, or genuine artistic value are finding it increasingly difficult to attract attention and generate sales” in this discerning market. ????????

However, does this mean NFTs are truly dead, as the article suggests? Not exactly. While it’s true that trading volumes have taken a hit, they’re far from non-existent. Recent data compiled by The Block indicates that NFT trading reached approximately $63 million last week. Admittedly, this is a far cry from the staggering $360 million-plus weekly volume witnessed back in February.

Nevertheless, it’s a substantial figure worthy of recognition. Moreover, let’s not forget the 5% of NFT collections that still retain value. Take Bored Ape NFTs, for example. They continue to trade impressively, with the average price of a Bored Ape Yacht Club NFT hovering around $42,000. ????????

Though precise trading dynamics are significant, what the Rolling Stone article truly highlights is the way mainstream media gravitates toward extremes, aiming for sensational headlines that captivate readers.

It’s worth noting that just last November, Rolling Stone published a headline proclaiming “The NFT Bubble Has Burst, but the Value For Creators Is Just Heating Up.”

Furthermore, they heavily promoted their partnership with one of the most prominent NFT collections, the Bored Ape Yacht Club, during the previous summer. The sheer irony! ????????

For those of us who’ve been around the crypto block, this narrative feels all too familiar. Bitcoin, for instance, has faced countless obituaries, yet it continues to defy expectations and thrive. With millions of followers and a price that now exceeds $26,000, Bitcoin’s resilience speaks volumes.

Yes, there have been ups and downs, but dismissing a technology with as much utility as NFTs seems rather short-sighted. NFTs serve as digital wrappers for both physical and non-physical items, enabling tracking and trading. ????????️

However, beyond the fate of NFTs, the larger issue at hand is the diminishing credibility of many media publications. In their quest for attention, they often overlook nuance and chase after sensational stories. As my colleague Dan Kuhn astutely noted, many individuals in the crypto sphere are already tuning out the noise. Instead of determining reality based on what some journalist claims, they focus on the technology and its practical application. ????????

CoinWestern Quixplaned????

????Bitcoin is at ‘800-Pound Gorilla’ downside risk, warns Bloomberg analyst Mike McGlone

????Pro-Bitcoin candidate Javier Milei takes commanding lead in Argentina’s election poll

????Binance’s $1M ETH gas fee shock: what went wrong?

Top Reddits This Week That Got Our Attention

JPMorgan says Ethereum’s activity post-Shanghai upgrade has been ‘disappointing’

I made new art for the Bitcoin Crab Market

Shrinkflation: a subtle way to hide inflation

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. Mondays, read our All-In-One crypto newsletter. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?