Happy Fri-nally, my crypto-loving friends! ????

If you had bought $100 worth of Bitcoin when the term ‘Crypto Winter’ was first used, how much do you think you’d have today? Well, get ready to clutch your weekend-at-last mimosas, because the answer might just shock you!

If you’re ready to kick off the weekend with some big crypto energy, I’ve got some juicy news for you.

???? Powell favors Bitcoin — not kidding!

???? SEC in the jury Box? Binance accuses

????Andrew Tate’s BTC holdings gone for good!

???? Bitcoin is heating up pools

Powell Thinks Bitcoin is Here to Stay

???? Federal Reserve Chair Jerome Powell has entered the chat, guys! He’s saying the U.S. central bank needs to play a “robust federal role” in overseeing stablecoins – and he’s got a point.

And as if that wasn’t enough to get your blood pumping, Powell also gave a nod to everyone’s favorite cryptocurrency, Bitcoin ???? by stating that it has “staying power.” Looks like Jerome is starting to catch on to something we all know: crypto is the future!

Now, let’s dive a bit deeper into what Powell actually said.

During a semiannual hearing on monetary policy held by the Republican-led House Financial Services Committee, Powell responded to a question about stablecoins by saying that they should have strong federal oversight.

And why is that? According to Jerome, payments stablecoins are a form of money, and the ultimate source of credibility in money is the central bank. Can’t argue with that logic, can you?

However, not everyone on Capitol Hill was jumping for joy at the idea of the Fed having a larger role in stablecoin regulation.

????♀️ Maxine Waters expressed concerns that the Fed would be “hamstrung” if stablecoin issuers could register directly with states. Powell, of course, had a rebuttal ready.

Leaving the Fed with a weak role in stablecoin regulation would be a mistake, he said.

He even suggested that stablecoins should be regulated in a way that mirrors money market mutual funds and bank deposits. Bold move, Jerome!

So where does that leave us now?

Well, several bills on stablecoin regulation have stalled out, but there’s still hope. After a session in July where lawmakers can iron out proposed changes, the current stablecoin bill that’s in the works will be advanced to the Senate if a positive consensus is reached.

Binance vs SEC: We Are Tired, Again

Well, well, well, looks like our friends over at ???? Binance.US, Binance Holdings Ltd., and CEO Changpeng Zhao are not happy with the U.S. Securities and Exchange Commission (SEC) these days.

In a court filing dated June 21, their attorneys are not holding back, accusing the SEC of putting out “misleading” information and apparently influencing the jury! Shots fired! ????

What, specifically, has them up in arms? A statement made by SEC Enforcement Director Gurbir Grewal, in which he insinuated that Zhao and Binance are at liberty to “commingle customer assets or divert customer assets as they please.”

Whoa there, SEC, that’s a pretty bold claim! Binance’s legal team is not having it, arguing that the SEC has no evidence that Binance.US customer assets have been dissipated, commingled, or misused in any way. ????

But that’s not all. Binance’s attorneys also take issue with an order that mandates all parties in the lawsuit to return to the U.S.

Apparently, they feel that the SEC’s press release is designed to sow confusion in the market, potentially harming Binance.US customers and negatively influencing the jury. ????

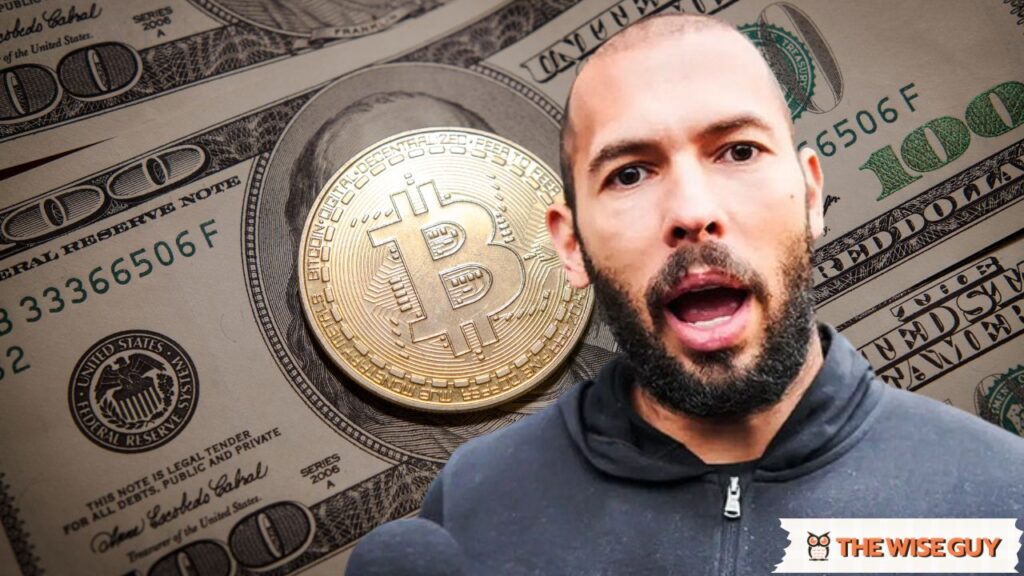

Top G’s Bitcoin Gone In Matter of Hours

We’ve got a news update that combines social media influencing, crypto, and… *gasp*… crime!

Romanian prosecutors are seeking to seize 21 Bitcoin worth around $560,000 from Andrew Tate, a social media influencer who is being indicted on severe charges of rape and human trafficking. Not cool, Andrew! ????

Andrew and his associates’ wealth reportedly played a significant role in the trial, with authorities believing they’re a flight risk. And with all the luxurious properties, vehicles, and watches they own, we can see why. ✈️

But what about the crypto angle? Well, the authorities are looking to take 21 Bitcoin from Andrew, along with other assets. For a brief moment, the crypto community thought that the authorities had seized $384 million in Bitcoin! That turned out to be a translation error, and the actual value was much less. Still, not a bad payday, eh? ????

New York Bathhouse Heats Pools with Crypto Mining Excess

Folks!We’ve got some exciting news for you – and it involves Bitcoin and… bathing! ????

BATHHOUSE, a bathhouse in Brooklyn, is using excess heat from its Bitcoin mining rigs to warm up its pools. Yep, you heard that right – Bitcoin is now heating up pools! ????????

So how did they come up with this genius idea? Well, Bitcoin mining generates a lot of heat as it uses electricity for computing power. Rather than wasting that heat, BATHHOUSE decided to put it to good use.

https://www.instagram.com/p/CtuESmhoicI/

And who doesn’t love a nice warm swim or soak in a hot tub while supporting the world of crypto? ????♀️????️

It’s not just about the pools, though – BATHHOUSE has a lot more to offer. They’ve got steam and sauna rooms, facials, massages, and a restaurant. It’s basically a one-stop shop for all your relaxation and rejuvenation needs. And now, with the added bonus of being powered by Bitcoin, it’s sure to attract even more crypto-savvy customers.

Honorable Mentions ????

- ???? Crypto Ban May Not Be Best Approach to Balance Risk, Demand: IMF

- ???? Nevada regulator says Prime Trust can’t meet withdrawal requests

- ???? Michael Saylor Sees ‘Parade of Positives’ for Bitcoin Backers

Crypto Market Watch

Despite the wild rollercoaster ride, those savvy enough to invest $100 in Bitcoin when it was trading at $3,236 on Dec. 15, 2018, are laughing all the way to the bank! ????

Right now that $100 investment would be worth around $903, thanks to Bitcoin’s current value of $30,000. They’ve played the crypto game like a boss and are enjoying a profit of 803%. ????

I mean, seriously, imagine turning $100 into almost a thousand bucks! That’s more than enough to buy yourself a fancy dinner with extra guac and still have some left over. Well played, Bitcoin investors! ????????

Twice weekly crypto goodness, coming your way! Catch us every Tuesday and Friday. And hey, don’t forget to check us out on Wednesdays for all the latest AI news – because why limit yourself to just one kind of intelligence?