Welcome to The Wise Guy,

Where we take cryptocurrency seriously, but we also know how to have a good time.

That’s why we’ve curated the crème de la crème from not one, not two, but FIVE newsletters.

MilkRoad, Defiant, Messari, Bankless, and CoinDesk Node.

Defiant’s Top Story

Defiant’s got some worrying news about a massive exploit has rocked the world of the cross-chain bridging protocol, Multichain.

Sneaky hackers managed to swipe away a whopping $120 million worth of digital assets, disappearing into the shadows with unidentified wallets in tow.

The Multichain team is hot on their trail, investigating the incident and issuing a plea to users to temporarily halt their activities. From wBTC to USDC, USDT, and a sprinkle of altcoins, these mischievous culprits made a grand escape, utilizing Multichain’s Fantom bridge and landing in a variety of hidden wallet addresses. What a heist!

???? Web3 Apps Thrive Amid Regulatory Storms! ????

Despite the regulatory challenges faced by top centralized exchanges, Web3 activity still soared to great heights in June!

According to the DappRadar, a staggering 2 million wallets were flocking to dApps every single day, with the DeFi sector flexing its muscles and growing by a whopping 14%.

The rise in adoption can be attributed to the fearless airdrop hunters exploring Layer 2 protocols and the remarkable LayerZero cross-chain bridging protocol.

Messari’s Desk

Messari’s desk explored Yearn Finance, a DeFi platform is breathing new life into the world of decentralized finance with not one, but two groundbreaking upgrades.

???? Introducing yETH

Say hello to yETH, the liquid staking token aggregator by Yearn! This creation diversifies your staked ETH across various liquid staking tokens, rewarding you with the coveted yETH in return.

yETH even lets you effortlessly swap between different liquid staking tokens for a small fee, giving you the flexibility you desire. Unlike other aggregators, yETH’s governance parameters are in the hands of its yETH stakers, minimizing those dreaded governance risks.

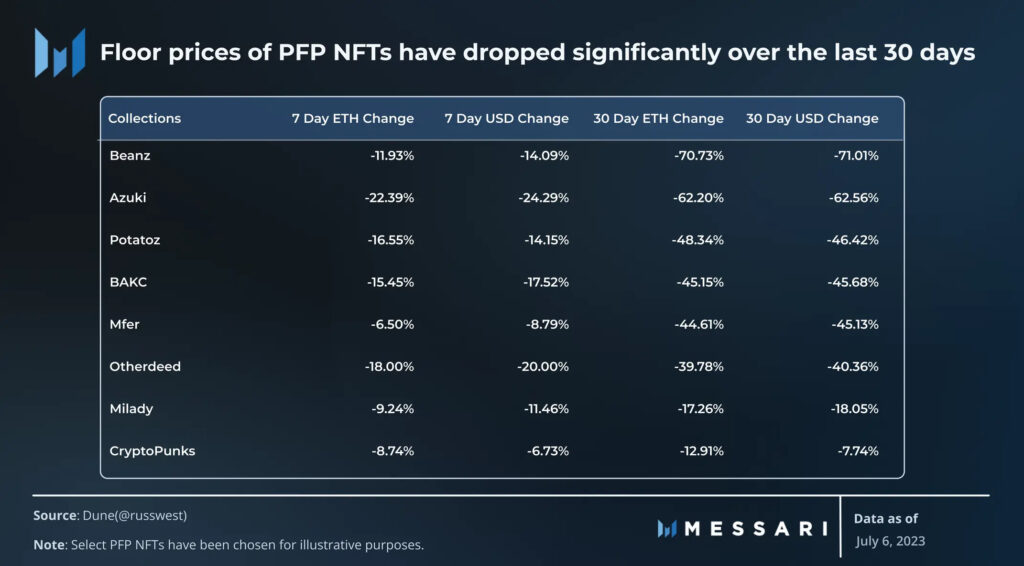

Is Blur the Culprit? ????

Oh, the rollercoaster ride of Profile Picture (PFP) NFTs! These digital collectibles have had their fair share of ups and downs in the past year. Unfortunately, the recent bear market has taken its toll, causing a significant decrease in the value and liquidity of PFP NFTs.

And if that wasn’t enough, the Azuki Elementals incident last week sent shockwaves throughout the NFT community, resulting in a drastic decline in floor prices for many blue-chip NFT collections.

Now, fingers are being pointed at Blur, a trading platform, for playing a major role in this decline.

How, you ask? Well, by introducing feeless trading, Blur basically took away creator royalties, which didn’t sit well with the creators, of course.

This move not only discouraged innovation but also undermined the earnings of these talented folks. On top of that, Blur’s token incentive scheme, where users were rewarded for listing and bidding on NFT projects, drove prices down to concerning lows. Yikes!

Bankless’ Desk

For Bankless’ nation one stories made all the difference in the world!

Even with all the talk about metaverses and Web3 platforms, Twitter still reigns supreme in the crypto world.

But things might be changing soon. Meta, the company formerly known as Facebook, recently launched Threads, its own Twitter competitor, and it’s causing quite a stir.

Threads, tied to the Instagram social graph, couldn’t have arrived at a worse time for Elon Musk. His attempts to monetize Twitter have stirred controversy among both his critics and supporters.

He even announced plans to limit the number of tweets users could access, but it’s unclear if he’s still following through with that.

In just two days, Threads has already amassed over 70 million users, about 20% of Twitter’s active user base when Elon acquired the company.

While not all of these users may stick around, it’s clear that Threads poses a massive threat to Twitter. Musk has even sued Meta, accusing them of “cheating.”

However, convincing the Crypto Twitter community to move to Threads won’t be easy.

The crypto culture that has blossomed on Twitter runs deep, and migrating that spirit may prove tough, if not impossible.

But competition for Twitter could actually be a good thing for users. So far, Musk hasn’t had much incentive to expand beyond monetizing previously free features.

With Threads now in the picture, he’ll need to up his game and create a platform that can’t rely solely on its reputation. Perhaps this pressure will push Musk to embrace decentralization, an area Jack Dorsey, Twitter’s founder, has championed.

Of course, Threads is still in its early stages, so let’s not get ahead of ourselves. We’ll see where it stands next week.

Milk Road’s Educational Desk

Milkroad got some juicy intel on a few whale wallets that will make your crypto senses tingle. Let’s dive into the three most interesting ones:

1/ EverydayWhale ($21.5M in assets) ????️ This wallet lives life to the fullest with three exciting activities:

???? Lending tokens on Maker: Our whale has put over $15M worth of stETH into Maker, a DeFi platform, and is earning some sweet interest along the way.

???? Providing liquidity on Uniswap: A cool $7M has been pumped into Uniswap v3’s liquidity pool. This means the whale gets a small piece of pie from every trade. Yum!

???? NFT loans on NFTfi and Blur: Ever heard of NFT loans? Well, this whale has supplied over $1M in ETH and received NFTs as collateral. Talk about unique investments!

2/ Ethereum ($19.3M in assets) ???? Naming a wallet after its own chain? Now that’s confidence! This wallet not only loves Ethereum but also spreads its assets across multiple blockchains:

57% on Ethereum: It may have the least % on its own chain, but that’s just diversification in action!

31% on Arbitrum: This whale knows the value of layer-2 scaling solutions.

4% on Avalanche, BNB Chain, and Optimism: A dash of variety to keep things interesting.

Oh, and what’s this wallet up to? You guessed it, yield farming! Whether it’s staking, lending, or providing liquidity, this whale is hustling across protocols.

3/ Vin Diesel ($58.9M in assets) ????️ No fancy name? No problem! We’ve nicknamed this wallet Vin Diesel because it’s Fast & Furious in the world of crypto trading.

This wallet loves to make trades and has invested in a whopping 60+ tokens. Talk about keeping things diverse!

Unlike some other cautious whales, Vin Diesel stays “liquid” and doesn’t lock up its tokens.

They prefer flexibility over staking and lending. Risky, but exciting!

And what are the biggest holdings? We’ve got:

$10.3M in ETH ????️ $8.4M in SHIB ???? $2.6M in VRA ???? $1.4M in SAND ????️ $1.2M in FTM ????

CoinDesk’s Best Story

In the world of cryptocurrencies, Binance, an embattled exchange, has seen some significant changes this week. According to a report from Fortune, three senior officials have bid adieu to the company as it gears up to defend itself on multiple fronts.

The departing individuals include Han Ng, the General Counsel of Binance, Patrick Hillmann, the Chief Strategy Officer, and Steven Christie, the Senior Vice President for Compliance. And that’s not all – Matthew Price, the Senior Director of Investigations, recently decided to part ways with the exchange as well.

Twice weekly crypto goodness, coming your way! Catch us every Monday, Tuesday and Friday. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?