Hey hey! Happy Friday, you crypto rebels! ???? The weekend is here, and it’s time to let loose and let that crypto magic take over! ✨ So, let’s catch up on all the rad stuff happening in the digital currency world with the top four news stories of the day: ????

???? DeSantis for President? Crypto Bros Say “Yes”

???? Crypto’s Heatwave: Celsius Network Bought by Fahrenheit Group

????”FTX Plans Crypto Comeback with ‘FTX 2.0’

????️♀️ Who’s Behind the $1.7 Million Bitcoin Mining Streak

Crypto Bros Are Thrilled Thanks To DeSantis

Governor Ron DeSantis’ announcement on Twitter that he is running for president in 2024 will make you, us, and most importantly — Crypto Bros ????Very Happy! Even the governor knows that the future is hodling! ????

The key takeaways from DeSantis’ remarks were:

???? Crypto owners “have every right to do Bitcoin,”

???? Govt aka Biden sees Bitcoin as “a threat to them” that they want to regulate “out of existence.”

????Why So Much Hate For Biden?

The last year under President Joe Biden has been a regulatory winter for crypto developers and owners. Biden started with a balanced executive order ???????? but then quickly lost his balance, like grandpa on an icy driveway ❄️.

Biden’s bank regulators created “Operation Choke Point 2.0,” which is turning into a chokehold on the crypto industry. Telling banks not to do business with anyone related to crypto is basically trying to stop the ocean with a mop ???? – it’s only getting bigger.

????Why Can DeSantis Be The Perfect Choice?

DeSantis presents a contrasting viewpoint on crypto that is like a breath of fresh air in a room full of people who just farted ????. Known for his pro-market approach ????, he has publicly expressed his reservations about a central bank digital currency (CBDC).

In his campaign announcement, DeSantis said, “if people want to ‘do Bitcoin,’ they should be able to ‘do Bitcoin.'” So simple, so brilliant. (Move over, Nike, there’s a new slogan in town.)

We don’t care that he’s not crypto-native. He gets the ethos, which is more than we can say for some of our current leaders. The SEC staff is probably shaking in their boots at the thought of someone coming to take away their toys ????.

Celsius Network Finds its Fahrenheit Savior

???? It looks like Celsius Network has found its knight in shining armor, or more appropriately, its Fahrenheit.

The bankrupt crypto lender has been acquired by a group of crypto firms, including venture capital firm Arrington Capital and miner U.S. Bitcoin Corp, all under the name Fahrenheit, for upwards of $2 billion.

They even had a backup plan with the Blockchain Recovery Investment Consortium, who unfortunately couldn’t stand up to the heat of Fahrenheit’s bid. ????

While the deal has been accepted by Celsius and its creditors, it remains to be seen whether regulatory approval will be as rare as snow in the Sahara ❄️.

What’s next, you ask?

Celsius’ remaining liquid crypto will be distributed to former users and custody account holders like a refreshing slushie on a hot summer day. ???? And don’t forget about the corporate restructuring, which is set to shake up the firm like a hurricane hitting an ice cream truck ????????.

FTX 2.0: A Horror Sequel in the Making

???? Grab your popcorn, folks! The crypto world might be getting a sequel to FTX – and it’s not just any sequel. Brace yourselves for FTX 2.0, the horror movie that nobody saw coming.

It sounds like the next installment of The Evil Dead trilogy that we didn’t even know existed. Can’t wait!

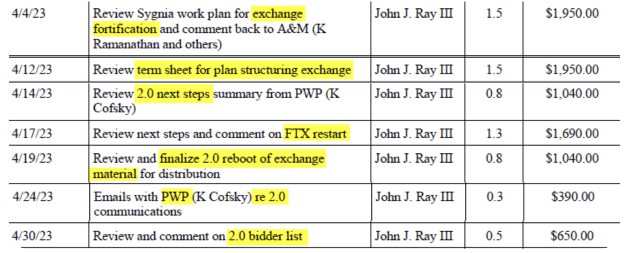

???? And who’s the man behind the madness? None other than John Ray III, the current FTX CEO.

Recent documents indicate that Ray and the FTX bankruptcy team have been working on a plan to potentially restart the exchange.

It’s like watching a director’s cut of a movie with an alternate ending. I hope it’s better than that time when George Lucas went back and messed with Star Wars. But let’s not celebrate yet.

What does FTX 2.0 mean for creditors?

Well, it might be one of the best shots for them to get their money back. And from what we hear, it has some support from FTX creditors.

However, even if FTX 2.0 is the best option for creditors, it’s still a long shot.

Why? Because the core FTX product is FLAWED. We’re talking about coding issues, poor performance, and software bugs. ????

Mystery Bitcoin Miner Earns $1.7 Million in less than 24 Hours

???? Looks like Bitcoin has a new player in the game! And no, it’s not Elon Musk’s dog.????

It’s an unidentified miner who seems to have infiltrated the world’s largest cryptocurrency network.

We are trying to figure out who this individual is and it feels like someone stole the last slice of pizza ???? from our refrigerator.

Twitter user ‘tulkoo’ was the first to point out this mysterious miner, who has been mining several blocks in the past 24 hours and earning more than 6.25 BTC per successful block.

???? The unidentified miner has verified over 10 Bitcoin blocks in the last day, earning more than 65 BTC, which is worth over $1.7 million at current prices.

Honorable Mentions ????

- Warren Buffet-backed Nubank, Visa, Mastercard to join Brazil’s CBDC pilot ????

- OpenAI’s Sam Altman Secures $115M in Funding for Worldcoin Project????

- Binance launches NFT loan service to rival Blend

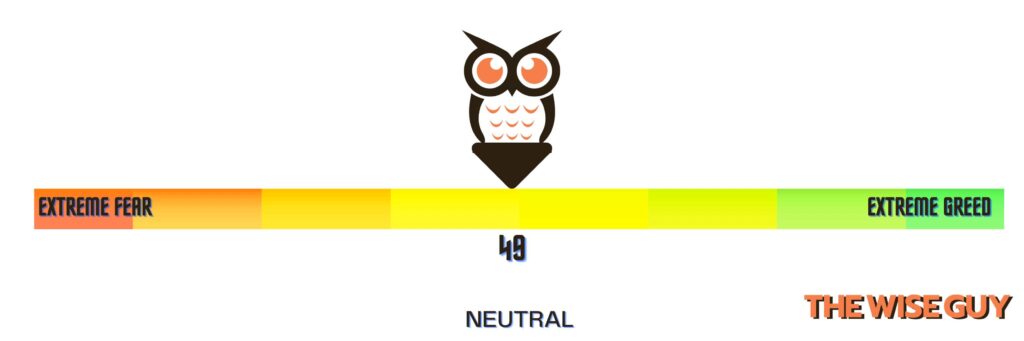

Crypto Market Watch ft. AI????

(This section is exclusively written by AI tools)

Currently, Bitcoin’s value is hovering above $26,000 as traders wait and see if their increased expectations of Fed rate hikes will affect the cryptocurrency market.

Compared to gold, Bitcoin is showing better performance as investors struggle to understand whether recessionary fears, positive stock flows, and increased optimism for the US economy will lead to any potential defaults.

Although Speaker McCarthy has expressed hopeful remarks, concerns about the debt ceiling persist. It’s worth noting that the current round of dollar strength may not last, and it remains to be seen if any market stress will encourage investors to shift back towards cryptocurrency.

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?