FTX, a cryptocurrency exchange facing bankruptcy, is seeking approval to liquidate $3.4 billion in Bitcoin and crypto assets. This has raised concerns among market analysts as it could potentially add selling pressure to the already struggling market.

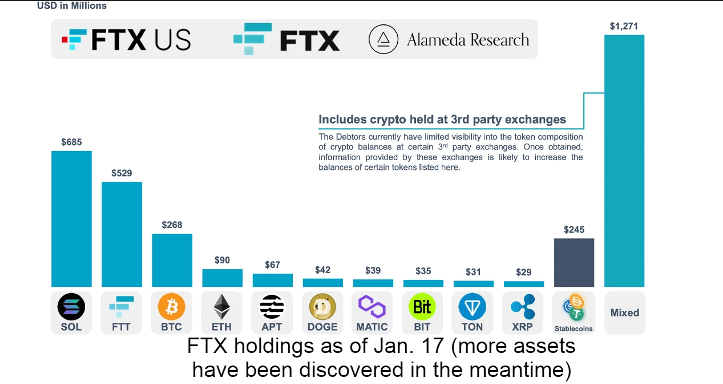

FTX’s crypto holdings include various assets such as Solana, FTT tokens, Bitcoin, Ethereum, and more. The exchange has proposed appointing Galaxy Digital as the investment manager responsible for overseeing the sale of these recovered assets. The plan suggests selling up to $100 million worth of tokens per week, which could be increased to $200 million for individual tokens.

However, it is unlikely that all of these coins will be sold on the open market. Most coins are expected to be sold over-the-counter, with any remaining sold gradually via market makers. It’s important to note that the actual sale won’t begin immediately, as regulatory bodies will oversee the process to protect investors.

While there will be some selling pressure, a sudden and massive sell-off is illegal and improbable. Market participants are advised to stay informed and avoid panic and misinformation.

Read Now: XRP eyeing for $130 – says bullish influencer